As Ethereum-centric institutional treasury strategies gain momentum, US-based Bitmine Immersion Technologies has once again drawn attention with its latest move. The company announced that its Ethereum reserves have reached 4.326 million ETH, bringing its total portfolio size, including crypto assets, cash, and other investments, to $10 billion.

Bitmine Back in the Spotlight with Ethereum Purchase

Bitmine Immersion Technologies, which has attracted attention with its Ethereum-focused treasury strategy, has once again become the center of attention in the crypto markets with its latest announcement. The company announced that its Ethereum reserves have reached 4.326 million ETH. Its total portfolio size, including crypto assets, cash, and other investments, has reached $10 billion. This figure makes Bitmine the company with the largest Ethereum treasury globally.

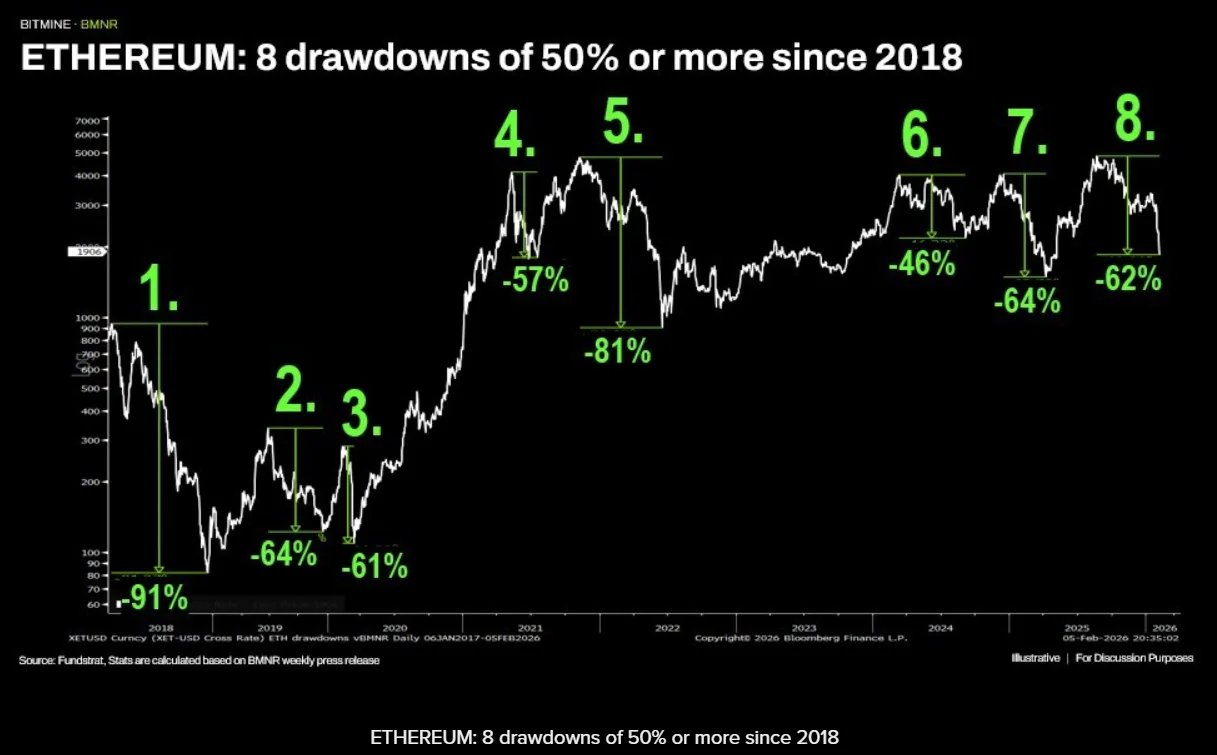

Thomas Lee, Chairman of the Board of the Las Vegas-based company, confirmed that more than 40,000 ETH were purchased in the last seven days. These purchases were made during a period when Ethereum prices experienced a pullback exceeding 60% compared to their 2025 peaks. Bitmine management notes that despite price weakness, on-chain activity remains at historical levels, viewing this as a long-term opportunity. The company holds 4.3 million ETH, representing approximately 3.58% of the total circulating Ethereum supply. Bitmine actively stakes 2.87 million ETH of this amount. Current staking activities generate approximately $202 million in annual revenue. Management expects the "Made in America Validator Network" (MAVAN) infrastructure, scheduled for rollout in the first quarter of 2026, to further boost these returns. Thomas Lee defines the company's long-term goal as "Alchemy of 5%," aiming to reach 5% of the total circulating Ethereum supply. Lee emphasizes that they have already approached over 70% of this goal in just six months, and states that bridging the gap between the Ethereum ecosystem and traditional capital markets is a strategic priority. According to the company, while the number of transactions and active addresses on the chain are at all-time highs, the fact that prices do not reflect these fundamentals creates a striking divergence.

Bitmine's balance sheet is not limited to Ethereum. The company holds 193 Bitcoin, while its cash position is at $595 million. In addition, a $200 million investment in the AI infrastructure company Beast Industries constitutes a significant part of its portfolio. This strong liquidity structure allows the company to continue its purchases despite market fluctuations.

The implemented high-trust treasury strategy has also increased interest in Bitmine shares. With an average daily trading volume of $1.3 billion, the company ranks 107th among the most traded stocks in the US. This level positions Bitmine in the same league as many global blue-chip companies. In pre-market trading, BMNR shares are priced at $19.56.