The resurgence of activity in wallets that have been dormant in the cryptocurrency market for a long time is attracting attention. Most recently, a Bitcoin wallet that had been dormant for 12 years made headlines on Sunday by transferring $44 million worth of assets to other addresses.

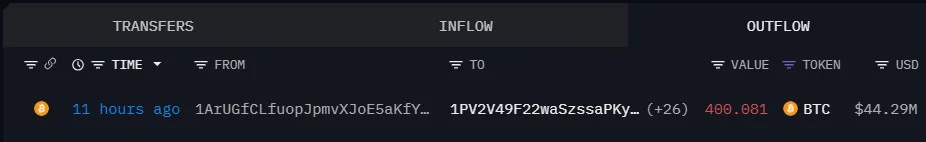

According to data from the blockchain analysis platform Lookonchain, the wallet in question sent approximately 400 BTC to multiple addresses. Transactions were generally made in equal increments of 15 BTC, leaving the wallet completely empty. Arkham Intelligence's data indicates that this wallet was first funded by miners 15 years ago. However, it is unknown who transferred the funds or what the purpose of the transfer was.

These old wallets, opened during Bitcoin's early years, known as the "Satoshi era," are being closely watched within the cryptocurrency ecosystem. This is primarily because these addresses likely belonged to early miners or market-leading investors. During this 12-year period of inactivity, Bitcoin's value increased approximately 830-fold. BTC, which was around $135 in 2012, is currently trading at over $111,000. This brings the value of these assets held in a single wallet to millions of dollars.

Bitcoin whales are taking action

Similar activity has been frequent in recent months. With Bitcoin reaching new record highs, millions of dollars in transfers are coming from wallets that have been dormant for a long time. In July, Galaxy Digital sold more than 80,000 BTC as part of the estate management of a Satoshi-era investor. The value of this sale exceeded $9 billion.

A similar development occurred in September. A wallet that had been dormant for about 13 years moved 444 BTC (approximately $50 million). Earlier this month, a major investor flipped their portfolio, converting billions of dollars worth of Bitcoin into Ethereum and accumulating approximately $4 billion worth of ETH.

According to experts, there may be different motivations behind these movements. Some believe that previous investors are profit-taking, while others suggest that the assets are being managed as part of inheritance or corporate strategies. However, wallet owners generally keep their identities secret, and the exact reasons behind the transfers remain unknown.

While such transfers don't directly exert significant pressure on cryptocurrency prices, they are closely monitored by investors. This is because activity from older wallets can often be interpreted as a signal of a shift in market trends. The repeated activation of Satoshi-era wallets, particularly during periods of peak Bitcoin prices, is no coincidence.