Harvard Management Company (HMC), which manages Harvard University's endowment fund exceeding $50 billion, revealed a significant change in its crypto asset strategy in its fourth-quarter 2025 SEC filing. The institution significantly reduced its Bitcoin ETF position while investing in an Ethereum ETF for the first time.

Bitcoin ETF Position Decreased by 21%

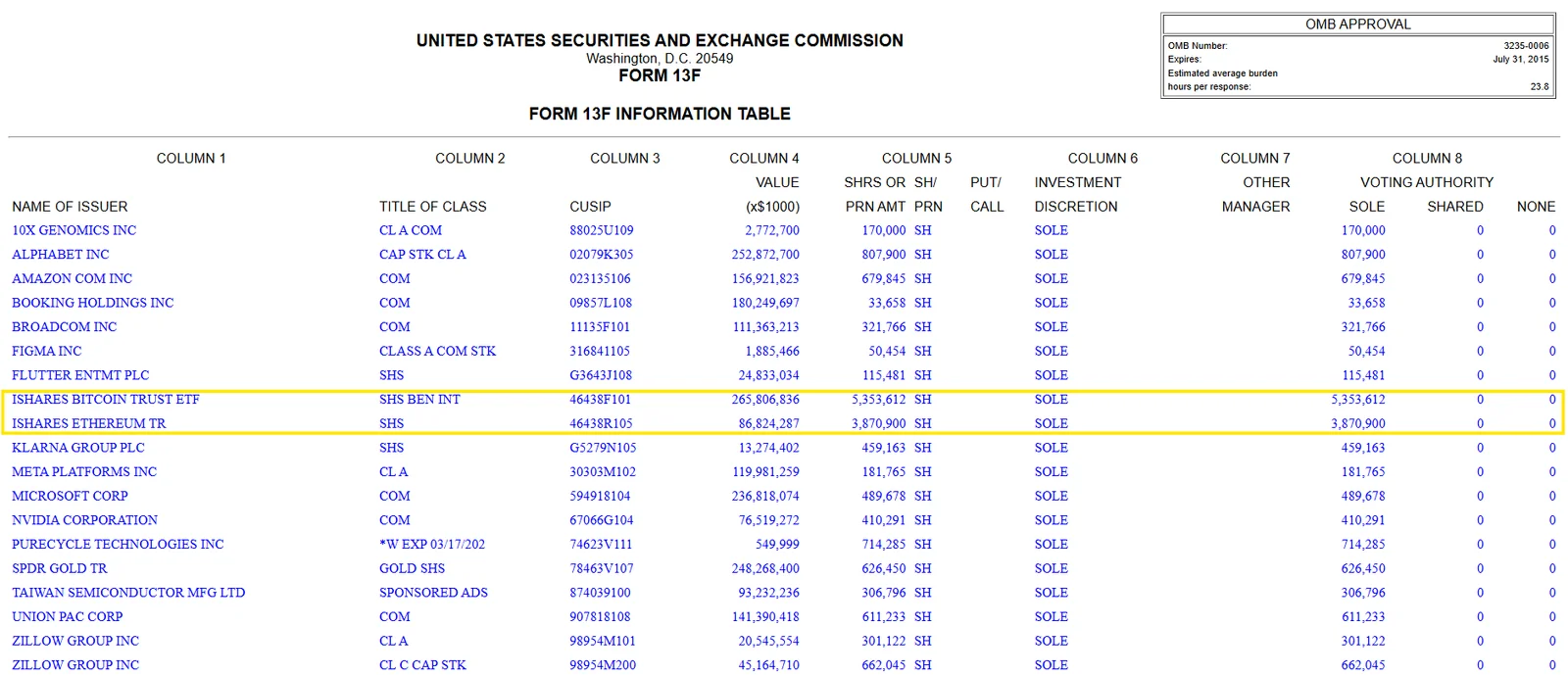

According to the 13F report submitted to the SEC, HMC reduced its stake in the iShares Bitcoin Trust (IBIT) fund, issued by BlackRock, by more than 21% compared to the previous quarter. The fund, which held 6.81 million shares at the end of the third quarter, reduced this amount to 5.35 million shares at the end of the fourth quarter. The market value of this position as of December 31 was recorded as $265.8 million.

In the previous quarter, the value of the IBIT position was $442.8 million. Both the decrease in the number of shares and the pullback in Bitcoin price contributed to the overall decrease in value. Despite this, Bitcoin remained Harvard's largest publicly declared single investment. A new chapter opened on the Ethereum side. HMC purchased 3.87 million shares of the iShares Ethereum Trust (IETH) fund, also issued by BlackRock. The amount paid for this investment was announced as $86.8 million. Thus, the Harvard foundation fund took a position in an Ethereum-based exchange-traded fund for the first time. As a result of these transactions, Harvard's total cryptocurrency exposure through Bitcoin and Ethereum ETFs reached $352.6 million. This shows that the university has not completely abandoned digital assets, but has adjusted its portfolio allocation. The quarter in question was quite volatile for the crypto markets. After peaking at approximately $126,000 in October 2025, Bitcoin experienced a sharp pullback towards the end of the year, falling to $88,429 on December 31st. Ethereum, meanwhile, lost approximately 28% of its value during the same period. Currently, Bitcoin is trading around $68,600 and Ethereum around $1,900.

Despite the reduction in Bitcoin positions, Harvard's $265.8 million investment in IBIT still surpasses its holdings in tech giants like Alphabet, Microsoft, and Amazon. This indicates that the university's appetite for digital assets remains strong.

On the other hand, Harvard's crypto strategy has sparked debate in academic circles. Andrew F. Siegel, a retired finance professor from the University of Washington, described the Bitcoin investment as "risky," pointing to its approximately 22.8% decline in value since the beginning of the year. Siegel argued that Bitcoin's risk profile stems partly from its "lack of intrinsic value."

Avanidhar Subrahmanyam, a finance professor from UCLA, stated that the addition of an Ethereum position has increased his reservations about digital assets. Subrahmanyam stated that he views cryptocurrencies as an unproven asset class with an as-yet-unclear valuation methodology, and that his doubts about Harvard's previous Bitcoin investment have been strengthened by recent performance.