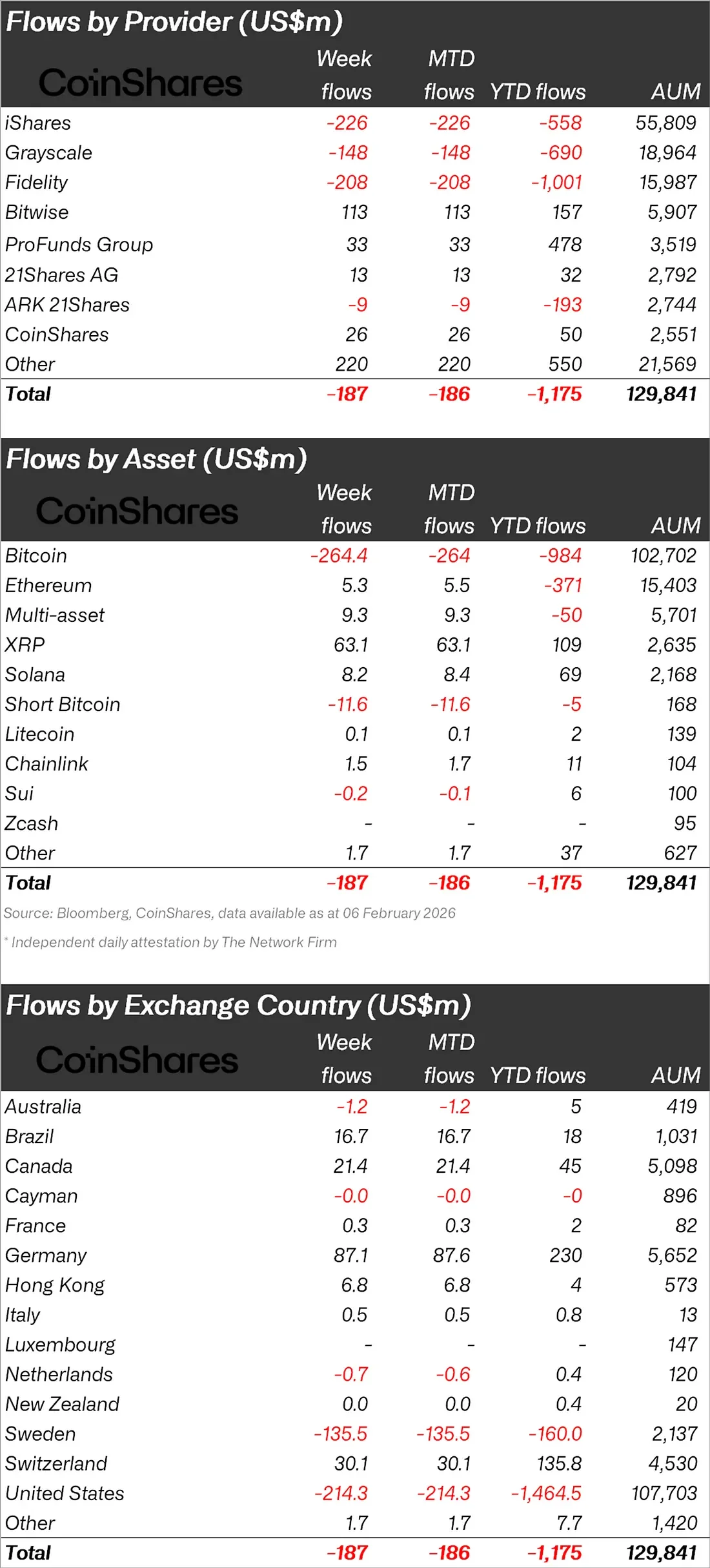

According to CoinShares' weekly report, the sharp outflow from cryptocurrency investment products has slowed significantly. In the last week, a total net outflow of $187 million occurred from digital asset-based investment products. This figure represents a sharp slowdown compared to the approximately $1.7 billion in outflows seen consecutively in the previous two weeks. While the market is still under price pressure, this loss of momentum in fund movements is interpreted as approaching a potential breaking point in investor sentiment.

What does the CoinShares report show this week?

According to the report, CoinShares Research Director James Butterfill emphasizes that changes in the rate of flows, rather than absolute inflow/outflow figures, have historically provided more meaningful signals. According to Butterfill, the fact that outflows haven't completely stopped doesn't automatically mean a negative picture; what's important is the slowdown in the momentum of these outflows. In past cycles, similar slowdowns have coincided with periods when local lows were formed in the markets.

On the cryptocurrency price side, the picture remains challenging. Although Bitcoin has lost approximately 9% of its value in the last week, its attempt to recover towards the $70,000 level is noteworthy. Despite this, total assets under management (AUM) fell to its lowest level since March 2025, reaching $129.8 billion. At that time, US tariff announcements caused a sharp market volatility.

On the other hand, trading volumes are showing a strong increase. Weekly trading volume in cryptocurrency exchange-traded products (ETPs) reached an all-time high of $63.1 billion, surpassing the previous record set in October.

Looking at the regional distribution, flows are not homogeneous. European markets stand out, with Germany leading the way with $87.1 million in inflows. Switzerland, Canada, and Brazil were also among the countries that recorded positive inflows. In contrast, outflows were noticeable in the US.

What is the latest situation with Bitcoin and altcoins?

When examined on an asset basis, Bitcoin showed the weakest performance of the week. With a total net outflow of $264 million, Bitcoin stood out alone on the negative side. However, some altcoins managed to attract investor interest again. XRP saw net inflows of $63.1 million, Solana $8.2 million, and Ethereum $5.3 million. XRP, in particular, has been the strongest performer since the beginning of the year, with total inflows of $109 million.

Smaller-cap altcoins also saw noteworthy movements. Chainlink experienced quiet but steady demand with a weekly inflow of $1.5 million, while Litecoin flows remained almost balanced. While Sui saw very limited weekly outflows, the fact that total inflows since the beginning of the year remain positive is noteworthy. The $9.3 million inflow seen in multi-asset products suggests investors are shifting towards more balanced portfolios rather than focusing on a single asset. Conversely, the $11.6 million outflow from Bitcoin-indexed short positions (Short Bitcoin) is interpreted as a weakening of expectations for a sharp decline. In other words, investors are preferring to readjust their risk at current levels rather than aggressively seeking profits from a decline.