The U.S. Securities and Exchange Commission (SEC) temporarily suspended trading in QMMM Holdings shares on September 29th following extraordinary price fluctuations. The Hong Kong-based company's announcement that it would create a $100 million cryptocurrency treasury sent its share price soaring; the shares quickly gained over 1,000%, catching regulators' attention.

QMMM on SEC's radar: "Suspicious market activity" warning

QMMM is traded on Nasdaq through a Cayman Islands-based holding company. The company's announcement of a large-scale investment in Bitcoin, Ethereum, and Solana has generated strong demand from individual investors. Analysts believe this development further demonstrates how the diversification of traditional companies into cryptocurrencies can cause sharp market volatility.

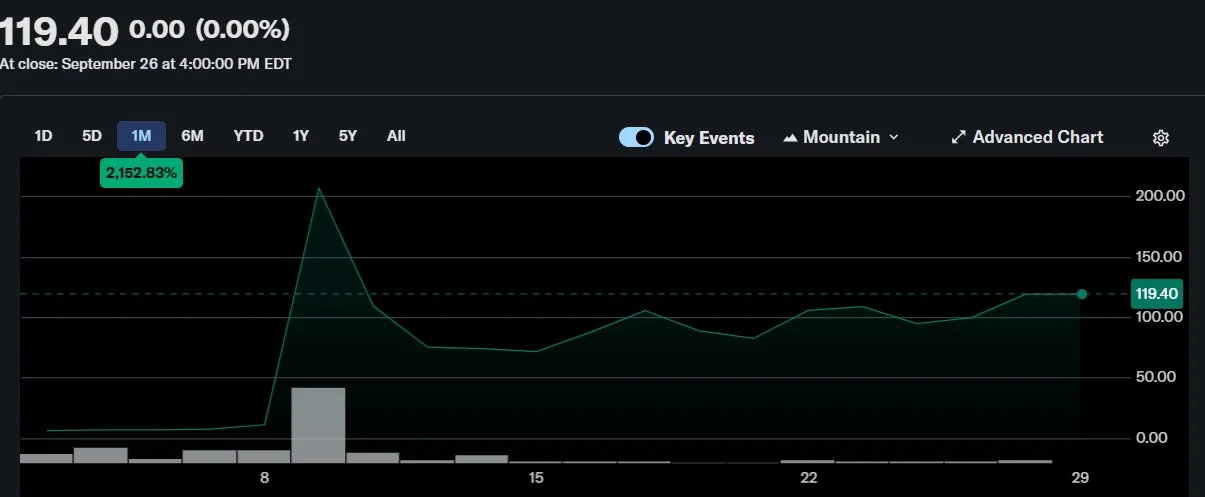

The SEC announced that QMMM shares have been suspended until October 10th. The institution stated that manipulations made by "unidentified individuals" on social media unusually inflated share volume and price, increasing the likelihood of creating artificial demand. QMMM's shares, which were below $12 at the beginning of September, skyrocketed to $200 in the last week of the month.

Experts say this scenario is reminiscent of manipulation tactics known as "pump and dump." The SEC and other US financial regulatory agencies (especially Finra) note that similar situations have increased recently, with unusual trading observed in some company shares ahead of crypto asset announcements.

Investors are uneasy, the company remains silent

QMMM has yet to issue an official statement. The company's shift from digital advertising to crypto assets earlier this year was interpreted as the first step in a strategic transformation. However, uncertainty prevails among investors following the trading halt.

Market analysts suggest that such developments could temporarily curb the trend of institutional crypto treasury. The shift towards cryptocurrencies by mid-sized companies quickly creates significant individual buying waves; However, this also accelerates regulatory scrutiny.

