US-based cryptocurrency exchange Coinbase announced a net loss of $667 million in the fourth quarter of 2025. This ended the company's eight-quarter winning streak. The financial results coincided with a period of sharp price fluctuations in the crypto market.

Coinbase Releases Financial Results

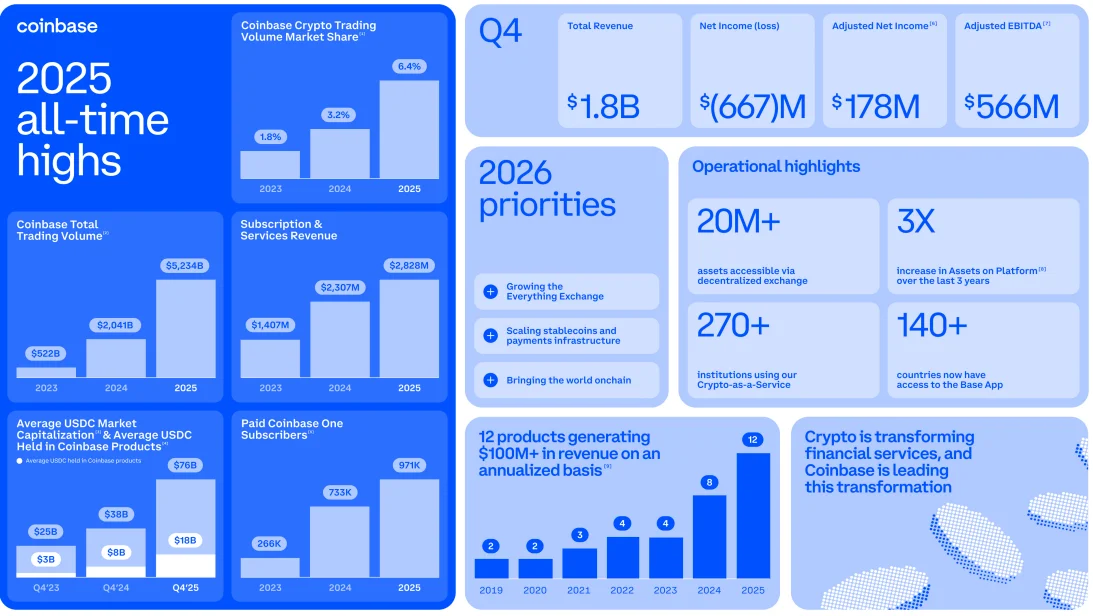

According to the financial results released by the company on Thursday, earnings per share were 66 cents. Analyst expectations were at 92 cents, meaning Coinbase fell 26 cents short of expectations. A similar picture emerged in terms of net income. The company's total net income decreased by 21.5 percent year-on-year to $1.78 billion. Market expectations were at $1.85 billion.

Looking at revenue items, the sharp decline in transaction revenue was noteworthy. Transaction-based revenue decreased by approximately 37 percent year-on-year to $982.7 million. In contrast, subscription and service revenue increased by over 13 percent to $727.4 million.

Coinbase is known to have last reported a loss in the third quarter of 2023. The loss in the last quarter of 2025 mirrored the general decline in the cryptocurrency market. After rising above $126,000 at the beginning of October, Bitcoin lost approximately 30% of its value by the end of the year, falling below $88,500. The decline continued in the first weeks of 2026; Bitcoin fell by over 25% since the beginning of the year, dropping to the $65,000 range. Despite this, the market reaction remained limited. Coinbase shares (COIN) rose 2.9% to $145.18 in post-earnings trading. The stock had closed the regular session down 7.9% at $141.10. The company also shared its expectations for the first quarter of 2026. It was announced that as of February 10th, transaction revenue reached $420 million. However, subscription and service revenues are projected to decline from $727.4 million to a range of $550 to $630 million.

Coinbase stated that it demonstrated a “strong” operational and financial performance throughout 2025. The company’s full-year revenue increased by 9.4 percent compared to 2024, reaching $6.88 billion. It was also stated that more than 12 percent of the world’s crypto assets were held on Coinbase in 2025.

Bitcoin purchases continue

In addition to the financial results, the company’s crypto asset position on its balance sheet also attracted attention. In its 8-K report submitted to the US Securities and Exchange Commission, Coinbase announced that it increased its Bitcoin position by $39 million in the last quarter of 2025 through regular weekly purchases. These purchases show that Bitcoin continues to be seen as a long-term balance sheet asset despite market fluctuations. As of December 31, 2025, the fair market value of crypto assets held by the company for its own investments was recorded at $2 billion. The fair value of crypto assets held as collateral was announced as $823 million.

The weekly regular purchase strategy is based on a method known in the markets as the "average cost" approach. This method aims to reduce the impact of price volatility and to create a long-term position at a more balanced cost.

Coinbase management plans to keep technology, sales, and marketing expenses relatively stable throughout the year compared to the fourth quarter. The company's chief financial officer, Aleshia Haas, stated that they will be flexible according to opportunities throughout the year and will remain cautious in expense management.