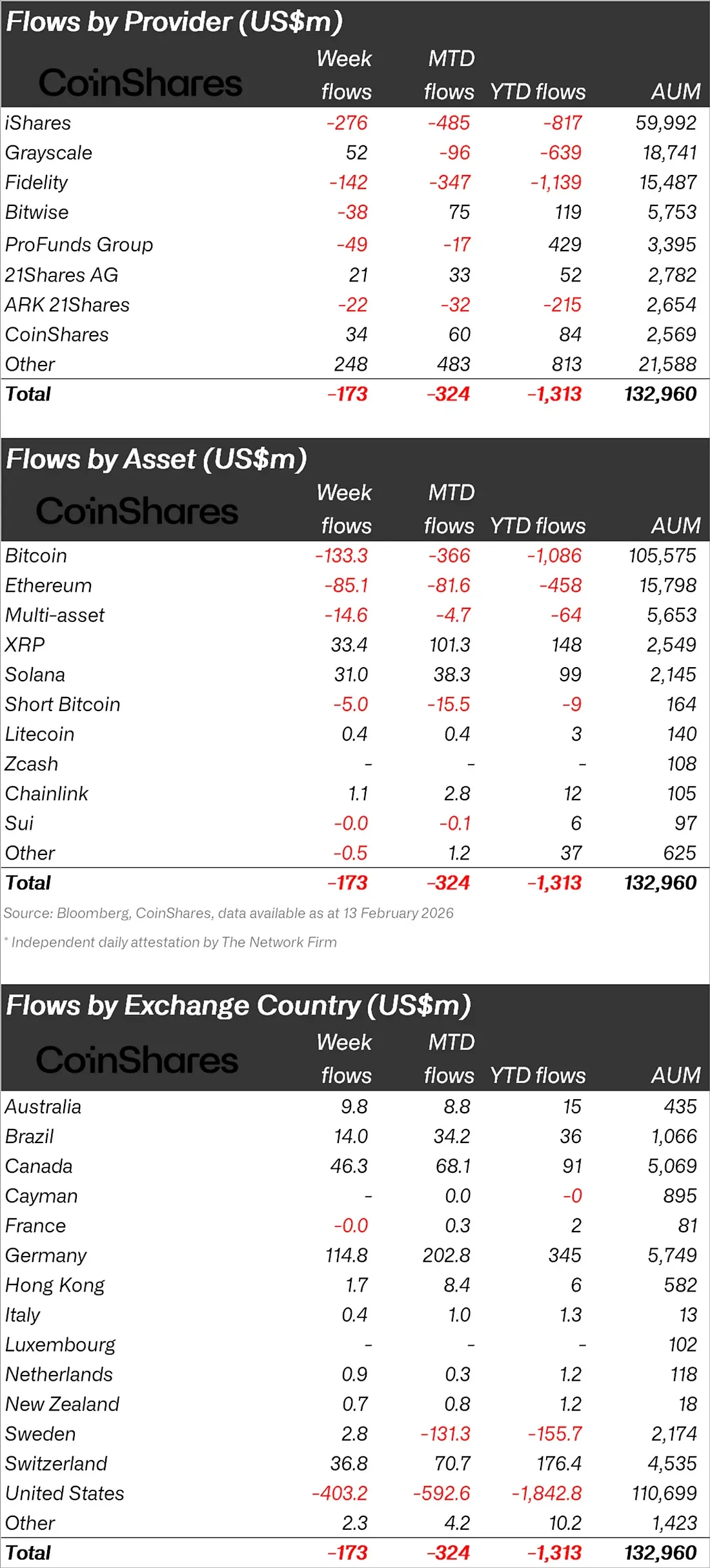

The outflow from cryptocurrency investment products has continued for a fourth week. According to CoinShares' weekly report, there was a net outflow of $173 million from digital asset funds last week. This brings the total outflow over the past four weeks to $3.74 billion. Although the pace has slowed after the sharp sell-off seen at the beginning of the month, the weakness in fund flows has not yet ended. The picture was more optimistic in the early days of the week. A total of $575 million in inflows was recorded on Monday and Tuesday. However, a strong outflow of $853 million followed. This wave is considered to be influenced by the weakness in prices. On the last trading day of the week, a limited recovery of $105 million was seen after the lower-than-expected US inflation data. Nevertheless, the overall weekly picture remained negative. There is also a noticeable decrease in trading volumes. The total volume in exchange-traded products (ETPs) fell to $27 billion. The previous week, a record high of $63 billion was reached. This sharp drop in volume indicates that speculative appetite has weakened and investors have adopted a cautious stance.

Sharp Outflow in the US, Selective Buying Wave in Europe

The regional distribution points to a significant divergence. US-based products saw a weekly outflow of $403 million. In contrast, Europe and Canada experienced a net inflow of $230 million. Germany led with an inflow of $114.8 million, followed by Canada with $46.3 million and Switzerland with $36.8 million. While risk aversion continues in the US, a selective buying appetite is noticeable in Europe.

Looking at assets, the largest outflow was seen in Bitcoin funds. $133.3 million was withdrawn from Bitcoin investment products. Interestingly, there was also a total outflow of $15.4 million in short-Bitcoin products in the last two weeks. CoinShares notes that such simultaneous outflows have historically been seen near market lows. The picture is also weak on the Ethereum side. There was a weekly outflow of $85.1 million from Ethereum funds. Thus, the total outflow from Ethereum products since the beginning of the year has reached $458 million. Multi-asset funds also experienced a limited withdrawal of $14.6 million.

However, some altcoins continue to outperform. XRP funds attracted $33.4 million in inflows last week. Solana funds recorded a net inflow of $31 million. Chainlink also showed a positive inflow of $1.1 million. This picture shows that investors are avoiding widespread risk-taking while preferring to increase positions in specific projects.

The total assets under management is at $132.9 billion. Bitcoin products are clearly leading with $105.5 billion in AUM. Ethereum products have approximately $15.8 billion in size. In summary, while selling pressure in crypto fund flows has slowed, it has not completely disappeared. While outflows from the US are dragging down the global picture, inflows from Europe and Canada are playing a balancing role. While a cautious atmosphere persists in Bitcoin and Ethereum, the relatively strong flows in altcoins like XRP and Solana reveal the presence of selective risk appetite in the market. Macroeconomic data and price movements in the coming weeks will determine the direction these balances will take.