The first non-farm payrolls data for 2026 in the US exceeded expectations, refocusing global market attention on the macroeconomic outlook. According to the report released Wednesday by the Bureau of Labor Statistics, 130,000 new jobs were added to the economy in January. Market expectations were only around 70,000. This strong data, following a 48,000 increase in December, indicates a significant acceleration in employment.

The unemployment rate also came in below expectations. In January, unemployment fell to 4.3%, while market forecasts predicted it would remain stable at 4.4%. The unemployment rate was also 4.4% in December. Both the higher-than-expected increase in employment and the decrease in unemployment demonstrate the resilience of the US economy at the beginning of the year. Following the release of the data, the initial market reaction was shaped by expectations regarding interest rates. The US Federal Reserve (Fed), which implemented multiple interest rate cuts in the second half of 2025, kept its policy rate unchanged at its January meeting and signaled that it was not keen on another cut in March. Prior to the employment data, the probability of a March rate cut was priced at 21% in interest rate markets. According to CME FedWatch data, this probability dropped to 19% after the strong employment figures. Markets have now pushed back the previously expected rate cut, which was initially projected for as early as June, to July.

There was also movement in the bond and dollar markets. The US 10-year Treasury yield rose five basis points to 4.20%. The dollar index, which had been weak during the day, recovered after the data. Moderate increases were observed in US stock futures indices. Nasdaq 100 futures rose 0.55%, while S&P 500 futures gained 0.5%.

How was the crypto market affected?

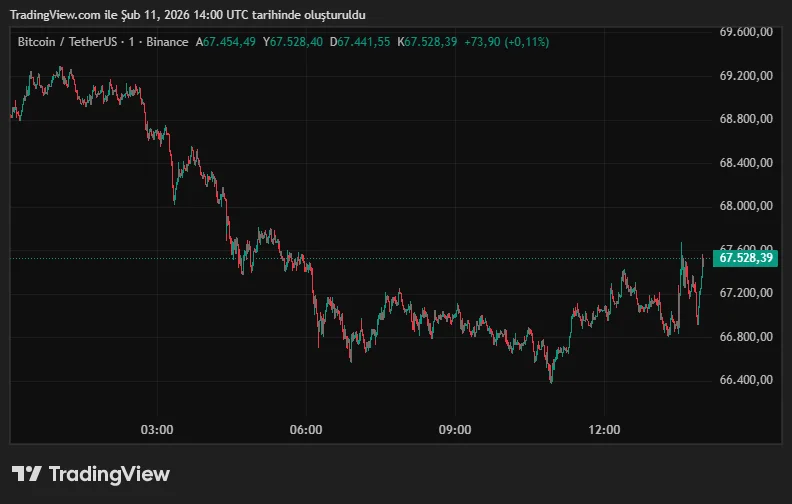

The cryptocurrency market also reacted quickly to the macroeconomic data. Bitcoin, which traded in a narrow range near the $69,000 level throughout the week, retreated to around $67,000 before the data release. Immediately following the announcement of strong employment figures, the price recovered towards the $67,500 level. Despite this, Bitcoin's performance over the last 24 hours remains approximately 2% lower.

Looking at the chart, it's clear that downward pressure was evident before the data release, with sales accelerating, especially in the morning hours. However, it's noteworthy that the price reacted from the $67,000 region after the employment figures, making an upward move. This movement shows that investors initially interpreted the data as a signal of "economic strength." On the other hand, the possibility that strong employment could delay Fed interest rate cuts stands out as a factor that could put pressure on risky assets in the medium term. Looking at the overall picture, the US economy performed stronger than expected in the first month of the year. This creates room for the Fed to maintain its cautious stance, while also indicating that volatility may continue in both the stock and crypto markets. Markets will now focus on inflation data and new guidance from Fed members.