Sam Bankman-Fried has re-emerged as one of the most controversial figures in the cryptocurrency world in recent years. The founder of FTX, once one of the world's largest cryptocurrency exchanges, targeted both the bankruptcy process and the legal proceedings with his posts on the X platform. Bankman-Fried, currently serving a 25-year prison sentence, argues that FTX never went bankrupt and that the bankruptcy filing was "forced" by lawyers. In his post, Bankman-Fried stated, "FTX never went bankrupt. I did not file such a complaint." He claims that control of the company passed into the hands of lawyers and a "fake" bankruptcy filing was made in just four hours. SBF alleges that the aim of this move was to plunder the company's assets through legal expenses. To support these claims, he cited a sworn court document dated January 2023.

What does the court document contain?

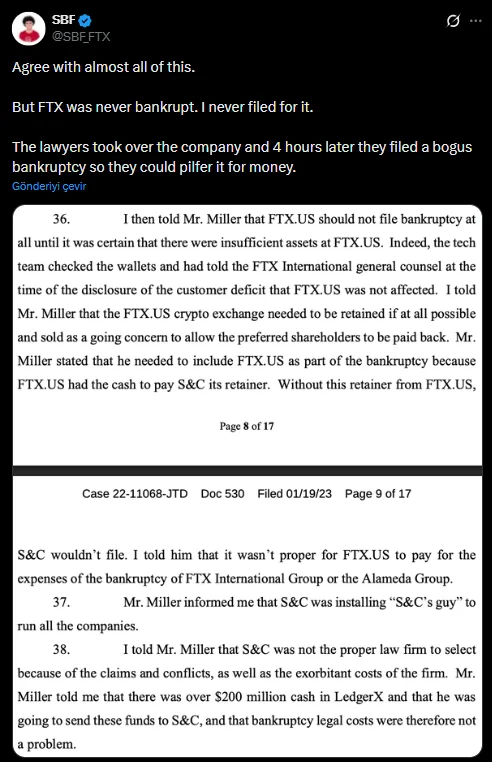

The document shared involves Bankman-Fried and lawyer Mr. The transcript includes conversations between Miller and Bankman-Fried prior to the bankruptcy filing. According to SBF, Miller specifically opposed the inclusion of FTX.US in the bankruptcy filing. His reasoning was that the technical team had checked the wallets and determined that FTX.US was not affected by the customer shortage. Bankman-Fried wanted FTX.US to remain afloat and be sold to compensate both customers and shareholders for their losses. However, Miller allegedly argued that FTX.US needed to be included in the filing for the law firm Sullivan & Cromwell to handle the bankruptcy proceedings. The justification given was that FTX.US had sufficient cash to pay S&C's advance fee. Bankman-Fried claimed, "Without this money, S&C wouldn't have opened the file." SBF also alleges that Miller stated Sullivan & Cromwell would place "their own people" in charge of the companies, implying that the over $200 million in cash held in LedgerX would be used to cover legal expenses.

The Tweet that Started the Controversy

The person who ignited this outburst was Bitcoin trader Alex Wice. Wice described the FTX case as a "show trial" and argued that crucial evidence in favor of the defense was withheld. According to him, Judge Lewis Kaplan prevented the jury from being presented with data on the company's solvency and the "trusted lawyers" defense. Wice suggested that this defense could eliminate the element of intent.

Wice also claimed that former FTX executive Ryan Salame was imprisoned for refusing to testify against Bankman-Fried. Bankman-Fried responded to this post by saying, "I agree with almost all of this." Serious Accusations Against Prosecutors

In another series of posts made the day before, SBF claimed that prosecutors deliberately concealed certain evidence to mislead the jury. He alleged that this evidence was documented by a prosecutor who was later dismissed during the Trump administration. Bankman-Fried also claimed that Salame was threatened with fabricated charges and that pressure was exerted on him through his pregnant fiancée. In all his posts, Bankman-Fried frames the case as a "legal battle," or "lawfare" as he calls it. However, a federal court ruled that FTX's collapse resulted in approximately $8 billion in customer losses and convicted Bankman-Fried on seven separate counts of fraud.