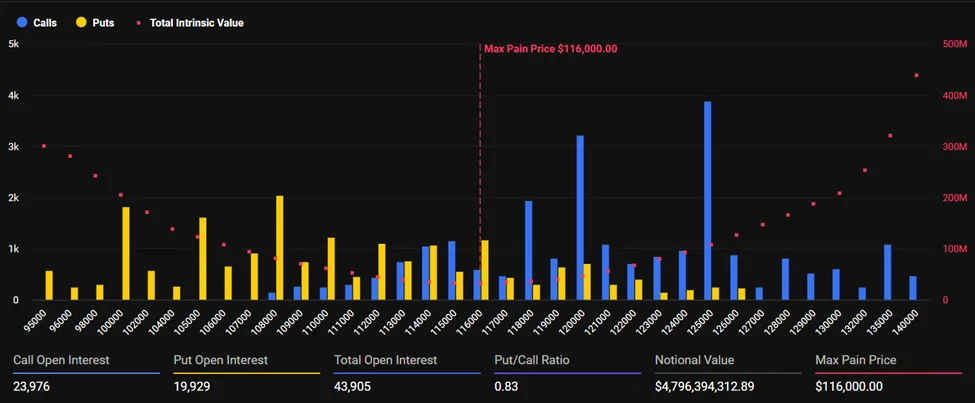

The final trading day of the week in crypto markets is marked by intense stress. With approximately $6 billion in Bitcoin and Ethereum options expiring today, investors have strengthened their defensive positions against the long-anticipated downward wave. According to Deribit data, $4.8 billion worth of contracts are expiring on the Bitcoin side. The put-call ratio is at 0.83, indicating higher demand for put options than for calls.

Critical Levels for Bitcoin and ETH

Bitcoin is trading around $105,000. While the price is struggling to hold just above key support levels, data from the futures and options markets indicate a weak outlook in the short term. The "maximum pain," or the level where investors will face the most losses, is around $116,000. This level confirms that expectations for an upward movement in the market are weak, as it suggests that many contracts will expire worthless.

The outlook for Ethereum is similar. ETH is trading around $3,700, while the $4,100 level represents a significant threshold, both technically and from an options perspective. With more than 250,000 ETH contracts expiring, the put-call ratio is at 0.81. This ratio suggests that the majority of investors are opting for downside hedging strategies.

One of the main reasons for the recent market unrest is the $50 million loss suffered by Selini Capital. The fund's significant loss due to a failed derivatives transaction has created a cascading anxiety among market makers. The cautious approach of liquidity providers, in particular, has led to a significant decline in trading volumes.

Macroeconomic developments are also impacting cryptocurrencies.

Global political and economic uncertainties have also added to this picture. The Trump administration's volatile statements on trade and energy policies have almost completely suppressed risk appetite. Investors are turning to hedging positions again as uncertainty grows. This "political noise" is seen as one of the main reasons for the selling pressure on crypto assets. Analysts consider $93,500 a potential bottom for Bitcoin, with $100,000 representing a short-term recovery threshold. However, current data suggests the market will remain sideways and tense for some time before approaching these levels.

The negative trend seen in the options market suggests that investors are preparing for increased volatility. Put-heavy trading increases the likelihood of further price declines. However, some investors are aiming to capitalize on short-term rebounds by selling put options near the bottom after this sharp sell-off.

The overall picture suggests a cautious approach in the crypto market. As long as the flood crisis subsides and the macroeconomic picture remains clear, a recovery in risk appetite appears unlikely. Options data also suggests that the market's next major move could still be downward.