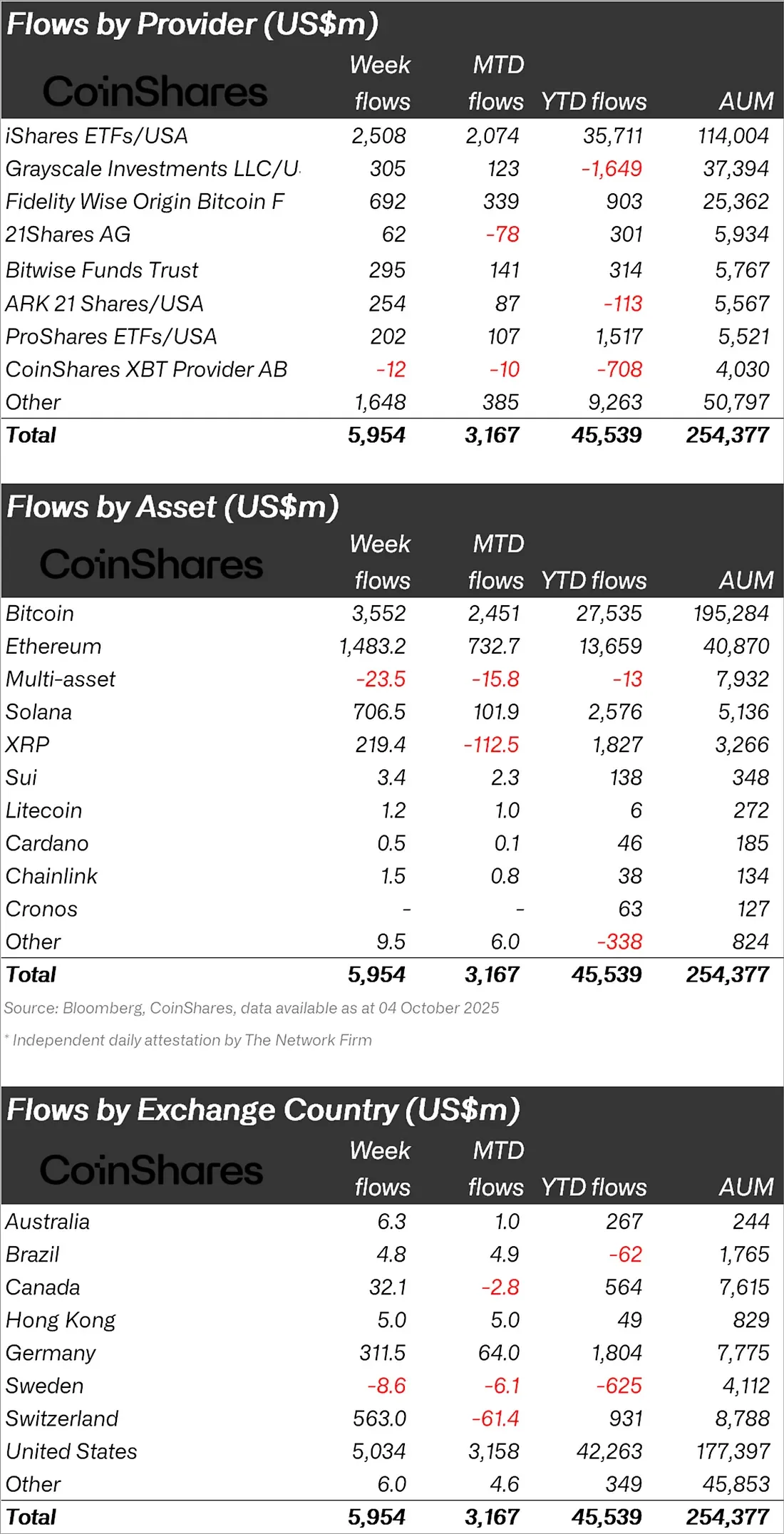

Crypto asset investment products saw a record inflow of $5.95 billion last week. According to CoinShares data, this figure marked the highest weekly inflow ever measured for digital asset funds. This surge in investor interest is believed to be driven by the delayed response to the US Federal Reserve's interest rate cut, weak employment data, and concerns about the risk of a government shutdown.

US-based products led the week by a large margin with $5 billion in inflows. Switzerland broke its own record with $563 million, while Germany saw its second-highest weekly inflow with $312 million. This strong performance brought the total asset value under management (AUM) of digital asset investment products to an all-time high of $254 billion.

Strong inflows led by Bitcoin and Ethereum

The lion's share of investment inflows went to Bitcoin. With $3.55 billion in weekly fund inflows, BTC reached its highest level in history. Despite this, investor interest in short-term instruments remained extremely low. This suggests that the overall bullish outlook in the market remains strong. Ethereum saw a strong inflow of $1.48 billion. This brings ETH's total fund inflow since the beginning of the year to $13.7 billion, almost triple the level of 2024. Spot Ethereum ETFs traded in the US reportedly received $1.3 billion, with BlackRock's ETHA product leading the way with an inflow of $691.7 million.

Records for Solana and XRP

Solana (SOL) saw its highest weekly inflow in history with $706.5 million. This figure brings Solana's total fund inflow for 2025 to $2.58 billion. XRP also attracted attention with a strong inflow of $219.4 million. However, other altcoins did not see the same momentum; Sui saw $3.4 million, Chainlink $1.5 million, and Litecoin $1.2 million.

In contrast, multi-asset products saw $23.5 million in outflows. CoinShares data shows that investors preferred to concentrate on specific assets rather than diversify their portfolios during this period.

US Dominance of ETF Providers

Among fund providers, iShares (BlackRock) ETFs topped the list with a massive inflow of $2.5 billion. Fidelity's Bitcoin fund saw inflows of $692 million, Grayscale's $305 million, and Bitwise's $295 million. CoinShares XBT products experienced a limited outflow of $12 million.

Total inflows since the beginning of the year have reached $45.5 billion, with $35.7 billion of these flows coming from iShares products. This chart clearly demonstrates that US-based ETFs clearly dominate the market dynamics.

Weakening global employment data has reinforced investors' tendency to reduce risk in traditional markets. This has fueled demand for liquid assets, particularly Bitcoin and Ethereum. According to CoinShares analyst James Butterfill, market movements indicate that the search for a “digital safe haven” has regained momentum due to both the delayed impact of the interest rate cut and political uncertainties in the US.