OP

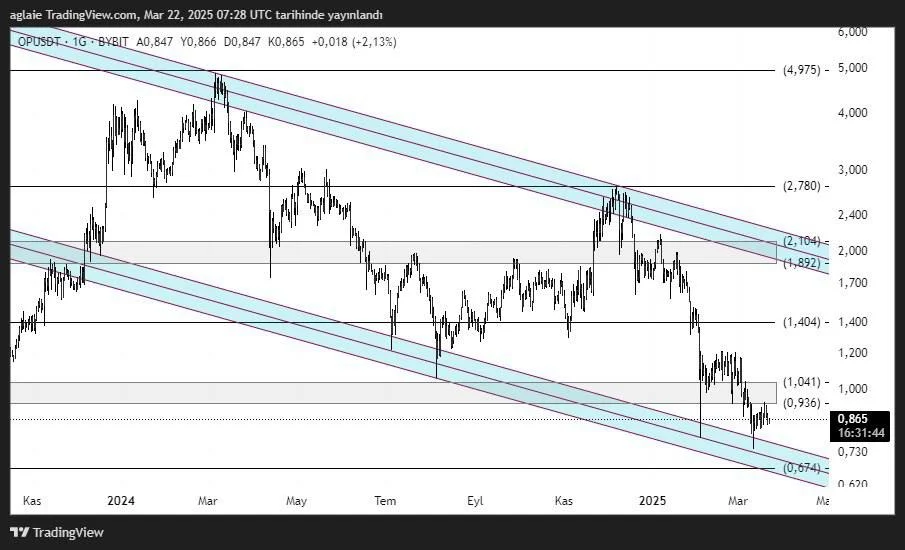

Optimism continues to move within a descending channel. After a bounce from the $0.674 support level, the price shows signs of recovery. In this analysis, we examine the short-term direction of the OP token based on key support and resistance zones.

OPUSDT is currently trading near a technically important region while maintaining its descending channel structure. The price has rebounded from the $0.674 level and climbed to $0.865. While this move indicates a potential short-term recovery, the overall trend remains bearish.

According to the current structure, the nearest resistance for OP Coin is located at $0.936. If this level is broken, the next resistance zone stands at $1.041. These two resistance zones are considered technically strong, and without significant volume, price action may struggle to break through them.

If the price can surpass the $1.041 level and maintain above it, upward momentum could increase. Sustained closes above $1.404 may lead the price to target $1.892 and higher.

On the other hand, if OP fails to break above the $1.041 resistance, a pullback toward the $0.760 level is possible. The $0.674 level remains the main support area, and a breakdown below this point could increase selling pressure.

Despite the overall bearish trend, the bounce from the lower boundary offers a potential buying opportunity in the short term. A sustained move above the $0.936 level could boost investor confidence and create a positive breakout.

Key technical levels to monitor for OPUSDT:

- Support levels: $0.730 – $0.674

- Resistance levels: $0.936 – $1.041

In conclusion, OPUSDT is approaching a critical resistance zone, and price action around this area will be decisive. A breakout above $1.041 could support a continued rally, but failure to break through may result in renewed selling pressure.

Disclaimer:

This analysis does not constitute investment advice. It focuses on support and resistance levels that may present potential short- to mid-term trading opportunities depending on market conditions. However, all responsibility for trading decisions and risk management lies entirely with the user. The use of stop-loss orders is strongly recommended for any trade setup shared.

Author: Ilahe