Consensys-backed SharpLink Gaming has made one of the largest institutional staking moves ever seen in the Ethereum ecosystem. The company staked approximately $170 million worth of Ethereum (ETH) on the Linea mainnet, one of Ethereum's scaling networks. This move, completed in the first days of January 2026, rapidly increased Linea's total locked value (TVL) and brought institutional capital's interest in Layer-2 networks back into the spotlight.

Consensys Ethereum Staking

This distribution was implemented as part of the "Linea Surge" initiative, which aims to grow the Linea ecosystem. This program aims to both accelerate TVL growth and create a more attractive environment for developers. SharpLink joined the process with an initial investment of approximately 7,000 ETH on January 3rd. This amount was equivalent to approximately $22.5 million at the prices of that day. The company added additional tranches within a few days, increasing its total investment to approximately 53,000 ETH as of January 6th. Thus, the total value transferred to the Linea network reached approximately $170 million.

This large capital inflow was directly reflected in Linea's TVL data. The network's total locked value quickly surpassed $340 million. A significant portion of this increase is attributed to SharpLink. This development indicates that Linea is in a stronger position in the competition to attract capital from other Ethereum Layer-2 solutions.

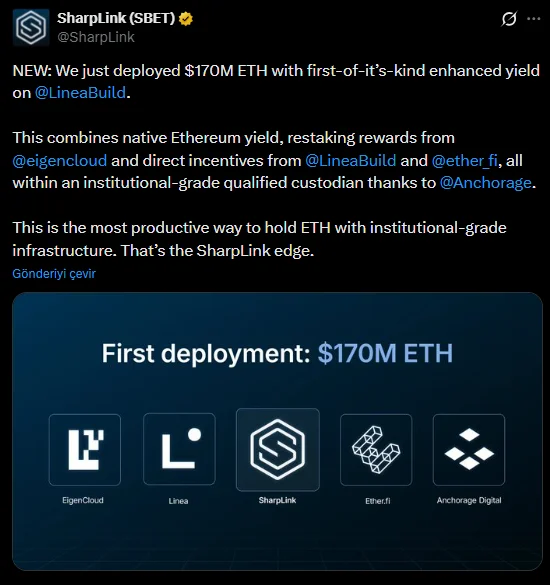

SharpLink's staking structure specifically targets institutional investors. The company uses a permissioned and verified liquid staking protocol. This structure combines different yield sources under one roof. The system includes Ethereum's native staking yields, restaking rewards obtained through EigenCloud, and direct incentives provided by Linea and Ether.fi. All assets are held by Anchorage Digital, which provides institutional-level custody services. In this respect, the structure offers a compatible and on-chain yield solution for large investors.

SharpLink's connection to Linea is further highlighted by the strong ecosystem behind the company. Linea was developed by Consensys, an Ethereum infrastructure company also known for being behind MetaMask. SharpLink's close relationship with Consensys makes it one of the institutional entry points into the Linea ecosystem. But the company's plans don't stop there. SharpLink aims to launch a native governance token called SHARP in the third quarter of 2026. The distribution is planned to be a combination of airdrops for early-stakers and a public sale. This step is expected to further strengthen protocol participation with long-term incentives. On the other hand, SharpLink holds one of the largest Ethereum treasuries among publicly traded companies. The company has approximately 864,840 ETH, all of which is staked. This figure corresponds to a value of approximately $2.7 billion at current prices. The management sees making Ethereum productive for shareholders, rather than simply holding it as a passive asset, as a strategic priority. This $170 million move demonstrates the growing interest of institutional investors in structured, regulated, and multi-layered yield strategies. It also positions Linea as an increasingly attractive Ethereum scaling network for large-scale capital investment.