Global markets are counting down the hours to the December 10th FOMC meeting, with the general expectation that the Fed will cut its policy rate by 25 basis points. However, investors' main interest has shifted from the decision itself to the signals Chairman Jerome Powell will give regarding 2026. Topics such as liquidity regulations, balance sheet management, and a possible leadership change are seen as key factors that will determine the long-term direction of US monetary policy. The Federal Reserve's interest rate decision will be announced at 10:00 PM tonight. Fed Chairman Jerome Powell will deliver a speech at 10:30 PM.

The Fed meeting is eagerly awaited

Data released before this meeting supports expectations. The September PCE report showing annual inflation rising to 2.8%, while still above the target, reinforced the interpretation that the Fed is leaving room for gradual easing steps. Price pressures, which have accelerated since the fall, indicate the strongest increase seen since the spring of 2024. UBS Strategist Jonathan Pink says there is broad support for a rate cut within the committee, but emphasizes that a significant policy revision should not be expected. According to Pink, the main focus of the meeting will be how Powell frames the risks and the tone he uses regarding long-term expectations. Pink forecasts two rate cuts for 2025, while reminding that the 2026 discussions will be shaped by the approach of the new Fed chairman. On the liquidity side, more details may emerge. Pink suggests that the Fed may purchase between $40-60 billion worth of Treasury bonds monthly to stabilize repo markets and manage overall liquidity. This is seen as a sign of a period where balance sheet policy will be re-discussed.

How will the crypto market be affected?

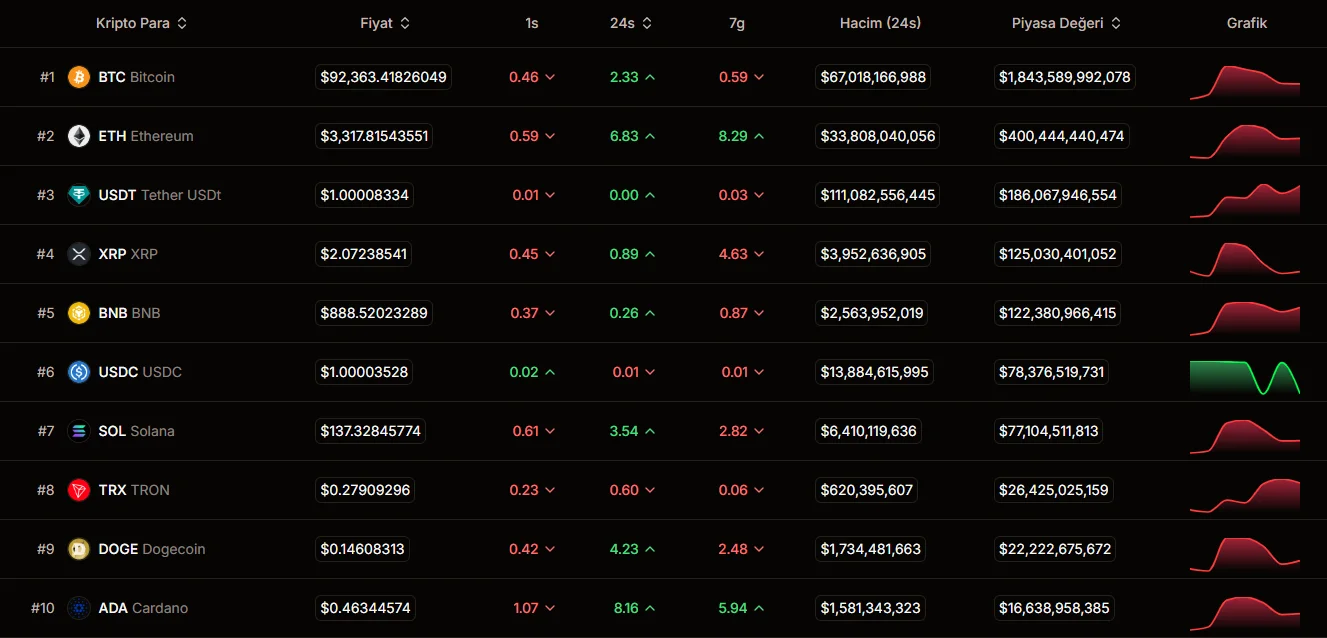

In the crypto market, the prevailing view is that rate cuts will not have an immediate impact. Analyst LA MAN says that monetary policy easing alone will not improve the weak market structure. According to him, unless the technical structure strengthens, rate cuts will have a limited effect. He adds that a large-scale asset purchase program (QE) could change the direction, but the timing is uncertain. Denny Research President Ed Ardenni sees the current inflationary pressures as temporary. Ardenni believes that tariffs have led to short-term price increases, but the overall trend is towards cooling. While he argues that the economy does not need interest rate cuts, he also acknowledges that the market's expectation set is putting significant pressure on the Fed. According to him, easing measures could trigger a new period of volatility in stocks. He also states that Bitcoin is strongly affected by this policy, and its value is determined not only by its identity as a "store of value" but also by the interaction of regulation and monetary policy. In the crypto outlook extending to 2026, interest rates may not be the only determining factor. Analyst Leon Waidmann says that a low interest rate environment will encourage investors to take on more risks, thus supporting crypto activities. However, he notes that as traditional finance returns fall, stablecoin and on-chain dollar returns will also decline, and this will be felt more clearly in 2026. Tokenization, expanding stablecoin adoption, and potential regulatory steps (such as the Clarity Act) are listed among the long-term growth dynamics. At the time of writing, Bitcoin, Ethereum, and other major cryptocurrencies are trading slightly higher in a period of 24 hours.