The fact that approximately $3 billion worth of Bitcoin and Ethereum option contracts are set to expire on the same day has drawn attention to derivatives in the cryptocurrency markets. Bitcoin's recent positioning above critical technical levels has made this large option expiry even more significant. However, data from the options market shows that the rise is not yet universally accepted as a strong bull breakout.

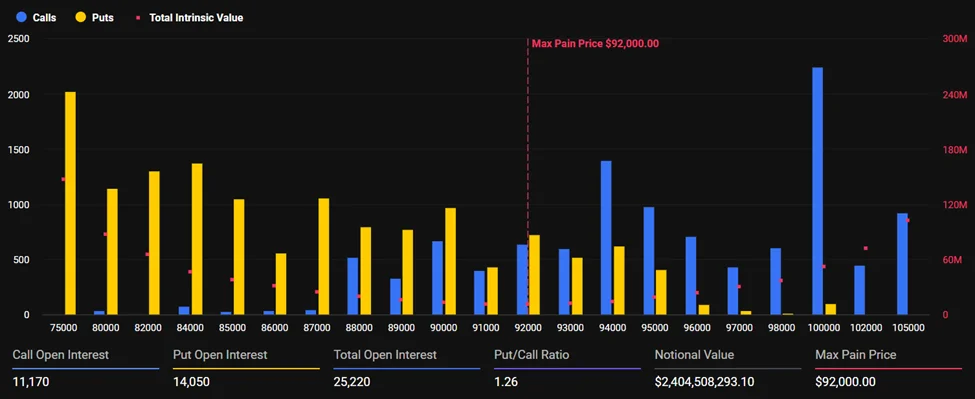

According to Deribit data, as of January 16th, the total volume of options expiring is approximately $2.84 billion. The majority of this amount is Bitcoin-related. While the total size of Bitcoin options is around $2.4 billion, this figure is limited to approximately $437 million for Ethereum. The resulting picture clearly shows that market interest and risk perception are predominantly focused on Bitcoin.

Cautious optimism on the Bitcoin front

The Bitcoin price is trading above $95,000 at the time of writing. This level is significantly above the $92,000 threshold, known as the "maximum pain" in the options market. The maximum pain level is considered the price point at which most contracts will become worthless at expiry, and prices often tend to move towards this level.

A move away from this threshold indicates that volatility may increase before the expiry date. Despite this, the option position distribution suggests that investors are still taking downside risks seriously. On the Bitcoin side, the number of put contracts exceeds the number of call contracts. The put/call ratio remaining above 1 indicates that hedging positions outweigh other upward movements.

From a technical perspective, if Bitcoin makes a sustained daily close above $94,300, the psychological $100,000 level could come back into play. However, if this support is lost, there is a risk that the price will return to the long-standing horizontal band.

Ethereum shows a calmer picture

On the Ethereum side, a more balanced and uncertain picture is evident. The ETH price is hovering around $3,300 and is only slightly above the maximum pain level of $3,200. In the options market, call and put contracts are almost equally distributed, revealing that the market has not reached a clear consensus on a specific direction.

Ethereum's difficulty in breaking the $3,400 resistance level shows that this indecision is reflected in its price movements. Although there are attempts at upward movement, it is difficult to speak of a strong and sustainable trend yet.

Institutional interest focused on Bitcoin

Institutional activity in derivative markets also highlights the difference between the two assets. According to data shared by the market analysis platform Greeks.live, a significant portion of large-scale transactions occur on the Bitcoin side. Institutional block transactions constitute more than 40% of the total volume in Bitcoin, while this rate remains more limited in Ethereum.

Analysts point out that despite this activity seen in Bitcoin, futures trading volumes have not shown a strong increase. In addition, the fact that implied volatility has not increased significantly strengthens the interpretation that a structural bull period has not yet begun in the derivatives market. Possibility of post-expiration volatility

Following today's large option expiration, there is a possibility that prices may head towards their maximum levels in the short term. Market volatility during this period would not be surprising. However, as in past examples, it is also likely that the market will calm down relatively after the expiration and begin searching for a new equilibrium.