The cryptocurrency markets are entering a critical day today due to approximately $2.3 billion worth of Bitcoin and Ethereum options expiring. This high-volume expiration sets the stage for renewed volatility in the short term, especially as prices tend to concentrate at certain levels. According to experts, price movements before and immediately after expiration may be shaped more by technical and mechanical hedging transactions than by fundamental developments.

Large amounts of Bitcoin and ETH options are expiring

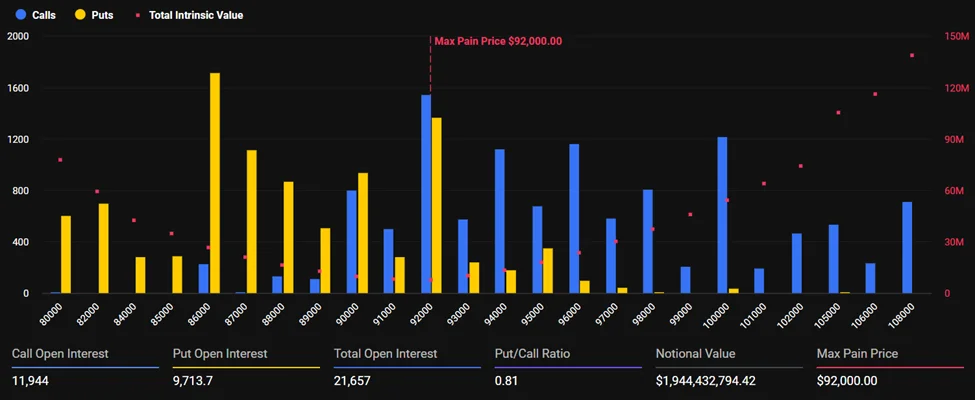

Bitcoin accounts for the majority of the total expiration amount, with a volume of approximately $1.94 billion. Bitcoin is trading around $89,700 before expiration, while the level known as "maximum pain" in the options market is $92,000. The maximum pain level is known as the price point where the most option contracts expire worthless, and price movements towards this level are frequently monitored.

The total open interest on Bitcoin is at 21,657 contracts. Of these positions, 11,944 are call options and 9,713 are put options. The resulting put/call ratio of 0.81 indicates cautious optimism in the market. However, this optimism is not strong, and it still leaves room for sharp price movements in both directions.

On the Ethereum front, the total nominal value of expiring options is approximately $347.7 million. Ethereum is trading in the $2,950–$2,960 range before expiry, with a maximum price of $3,200. The number of open positions in Ethereum options is higher in absolute terms; there are a total of 117,513 contracts. Of these, 63,796 are call options and 53,717 are put options. The put/call ratio of 0.84 shows that Ethereum investors also have a similar cautious bullish expectation. It is noteworthy that this week's options expiry is more limited compared to the approximately $3 billion in options volume that expired last week. Nevertheless, the main reason for the high market sensitivity is the concentration of positions around key strike prices.

Deribit, one of the leading derivatives platforms, points out that the clustering of open positions at certain price levels increases short-term price sensitivity. According to analysts, geopolitical risks, uncertainties regarding trade policies, and question marks regarding global monetary policy are driving investors towards hedging options rather than directional positions. This causes the implied volatility to remain high even if spot prices appear calm.

As the expiry time approaches, price levels called "strike magnets" can create a magnetic field in the market. Hedging transactions carried out by market makers to remain delta-neutral can push prices towards these levels. On the other hand, if the price moves sharply away from these bands, the rapid readjustment of hedge positions can further increase volatility. With the expiration of options, the accumulated gamma risk in the market is expected to be resolved, and volatility is expected to be repriced. This could trigger a new directional movement in Bitcoin and Ethereum as we head into the weekend. This movement could take the form of a relief rally as selling pressure decreases, or it could turn into a downward move as macro risks resurface.