Today marks a critical threshold in the crypto derivatives markets. Bitcoin and Ethereum are stuck at "max pain" levels ahead of the expiration of over $2.2 billion worth of options contracts on the Deribit exchange. Simultaneously, macroeconomic decisions and data from the US are making the market's direction even more sensitive.

$2.2 billion in options expiring locks the market

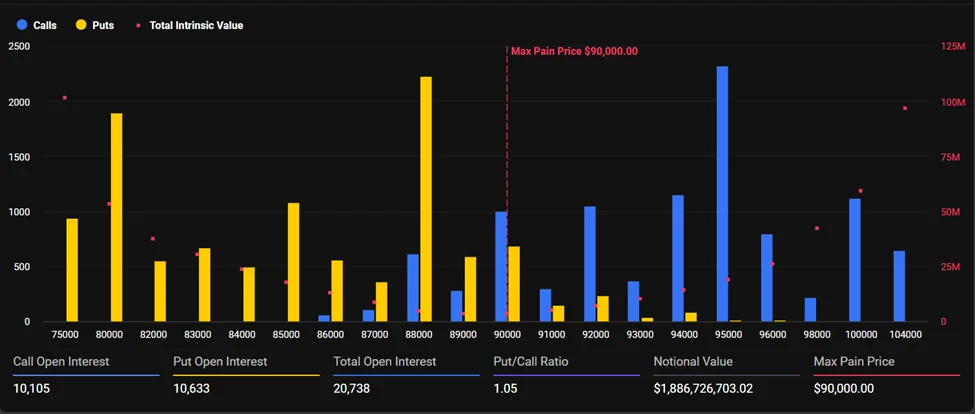

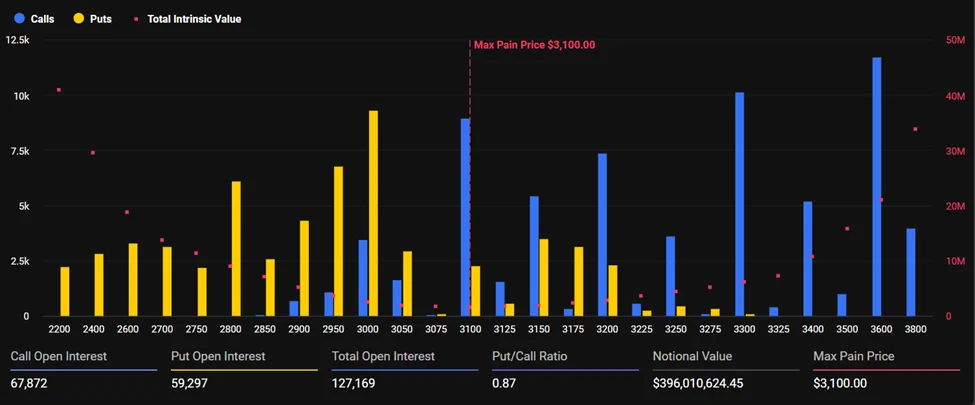

According to data, Bitcoin is trading around $90,000 at the time of writing. This level almost perfectly matches the $90,000 max pain point set for BTC options. On the Ethereum side, the price is stabilizing around $3,100; this is also quite close to the maximum pain level calculated for ETH options.

Looking at the overall picture, the size of Bitcoin options is approximately $1.84–$1.89 billion, while the size of Ethereum options is in the $380–$396 million range. This concentration is causing prices to remain in a narrow range before expiration. In particular, market makers' hedge positions are suppressing volatility by putting pressure on the spot price.

Another notable element in the Bitcoin options market is the balance between call and put positions. Call and put open positions are almost equal. This indicates that investors are cautious about both upward and downward scenarios, and a strong directional expectation has not yet formed. On the Ethereum front, the picture is somewhat more asymmetrical. Call contracts are seen to be more dominant than puts in ETH options. The concentration of calls, especially above $3,000, suggests that Ethereum may become more sensitive to upward movements after expiration. According to analysts, if the ETH price remains above its maximum pain level, market makers may be forced to pursue bullish positions.

Macroeconomic agenda is putting pressure on crypto

The option expiration date alone does not create risk. The real pressure stems from two critical developments coming from the US on the same day. The first is the US non-farm payrolls (NFP) data for December. Market expectations are that employment growth will accelerate compared to the previous month. In particular, average hourly earnings data is closely watched in terms of the inflation outlook.

High wage increases could strengthen expectations that the Federal Reserve may keep its interest rate policy tight for longer. This scenario puts pressure on non-interest-bearing assets and can negatively affect instruments such as Bitcoin and gold. Indeed, the recent strengthening of the dollar index has limited upward attempts in the crypto market.

The second important issue is the decision of the United States Supreme Court regarding the tariffs implemented during the Trump administration. The possibility of the court making a decision that limits the tariffs implemented under presidential powers could affect trade and growth expectations in the short term. Crypto markets are known to react sensitively to tariff news in the past.

Sharp drop in open interest signals a "reset"

In addition to option expiry, open interest data in derivative markets is also noteworthy. Bitcoin open interest has fallen to its lowest levels since 2022. Significant declines on major exchanges such as Binance, Bybit, and OKX indicate that leveraged positions are being cleared across the market. Historically, these periods mark phases when the market experiences a "reset." When excessive leverage disappears, prices generally settle on a more stable level. While this process sometimes results in horizontal consolidation, in other cases it can pave the way for a new upward wave.