The crypto market entered a period of uncertainty following the Federal Reserve's announcement of a quarter-point interest rate cut. Initially welcomed, the decision was quickly digested due to internal committee disagreements and the lack of clear indications of further easing; risk appetite weakened, and prices turned down again. Futures data, however, shows that traders have already shifted to new expectations, pricing in a near 40% probability of a cut by March. This situation has carried the market into the final weeks of the year on an uncertain footing. At the FOMC meeting, the federal funds range was lowered to 3.5-3.75. The vote passed 9-3; two regional presidents opposed the cut, while Fed Governor Stephen Miran advocated for a more aggressive half-point reduction. The emphasis on "carefully evaluating incoming data" was closely watched, as it is language used in the past during periods of slowing interest rate cut cycles. This tone dampened hopes for further easing. Bitcoin experienced sharp fluctuations between $93,200 and $91,700 after the decision; Ethereum also exhibited similar volatility in the $3,340-$3,440 range. Solana, XRP, and BNB were also caught in the same fluctuations. The Fed's $40 billion Treasury bond purchases, starting on December 12th, have brought the "quantitative easing" debate back to the forefront. A similar program in 2019 was implemented for reserve management purposes; today, it is being discussed that its effect may be limited but potentially directional.

What do the experts say?

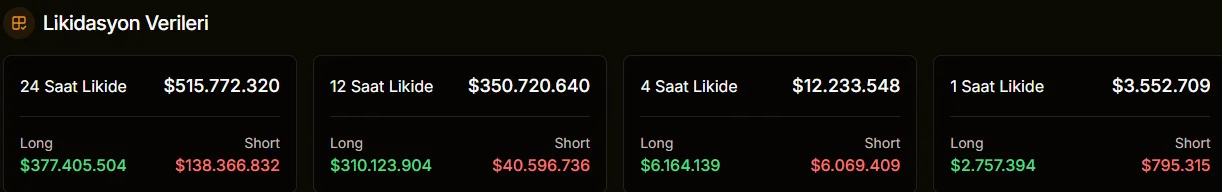

Analyst comments reflect the confusion in the market. According to the CryptoQuant team, BTC has the potential to break through the $99,000 and $102,000 resistance levels and head towards $112,000 if the Fed becomes more clearly "dovish." However, this requires not only further rate cuts but also a more consistent guide from the Fed regarding its inflation path until 2026. Nic Puckrin of Coin Bureau stated that the decision being less hawkish than expected gave the market a brief respite, but the fact that only one rate cut was predicted dampened this relief. Another view came from David Hernandez of 21Shares; according to Hernandez, the rate cut itself is the first sign that could increase risk appetite. "Today's rate cut is a lifeline thrown to sinking Bitcoin," he says, recalling the historical tendency of cheaper liquidity to flow into crypto. However, the price action in the market did not immediately confirm Hernandez's optimism. Bitcoin retreated to the $90,000 threshold the morning after the decision. After a brief jump above $94,500 on Tuesday, BTC returned to the middle band after failing to break this resistance. Over $514 million in leveraged positions were liquidated in the last 24 hours; losses from long positions were approximately three times greater than those from short positions.