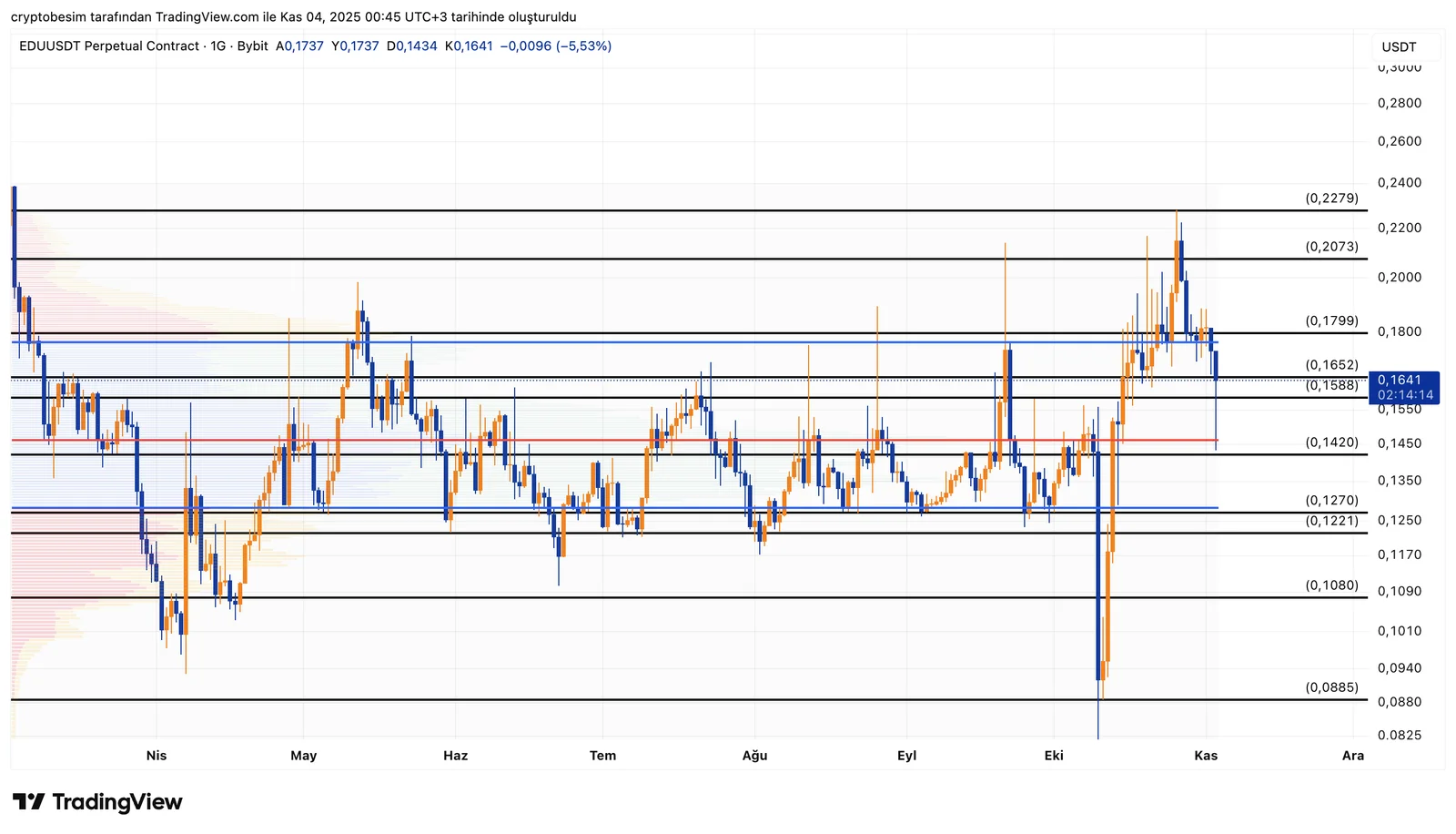

EDU/USDT Technical Analysis

Open Campus keeps attracting attention with its blockchain-based education infrastructure. In October 2025, the project completed a $5 million funding round, advancing its mission to bring Web3 innovation into the education sector, particularly in Asia, with concepts like on-chain student loans. These developments show that EDU is evolving beyond speculation into a token with real-world utility potential.

- Summary• EDU remains within a solid consolidation structure.• $0.12 is the major accumulation and trend-base zone.• Sustaining above $0.158 supports a short-term bullish outlook.• $0.18–$0.20 stands as the next upside target zone.• Below $0.142, risk of a drop back toward the range bottom increases.

These analyses, not offering any kind of investment advice, focus on support and resistance levels considered to offer trading opportunities in the short and medium term according to the market conditions. However, traders are responsible for their own actions and risk management. Moreover, it is highly recommended to use stop loss (SL) during trades.