The U.S. Securities and Exchange Commission (SEC) has once again extended the decision process for new ETF applications, which the crypto market has been eagerly awaiting. The regulator announced that it needed additional time to review applications for staking-enabled ETFs, particularly those planned for Ethereum. Applications from major financial institutions such as BlackRock, Fidelity, and Franklin Templeton were affected by the decision. The XRP and Solana ETFs were also put on hold.

Staking Uncertainty in Ethereum ETFs

In documents published by the SEC on Wednesday, it was stated that its review of several Ethereum ETF applications, including BlackRock's iShares Ethereum Trust, is ongoing. The key difference of these ETFs is that they will offer investors the opportunity to generate additional income through staking. As you may recall, an opinion letter published by the SEC in May stated that certain blockchain staking activities do not fall within the scope of securities. This statement created expectations in the markets that staking could be approved for ETFs. However, the SEC recently postponed Grayscale's request to add staking to its Ethereum ETF. Recent decisions indicate that the regulator has still not taken a clear stance on this issue.

XRP and Solana ETFs also on hold

Franklin Templeton's proposed XRP and Solana-focused spot ETFs suffered the same fate. The company submitted its application in March, but the SEC extended the process for these products as well. This has once again delayed the launch of products that would provide institutional investors with access to assets other than Bitcoin and Ethereum in the crypto market.

Still, market participants are hopeful. Bitwise CIO Matt Hougan stated that they expect a strong performance for Solana, particularly towards the end of the year, and that ETF approvals could accelerate this process. In addition to Franklin Templeton, institutions such as Grayscale, VanEck, Fidelity, Invesco/Galaxy, and Canary Capital have also submitted applications for the Solana ETF.

More than 90 ETF applications are on the table

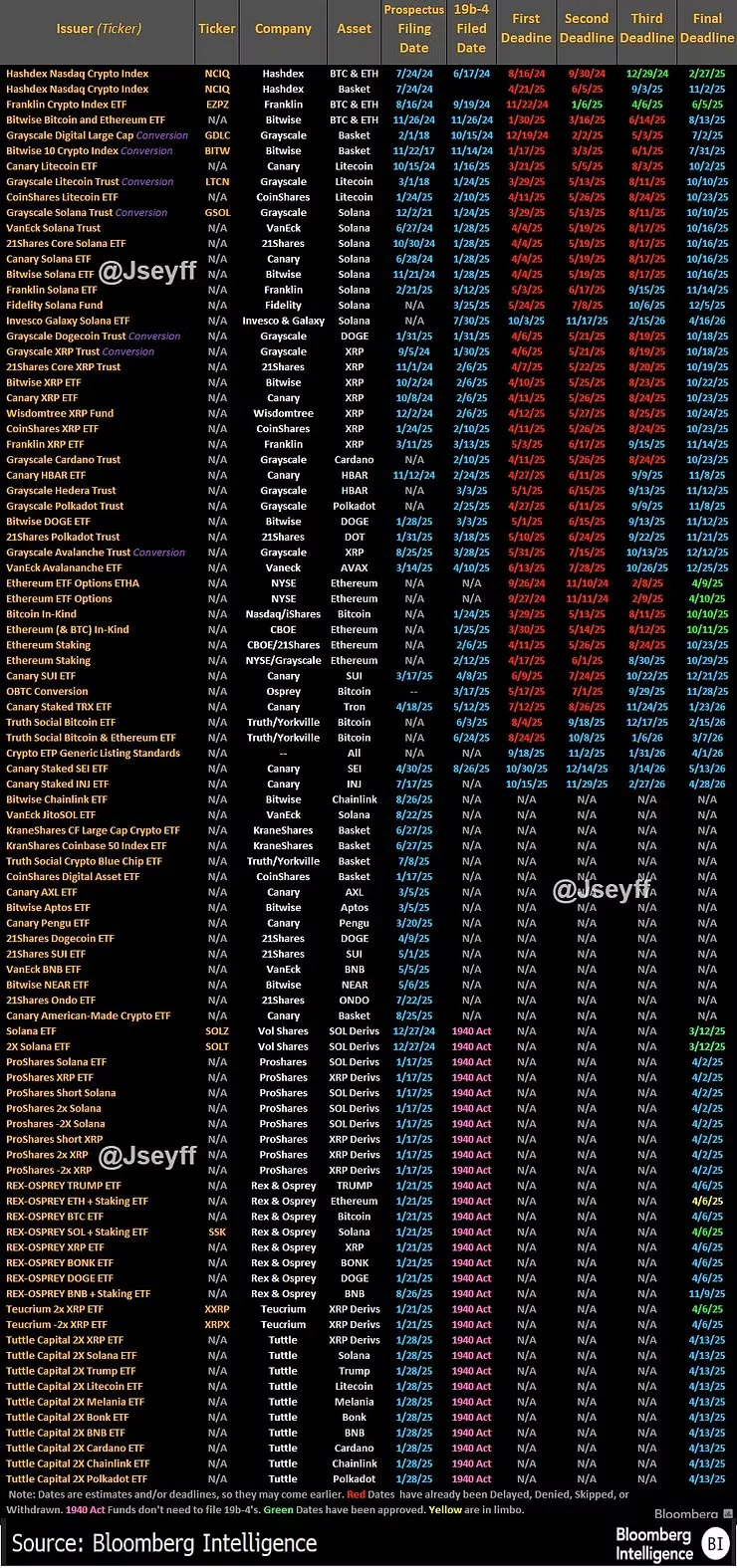

According to data compiled by Bloomberg Intelligence analyst James Seyffart, more than 90 crypto ETF applications are currently before the SEC. McKayResearch founder James McKay stated in a post on the social media platform X, "At this rate, we will see an ETF application for each of the top 30-40 cryptocurrencies within 12 months."

The increase in ETF applications demonstrates the continued appetite of traditional financial institutions for cryptocurrencies. Staking, in particular, is attracting significant interest because it offers investors an additional source of income. However, the SEC's delaying policy continues to create uncertainty in the markets in the short term.

The SEC's decision to delay the application once again demonstrates the challenging nature of the crypto ETF process. Staking on Ethereum could make investment products more attractive than ordinary funds. However, this very innovative feature is causing the regulator to take its decisions slowly.