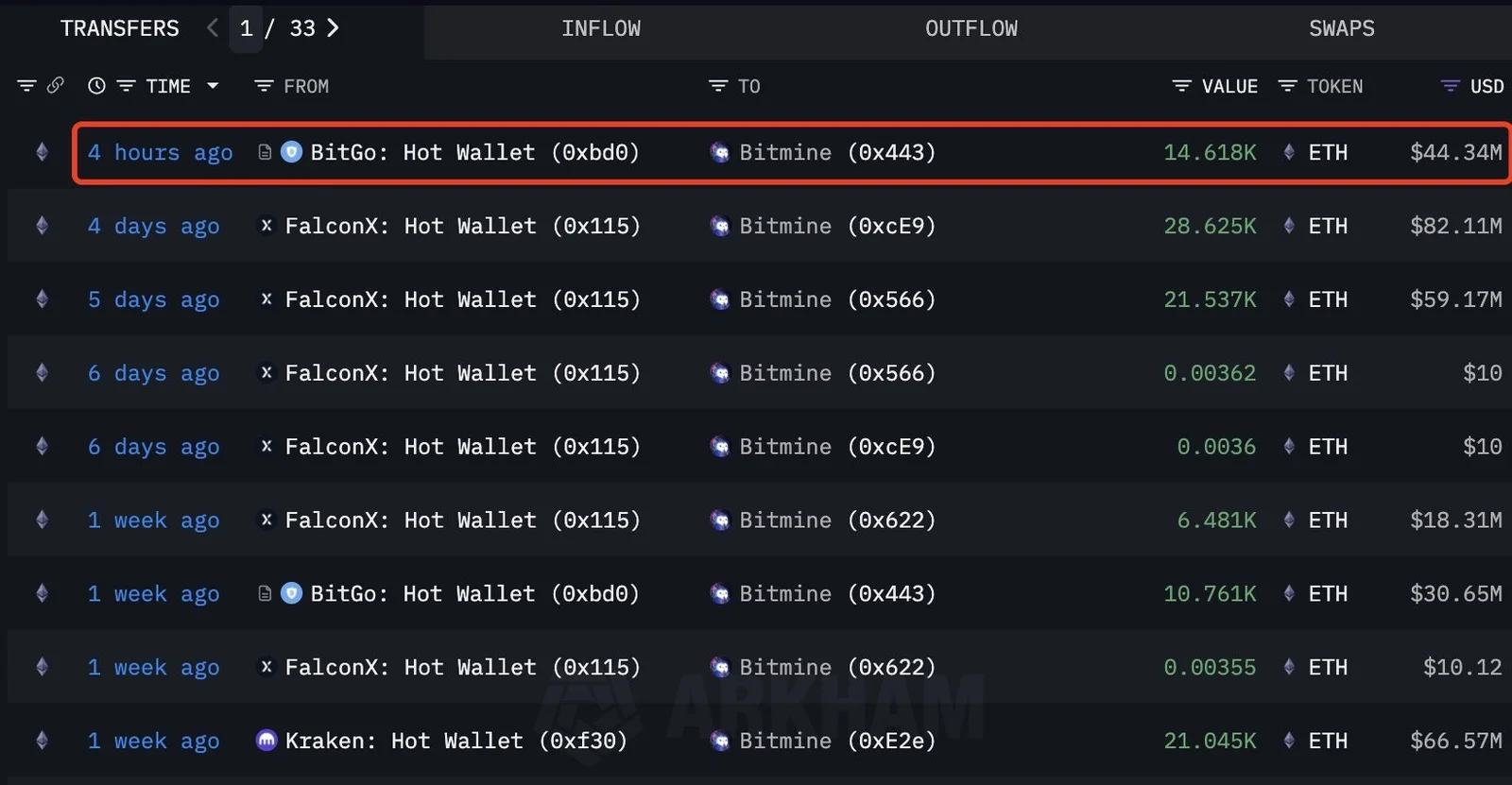

While the crypto market has undergone a sharp correction in recent weeks, large-scale institutional purchases continue to attract attention. Most recently, BitMine Immersion Technologies reportedly purchased 14,618 Ethereum (ETH) on Thursday. Using Arkham Intelligence data, Lookonchain reported that the transaction was conducted through BitGo's "0xbd0...E75B8" wallet for approximately $44.34 million. While there has been no official confirmation from the company, the purchase has generated significant market interest.

BitMine's move follows the giant's $200 million ETH purchase just a few days earlier. According to the company's latest official statement, BitMine holds 3,629,701 ETH in its treasury. This amount equates to approximately $10.9 billion and represents approximately 3% of the total Ethereum supply. BitMine has long emphasized its goal of reaching 5% of the total supply and has expressed its belief that Ethereum's importance in financial markets will continue to grow. The company's chairman, Tom Lee, is known for his strong support for Ethereum. He has previously stated that Wall Street and even the White House will be more receptive to Ethereum in the future because the network is a "truly neutral" blockchain. According to Lee, Ethereum will become an integral part of corporate infrastructure with the proliferation of smart contract-based solutions in financial services.

$7,000-$9,000 ETH Prediction

While the crypto market has been under pressure in recent weeks, Tom Lee believes a new bullish period is imminent. In a podcast interview, Lee stated that the price of Ethereum bottomed out around $2,500 and that he expects ETH to rise to the $7,000-$9,000 range by the end of January 2026.

A few days ago, Lee told CNBC that the US Federal Reserve would adopt a more dovish stance towards the end of the year. He believes that clarification of the Fed's statements on interest rate policy and inflation will reduce investor pressure. He argues that this environment could pave the way for a strong rally for both Bitcoin and ETH. Lee even stated that Bitcoin could surpass $100,000 by the end of the year and even reach a new high.

According to market data, Bitcoin is currently trading at $91,309, posting a limited daily increase of 0.13%. Ethereum, on the other hand, is down 0.69% in the last 24 hours, reaching $3,018.

BitMine's massive purchases indicate that institutional investors continue to expand positions during downturns. This, combined with the expected macroeconomic easing in 2025 and 2026, could create a strong medium-term story for Ethereum. The company's target of reaching 5% of the market's supply remains a topic to be closely monitored in terms of both liquidity and institutional demand.