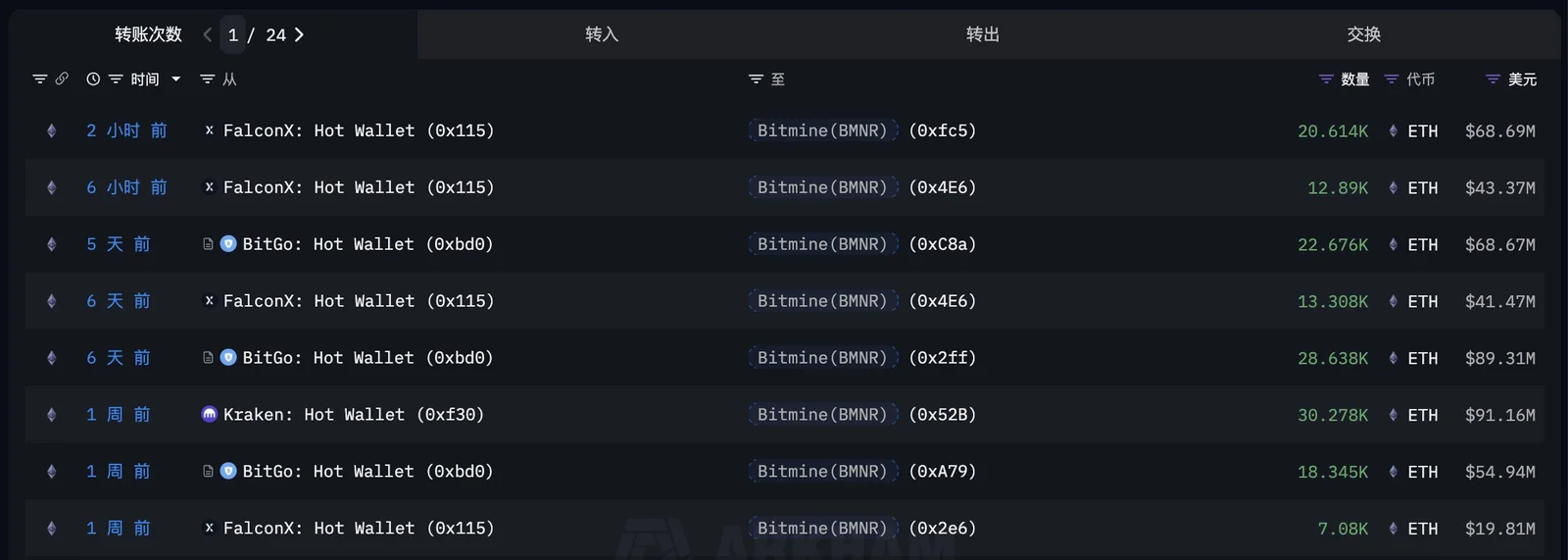

The Ethereum market is once again focused on BitMine. Following increasingly optimistic statements from Fundstrat co-founder and BitMine Chairman Tom Lee in recent weeks, the company made a new Ethereum purchase worth $112 million on Wednesday. According to data from blockchain analytics platform EmberCN, based on Arkham figures, BitMine purchased 33,504 ETH via FalconX. While official confirmation is yet to come, the transaction perfectly aligns with the company's aggressive ETH accumulation strategy throughout the year.

Through regular purchases, BitMine has maintained its position as the largest institutional Ethereum holder in the market and has repeatedly reiterated its long-term goal: to hold 5% of the total ETH supply by 2025. According to the company's 8-K filing dated December 7th, BitMine holds 3,864,951 ETH. In addition, there are 193 BTC, a $1 billion cash reserve, and a $36 million "moonshot" investment in Eightco Holding, which focuses on the Worldcoin ecosystem.

Tom Lee reveals his Ethereum expectations

Tom Lee is the clearest name behind all these purchases. Arguing that the bottom for Ethereum is now behind us, Lee said last month that ETH bottomed out around $2,500 and that he expected the price to rise to the $7,000-9,000 range by the end of January. In a more recent statement, he revealed the company's appetite by saying, "BitMine is buying twice as much ETH as it did two weeks ago."

On the other hand, on the macroeconomic front, the 25 basis point interest rate cut announced by the Fed on Wednesday did not bring the expected relief in the crypto market. Powell's cautious statements about further cuts were interpreted as a "hawkish cut" and created a short-term pullback in both Bitcoin and Ethereum. Bitcoin fell as low as $90,028, a daily loss of 2.82%; Ethereum dropped 4.29% to $3,186.

According to Tom Lee, these pullbacks are temporary. In an interview with CNBC, he stated that regardless of whether the Fed's current stance changes or remains unchanged, the real turnaround will come in early 2026. Lee bases his expectation on two key factors: the possibility of a new Fed chairman adopting a more dovish stance and the ISM Index, which indicates the expansion of the US economy, rising back above 50. Lee said, "Crypto prices are very sensitive to the ISM. Historically, the ISM rising above 50 coincides with the start of supercycles in Bitcoin and Ethereum."

BitMine's recent acquisition is another piece of the puzzle. Despite the volatile market conditions, the company is not backing down from its long-term strategy. Overall, it seems that investors will be watching Ethereum's performance in the coming period more closely.