Institutional crypto adoption on the rise

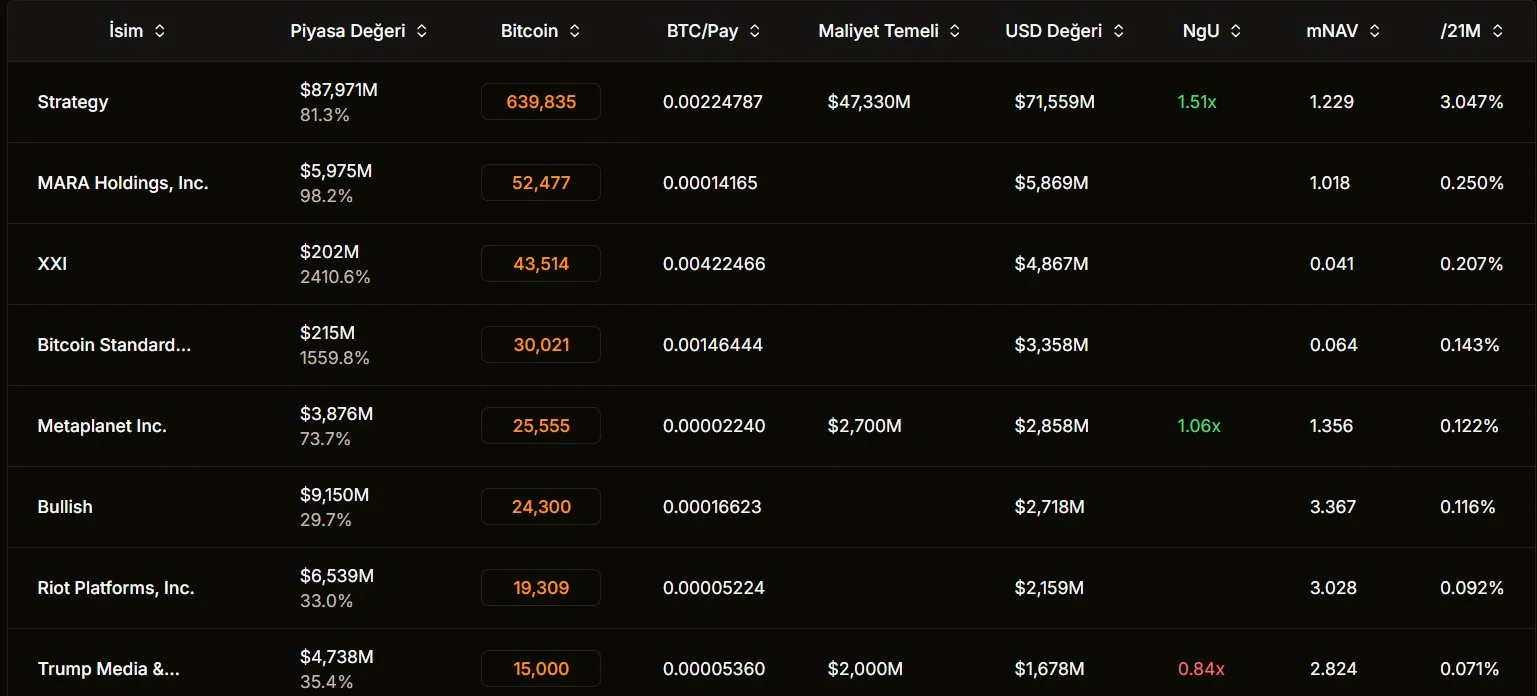

Despite this negative outlook, institutional crypto adoption continues to grow. According to current data, approximately 200 publicly traded companies worldwide hold over $112 billion in digital assets on their balance sheets. These companies' Bitcoin reserves exceed 1 million BTC, representing 4.7% of the total supply. Companies' total holdings of altcoins like Ethereum and Solana have also surpassed $10 billion.

Analysts agree that while the QMMM example may create uncertainty in the short term, it will likely increase the use of cryptocurrencies in corporate treasuries in the long term. In addition to Bitcoin and Ethereum, alternatives like Solana are also expected to gain a greater presence in institutional portfolios.

While the SEC's temporary trading ban on QMMM has caused market volatility, institutional interest is expected to remain strong. With tightening regulatory oversight in the coming period, companies may be required to conduct their crypto investments in a more transparent and controlled manner.