Assessments from two global banks in the cryptocurrency market indicate a cautious outlook in the short term, while optimism remains in the long term. US financial giant JPMorgan lowered its estimate for Bitcoin's production cost, while British banking group Standard Chartered revised its price expectations. According to JPMorgan analysts, the production cost, which historically served as a "soft support level" for Bitcoin, has fallen from $90,000 at the beginning of 2026 to $77,000. This decline was influenced by a decrease in hashrate, which represents the network's total processing power, and a drop in mining difficulty. The bank emphasized that the recent decline is the sharpest difficulty drop since China's mining ban in 2021. The cumulative decrease in mining difficulty since the beginning of the year has reached approximately 15 percent. Mining difficulty on the Bitcoin network is adjusted approximately every two weeks, aiming to keep the block time stable at an average of 10 minutes. When the hashrate drops, the system automatically lowers the difficulty. According to JPMorgan, this situation is leading to the exit of high-cost miners from the market and allowing more efficient players to gain market share.

Bank analysts pointed out that there are two main reasons for the decrease in production costs. First, the decline in Bitcoin price made operations unprofitable for miners with high energy costs or those using outdated equipment. Some of these companies were forced to shut down their machines. Second, severe winter storms in the US, particularly in Texas, caused large mining facilities to temporarily cease operations.

JPMorgan notes that historically, sharp drops in mining difficulty signal a "capture" period. During such periods, high-cost miners may sell their Bitcoins to cover operating expenses, reduce debt, or shift to different areas such as artificial intelligence. This selling pressure has increased the downward pressure on prices since the beginning of the year. However, the bank believes that the picture has become more balanced after inefficient players exited the market. Indeed, analysts state that signs of a recovery in hashrate are being seen, and this could push production costs up again in the next difficulty adjustment. JPMorgan maintains its positive outlook for the crypto markets for the whole of 2026. The bank cites increased institutional investor inflows and clarification of the regulatory framework in the US as potential catalysts. It also reiterated its long-term target of $266,000 for Bitcoin.

Standard Chartered also shared its Bitcoin and Ethereum forecast

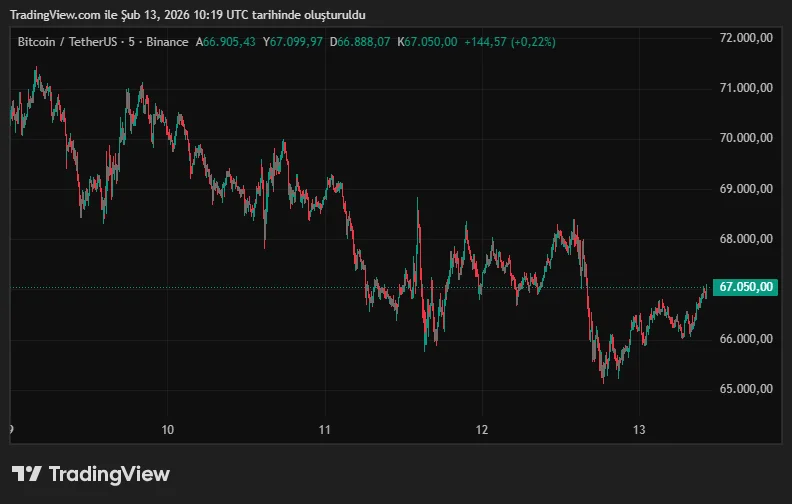

On the other hand, a more cautious short-term outlook emerges from Standard Chartered. The bank's head of crypto assets, Geoff Kendrick, stated that "captivation selling" may continue in the coming months. According to Kendrick, Bitcoin could fall to $50,000 and Ethereum to $1,400. The analyst also drew attention to outflows from spot Bitcoin ETFs. Kendrick emphasized that the amount of assets held in ETFs has decreased by approximately 100,000 BTC since the peak in October, noting that the average purchase price was around $90,000, meaning many investors have incurred significant losses on paper. On the macroeconomic front, the postponement of interest rate cut expectations to June is limiting risk appetite. Despite this, Standard Chartered remains optimistic in the long term. The bank expects a recovery towards the end of 2026 and predicts that Bitcoin could reach $100,000 again. The $4,000 target for Ethereum remains unchanged, although a downward revision has been made compared to previous estimates. At the time of writing, the Bitcoin price is trading around $67,000.