EDU

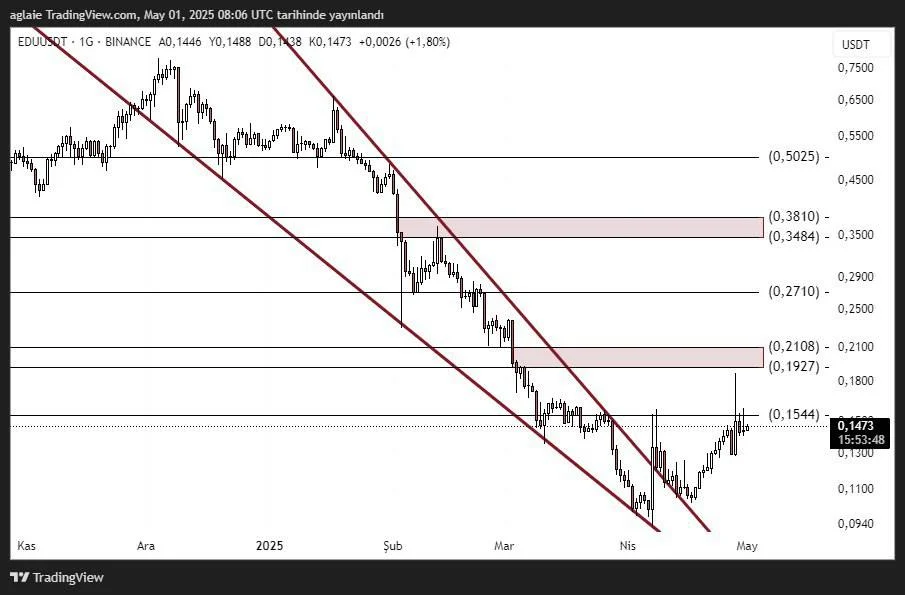

EDU has been moving in a hard downtrend for a long time and has gone through a period that has forced its investors. However, there has been a very positive development on the charts in recent days: the price has come out of the long-standing falling channel with a strong break. This technical break gives an important hint that the price may start rising again.

EDU is currently trading around $0.1440. The rise that took place recently managed to move the price up to the level of $ 0.1544 in a short time. This rise can be interpreted as the beginning of a new upward momentum for EDU.

Technical Levels: Supports and Resistances that Need to be Considered

Support Levels:

- 0.1440 - 0.1400 $: Current and Dec support level, the price is trying to hold on here.

- 0.1250 – 0.1160 $: Important support area for confirmation of channel breakage.

- $ 0.1000: Psychological support as one of the bottom levels.

Resistance Levels:

- $0.1544: The first tested resistance point after the break.

- 0.1927 – 0.2108 $: The most critical resistance zone to target in the medium term.

- $0.2710: Another resistance that can be tested if the uptrend strengthens.

- $0.3484 - $0.3810: The critical return zone in the long term.

EDU may have started a new upward trend with the breaking of the falling channel structure. Nevertheless, the critical point for investors right now will be to ensure permanence above the $0.1440 level. If the price manages to hold on here and starts rising again, the December of $ 0.1927 – 0.2108 will be targeted in the first place. Daily closures above this region, on the other hand, may make the rise even stronger and bring the $ 0.2710 levels to the agenda. In case of possible pullbacks, maintaining the $0.1250 – $ 0.1160 support zone will be critical for the continuation of the bullish scenario.

As a result, this technical breakage in the EDU chart indicates that the negative weather that has been going on for a long time may be changing now. It is now the time for investors to be patient and careful. Even if there are short-term retreats, we are technically facing a more positive and promising outlook. EDU may have re-entered the radar of investors.

These analyses, which do not offer investment advice, focus on support and resistance levels that are thought to create trading opportunities in the short and medium term according to market conditions. However, the responsibility for making transactions and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss in relation to shared transactions.