Goldman Sachs revealed a remarkable position in crypto assets in its 13F filing for the fourth quarter of 2025. According to the filing submitted to the US Securities and Exchange Commission (SEC), the bank holds a total of over $2.36 billion in digital asset-linked ETF positions.

What's in the Wall Street giant's portfolio?

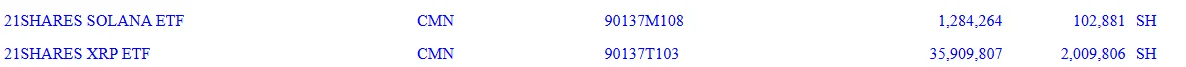

Looking at the portfolio breakdown, approximately $1.1 billion in Bitcoin ETFs, $1 billion in Ethereum ETFs, $153 million in XRP ETFs, and $108 million in Solana ETFs stand out. These items represent approximately 0.33% of the bank's reported investment portfolio.

While seemingly small in proportion, in terms of nominal size, it makes Goldman Sachs one of the major US banks with the highest exposure to crypto-linked assets.

The detail regarding XRP is particularly noteworthy. The bank's approximately $152–153 million XRP position is held not through direct token custody, but through exchange-traded funds (ETFs). The total net asset value of spot XRP ETFs traded in the US has exceeded $1 billion, and the products have only recorded net outflows for a few days so far. This indicates that institutional demand for XRP through regulated instruments remains stable.

Goldman Sachs, managing approximately $3.2-3.6 trillion in assets, is a leading global player in mergers and acquisitions, capital markets, and asset management. Therefore, the bank's portfolio statements are often read as a leading indicator of broader institutional trends.

Goldman's approach to Bitcoin has undergone a significant transformation over the years. Before 2020, bank executives and research teams described Bitcoin as a highly volatile, non-cash-flow generating speculative asset. It was frequently emphasized that crypto assets were not suitable for conservative portfolios and that regulatory risks outweighed other considerations.

However, after 2020, increased institutional demand and market depth softened this rhetoric. The bank reactivated its crypto trading desk, expanded access to derivatives, and published research acknowledging Bitcoin's potential as a hedge against inflation. Despite this, it avoided positioning crypto as a primary asset class.

During the crypto winter of 2022, attention was drawn again to infrastructure and counterparty risks. The recent strategy offers a more cautious participation model; instead of directly holding spot assets, it proceeds through ETFs, structured products, and tokenization projects.

ETFs play a critical role here. For traditional financial institutions, ETFs offer a liquid and transparent access channel that is compliant with existing regulatory and risk management frameworks. Banks can thus be exposed to crypto price movements without directly undertaking custody, technical infrastructure, or operational risks.