United Arab Emirates-based investment firm Aqua1 has announced that it has invested $100 million in a cryptocurrency platform called World Liberty Financial (WLFI), which has ties to the Trump family. This move makes Aqua1 the largest holder of WLFI, the governance token of WLFI, while also surpassing Tron founder Justin Sun, who previously supported the project. The timing of the investment comes at a time when both economic and political repercussions for the Trump family’s crypto activities are intensifying.

Aqua1 and WLFI: Real-asset tokenization, a common goal

A joint statement stated that the main purpose of Aqua1’s investment is to move real-world assets (RWA) onto the blockchain, expand the stablecoin infrastructure, and promote decentralized finance (DeFi) solutions. Aqua1 co-founder Dave Lee described WLFI’s vision as a “trillion-dollar transformation opportunity,” emphasizing the project’s efforts to integrate traditional finance with blockchain technology.

Zak Folkman, one of the co-founders of WLFI, described the collaboration as “a historic step that will accelerate the integration of cryptocurrencies into the global financial system.” Aqua1 also aims to increase blockchain, artificial intelligence and Web3 investments in the region by launching an initiative called “Aqua Fund” that will lead the digital transformation of the Middle East.

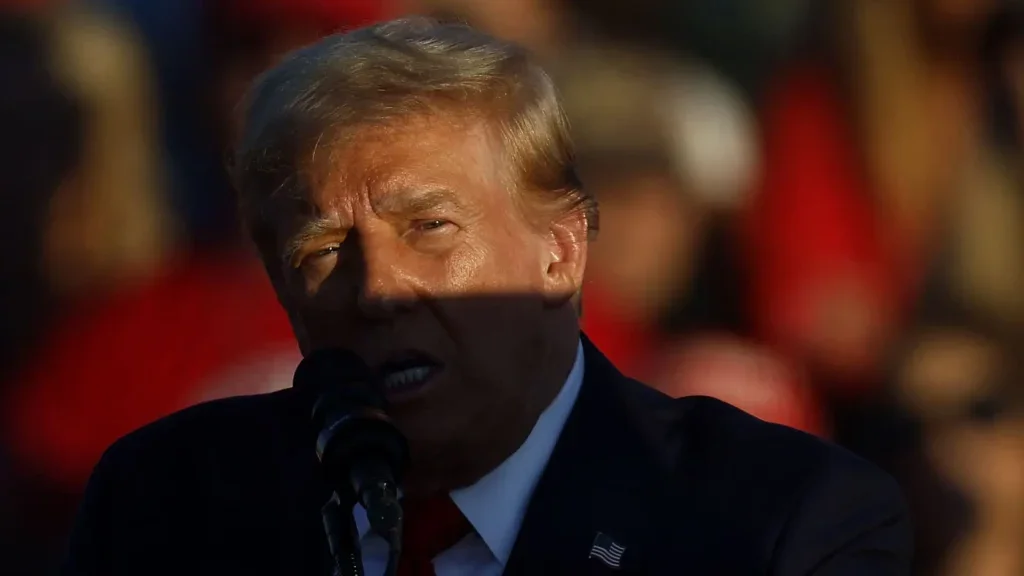

Trump and WLFI relationship sparked controversy

However, WLFI’s ownership structure and close ties to the Trump family also bring with it demands for transparency regarding the project. The WLFI platform, which is co-founded by three of US President Donald Trump’s sons, has previously been subject to political criticism. According to the latest filings with the SEC, Trump owns 15.75 billion WLFI tokens and earned $58 million in revenue from sales of these tokens alone through 2024.

Following this investment news, eyes once again turned to the Trump family’s crypto connections. As you may recall, in May, Eric Trump announced that the Abu Dhabi-based MGX company would make a $2 billion investment in Binance using WLFI's stablecoin called USD1. This statement came at a time when the US Congress was discussing regulations on payment stablecoins.

Criticism from Congress

In a hearing held this week in the Senate Appropriations Committee, Senator Jeff Merkley asked US Attorney General Pam Bondi about Trump's relationship with WLFI. However, Bondi avoided giving a direct answer, citing ongoing processes. Merkley, on the other hand, clearly expressed the issue: "American decisions should be made by Americans; they should not be purchased through crypto coins." Trump's $2.3 billion Bitcoin treasury application to the SEC through his media company Trump Media and Technology Group (TMTG) also strengthens the conflict of interest allegations against the family. In addition, Trump is expected to earn another $390 million in new income from meme coin sales in 2025.