Another significant step has been taken in the Japanese financial world. The country's financial regulator, the Financial Services Agency (FSA), has officially supported a joint stablecoin project led by three major banks: Mizuho, MUFG, and SMBC.

Japanese regulator FSA releases statement on stablecoin initiative

A significant step has been taken that could herald a radical transformation in payment systems in Japan. The country's financial regulator, the Financial Services Agency (FSA), announced its official support for a stablecoin pilot project to be jointly implemented by three major banking groups. This project is seen as a milestone in Japan's long-awaited transition to a blockchain-based payment infrastructure.

The FSA announced that the pilot will be conducted by Mizuho Bank, MUFG Bank, and Sumitomo Mitsui Banking Corporation (SMBC). These banks are among the most powerful players in the Japanese financial system. Under the project, stablecoins jointly issued by these three banking groups will be considered "electronic payment instruments" under Japanese law. This will test the use of these digital assets in accordance with both legal frameworks and operational requirements.

The pilot project is the first step of the FSA's newly launched initiative, the "Payment Innovation Project" (PIP). The PIP is run under the agency's FinTech Proof-of-Concept Hub program, which has been operating since 2017, and enables financial innovations to be tested in a controlled environment. In this context, areas such as the integration of blockchain technology into payment systems, legal compliance, and user security will be evaluated.

The project also includes private sector representatives in addition to banks. Mitsubishi Corporation is contributing as a technological infrastructure partner, while Progmat Inc., which developed the digital token infrastructure, and Mitsubishi UFJ Trust and Banking Corporation, which will handle secure storage, are also part of the consortium.

The pilot is scheduled to begin in November 2025. Throughout the trial, detailed assessments will be conducted on the legal suitability and feasibility of the system, user security, and transaction efficiency. The FSA stated that the results will be shared in a public report upon completion of the project. Japan has traditionally been a country with high cash and credit card usage. However, the government and financial authorities have been taking significant steps in recent years to accelerate the transition to digital payments. This stablecoin pilot is at the heart of this shift. Stablecoins can increase the efficiency of the financial system by offering both fast and low-cost transfers.

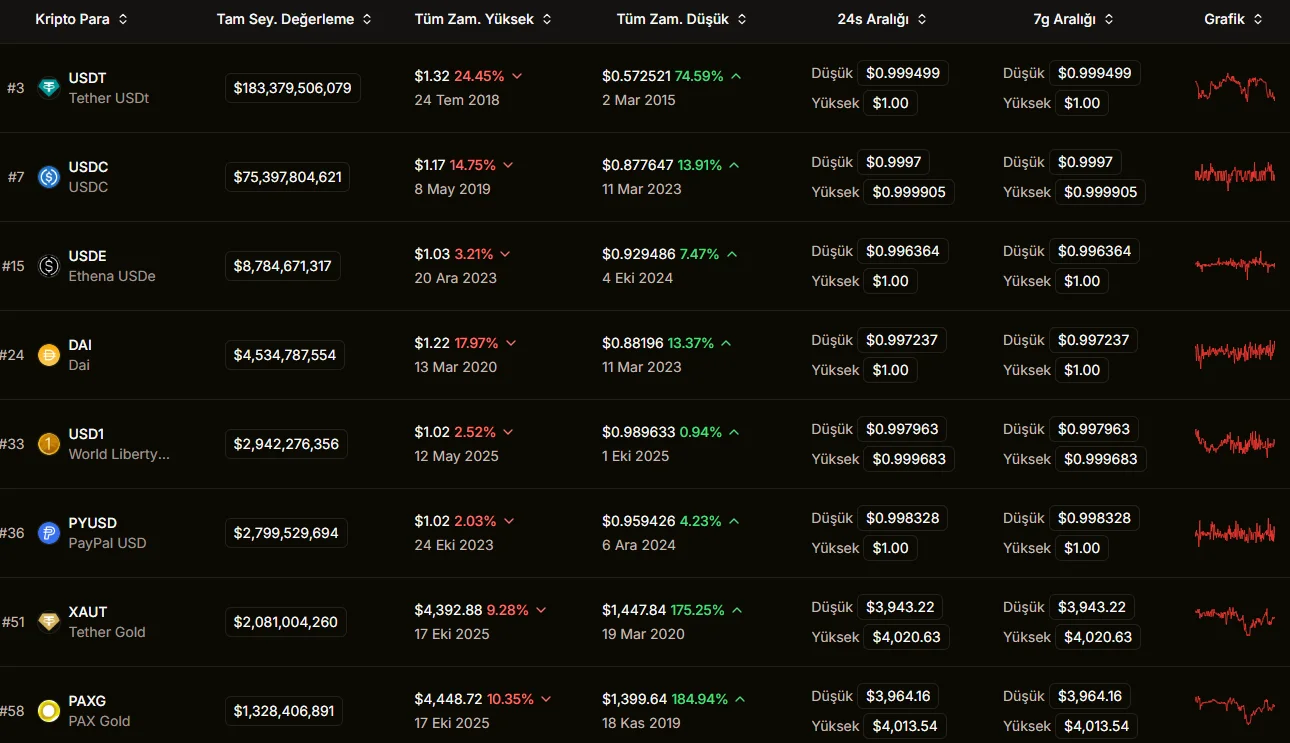

Currently, the largest stablecoins are listed below:

However, this transformation faces several challenges. Stablecoins need to be legally established, and reserve management, cybersecurity, and auditing mechanisms need to be strengthened. Furthermore, the use of digital tokens in interbank fund transfers could reshape the functioning of the current financial system, creating new areas of responsibility for both regulators and banks.