The US Federal Reserve (Fed) will hold a "Payments Innovation Conference" on October 21st to discuss the future of new technologies in the payments field. The event will discuss Bitcoin, stablecoins, and blockchain-based payment systems. This development is considered a significant turning point in the US approach to the role of digital assets within the financial system.

Fed Discusses Cryptocurrencies

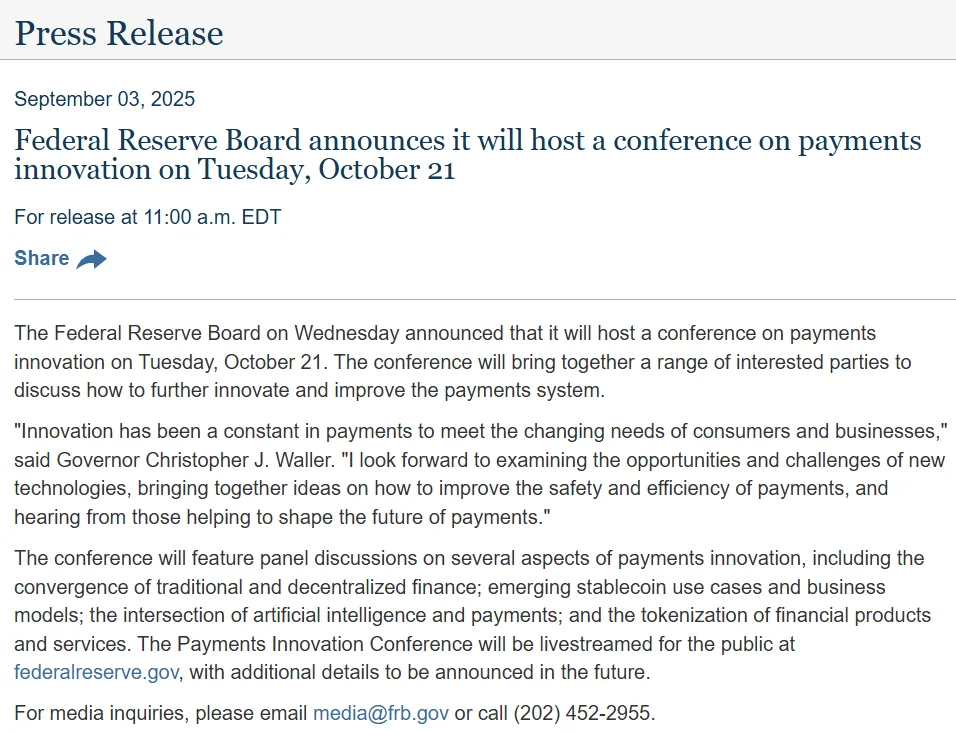

According to a statement released by the Fed on September 3rd, the conference will bring together regulators, financial institutions, and technology experts on October 21st. The main themes of the event will be the intersection of traditional and decentralized finance, stablecoin use cases, the impact of artificial intelligence on payments, and the tokenization of financial products. Fed official Christopher J. Waller, who will speak at the conference's opening, said, "Innovation in payments has always existed to meet the changing needs of consumers and businesses. Now is the time to examine the opportunities and challenges of these technologies together."

This statement signals a shift in the US Federal Reserve's tone toward digital assets, which it has long distanced from. Until now, Bitcoin and stablecoins were largely viewed as speculative investment instruments or elements posing regulatory risks. However, the Fed's decision to address these assets in conjunction with the future of the financial system at an official event is being interpreted as a paradigmatic shift. Clarifying the regulatory framework for the use of stablecoins in payments could pave the way for new opportunities for both financial institutions and technology companies.

The crypto community sees this step by the Fed as a hope that, in the long term, digital assets will gain a more institutional footing in the US financial system. The event's agenda is not limited to cryptocurrencies. Tokenization, AI-powered payment systems, and decentralized financial infrastructures will also be among the topics to be discussed. Experts believe these issues could pave the way for the Fed's future steps in the field of digital currencies and payments. The implications regarding the oversight of stablecoins and their role in interbank payments are particularly significant for the sector. Immediately following this meeting, the Federal Open Market Committee (FOMC) meeting, scheduled for October 28-29, will be closely watched by markets. Economists predict the Fed may consider cutting interest rates at this meeting. Chairman Jerome Powell stated last month that the bank has shifted to a "more neutral policy stance." However, there is still no consensus among members on the interest rate range encompassed by "neutral."

This softening of the Fed's stance on cryptocurrencies could be a turning point in terms of both regulatory clarity and institutional participation. The official discussion of Bitcoin and stablecoins within payment systems is seen as a signal that a new chapter may be opening in US policies toward digital assets.