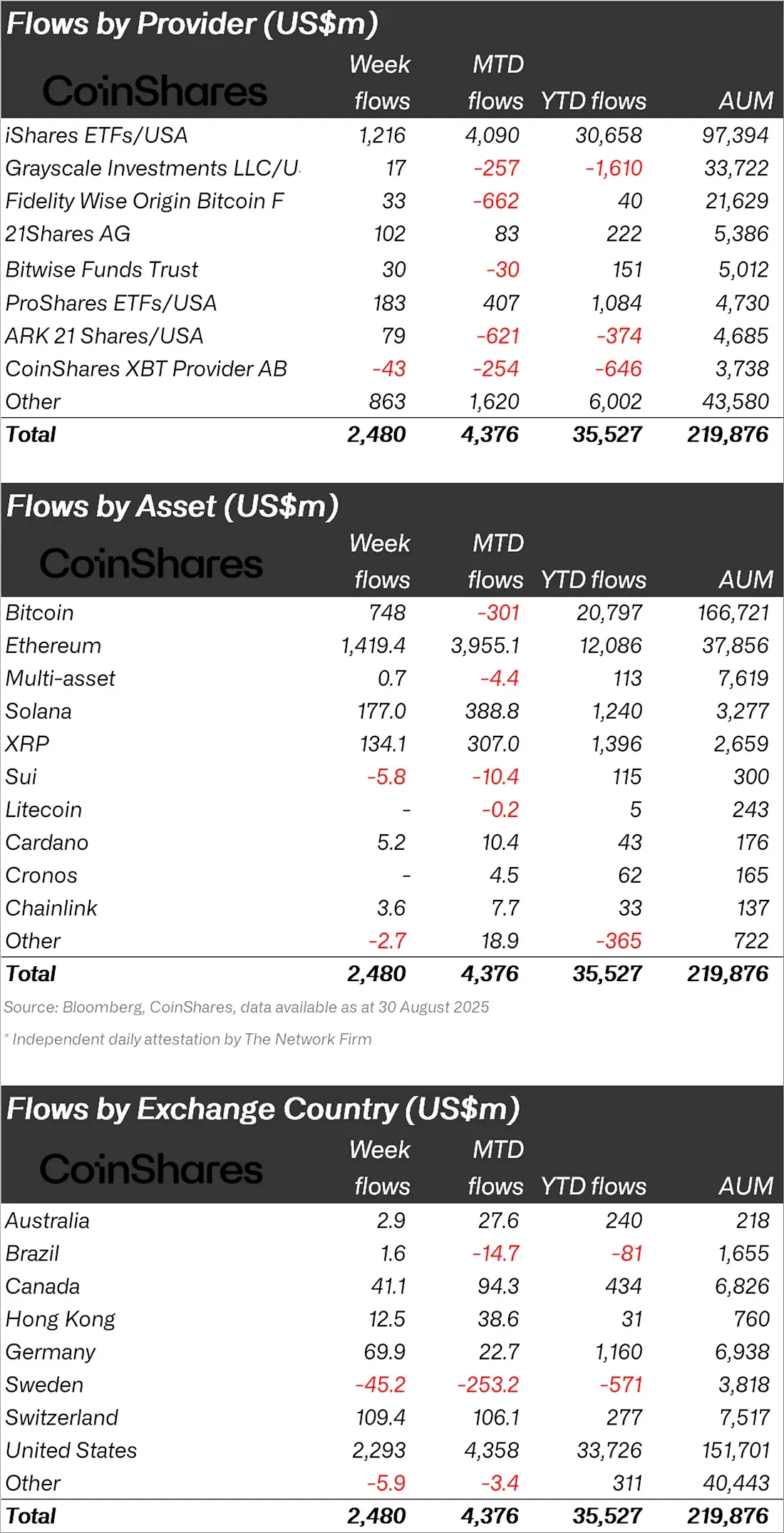

Crypto investment products performed strongly in August, accelerating the inflow of fresh capital into the market. According to CoinShares' latest report, net inflows of $2.48 billion were recorded last week alone. This brings the August total to $4.37 billion, while inflows since the beginning of the year have reached $35.5 billion. However, due to the negative market price movement, total assets under management (AUM) declined by 10% to $219.8 billion.

The Shadow of Macro Data

Fund inflows, which had been positive throughout the week, turned negative following Friday's release of US core PCE data. The underperforming data weakened the prospects for a September interest rate cut, limiting demand for digital assets. CoinShares Head of Research James Butterfill stated that this development was disappointing for investors.

Regional Outlook: US Remains Leading

Regionally, the US market remains the leader with weekly inflows of $2.29 billion. $4.35 billion flowed into US funds throughout August. Switzerland, with $109.4 million, Canada, and Germany, with $41.1 million in inflows, were other prominent countries. Sweden, however, saw a notable weekly outflow of $45.2 million, bringing the total outflow to $253.2 million in August. This figure demonstrates the diversification of investor behavior across European countries.

iShares Leads the Way Among Fund Providers

iShares/USA was clearly the leading provider among investors' preferred providers. With $1.21 billion in inflows in just one week, iShares funds recorded net inflows of $4.09 billion for the entire August, maintaining their leadership position with a record $30.6 billion in inflows since the beginning of the year. ProShares and 21Shares, with $183 million and $102 million, respectively, were also prominent providers. In contrast, Fidelity (-$662 million), ARK 21Shares (-$621 million), and CoinShares XBT Provider (-$254 million) experienced significant outflows in August.

Ethereum funds outperform Bitcoin

The largest difference in terms of assets was seen on Ethereum. Ethereum funds recorded $1.42 billion in inflows last week, reaching a total of $3.96 billion in August. Bitcoin funds, on the other hand, experienced $301 million in outflows for the month, despite a weekly inflow of $748 million. Year-to-date, Bitcoin funds have seen total inflows of $20.8 billion, while Ethereum's has risen to $12 billion.

Solana funds attracted attention with a weekly inflow of $177 million, while XRP funds gained $134 million. The movement in these two altcoins is linked to expectations for potential spot ETF approval in the US. Cardano ($10.4 million), Chainlink ($7.7 million), and Cronos ($4.5 million) also saw positive inflows, albeit limited, in August. In contrast, Sui recorded an outflow of $10.4 million.

August was a strong month for crypto investment funds. Ethereum, in particular, has become a clear favorite among institutional investors, while Bitcoin's outflows signal a market shift. Increasing demand for altcoin funds like Solana and XRP suggests investors are diversifying. Regional differences, macroeconomic data, and Fed policies will be the most important factors shaping fund movements in the coming period.