SHIB/USDT Technical Analysis

Shiba Inu (SHIB) is drawing renewed attention this year. Recently, millions of SHIB tokens were burned, meaning the circulating supply decreased. This can theoretically have a positive effect on price. In addition, there is a general revival in the meme coin market, and SHIB is also benefiting from this trend. These developments take SHIB beyond being just an old meme coin and make it a coin worth watching again in 2026.

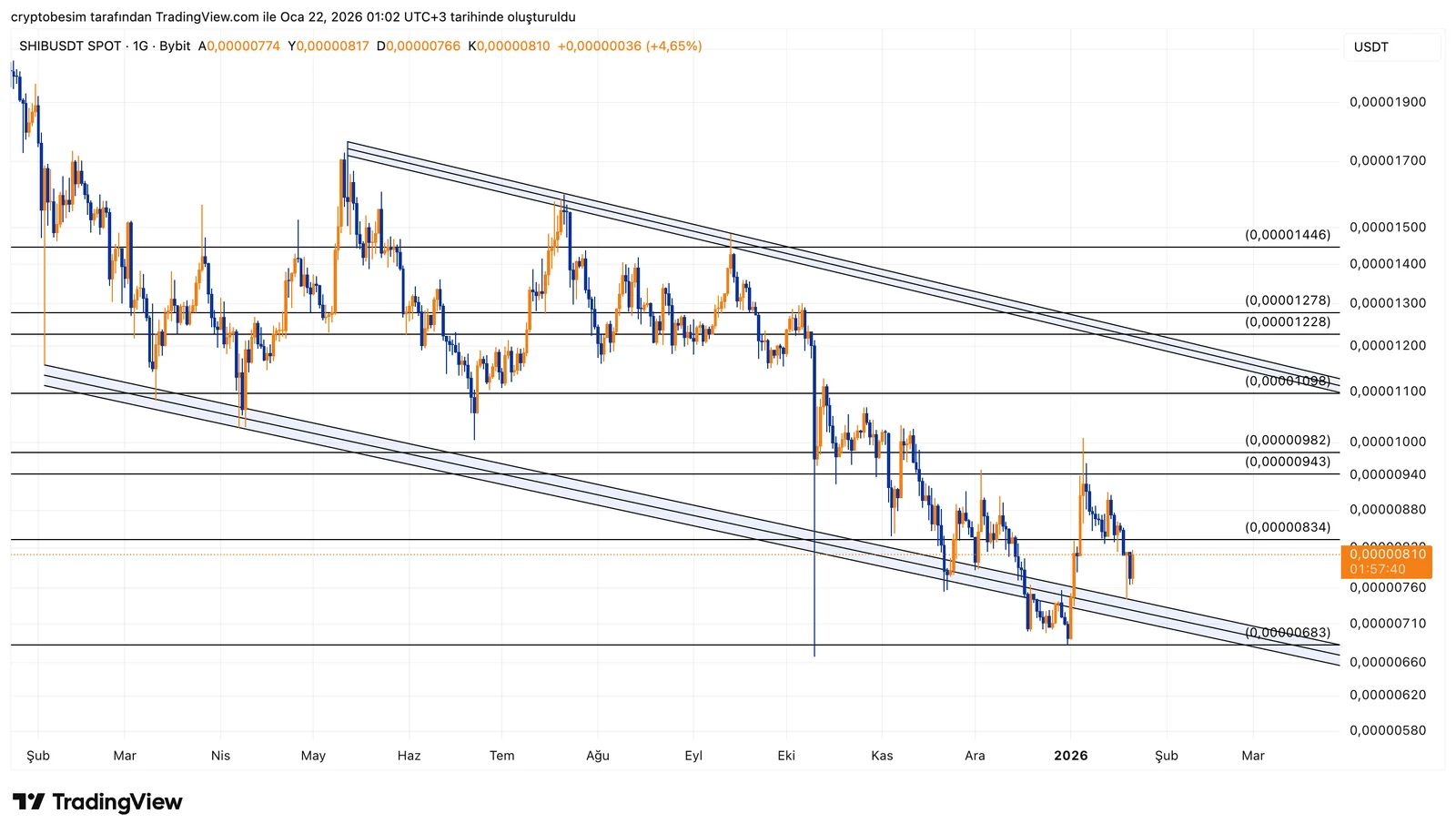

On the SHIB side, the descending channel structure is clearly being preserved. For a long time, the price has been facing selling pressure from the descending upper band and moving toward the lower band. The latest upward attempt also failed to move above the channel and has pulled back once again.

The current price is trading close to the lower band of the channel. Since this area has produced reactions before, it is technically important in the short term. If the lower band is preserved, a limited recovery toward the channel’s mid-band may be seen in the first stage. In this scenario, the 0.0000098 – 0.0000109 range stands out as the first resistance area.

The upper band remains downward sloping and strong. As long as the channel is not broken to the upside, rises will continue to remain reactionary in nature. For a clear trend change, sustained price action above the 0.0000122 – 0.0000128 band is required.

In the downside scenario, if the lower band of the channel is lost, the 0.0000068 – 0.0000065 region comes back into focus.

These analyses, which do not provide investment advice, focus on support and resistance levels that are thought to create short- and medium-term trading opportunities depending on market conditions. However, the responsibility for trading and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss for the positions shared.