The cryptocurrency market experienced rare activity. A Bitcoin whale, which hadn't made any transactions since 2014, transferred 1,000 BTC of its holdings to new addresses. According to on-chain data, this move represents a single transfer of approximately $116.6 million worth of cryptocurrency.

Bitcoin whale strikes

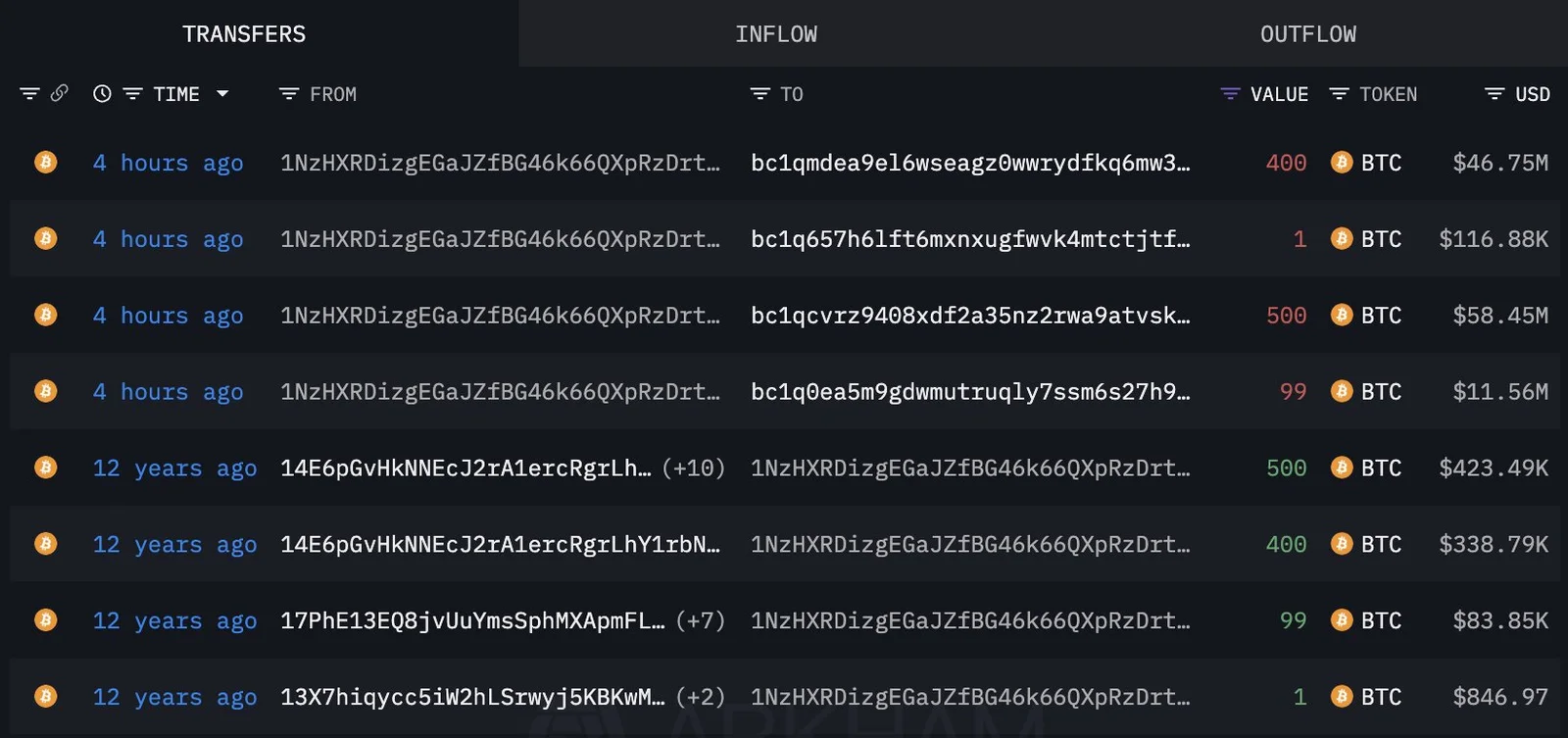

According to a report by on-chain analysis platform Lookonchain, based on Arkham data, the "1NzH...DrtpZo" wallet had been dormant for over 11 years. The address in question purchased 1,000 BTC in January 2014 at a price of approximately $847 per Bitcoin. At the time, the total value was around $847,000, and today, this amount has grown by over 100 times, reaching hundreds of millions of dollars.

The whale transferred all of its holdings to four new addresses. However, Arkham did not disclose any information about the owners of these addresses. Whether the transfer was made to exchanges or personal cold wallets remains unclear.

The Bitcoin price, however, continued its upward trend during this volatility. According to market data, BTC rose 1.3 percent in the last 24 hours to $116,637. The weekly gain reached 4.8 percent.

Whales breaking their long silences is particularly striking during bullish periods. Last week, a wallet that had been inactive for years sent 132 of its 445 BTC to another address and 5 to the Kraken exchange. It was also reported that this wallet hadn't made any transactions for almost 13 years.

A more significant example occurred in July. A Satoshi-era whale sold approximately 80,000 BTC (worth over $9 billion at the time) through Galaxy Digital. This sale was recorded as part of the investor's inheritance planning.

What does the activation of old addresses mean?

Such movements in the crypto market significantly impact investor psychology and price expectations. Some analysts interpret the trading activity of wallets that have been inactive for a long time as a sign of a new wave of market volatility. However, as long as it remains unclear whether the transferred BTC is being sold or moved for safekeeping, sustained price pressure may not be felt.

The increased activity of early Bitcoin wallets, known as "OGs," over the past year is noteworthy. This situation both serves as a reminder of the cryptocurrency's current state and suggests a potential shift in strategies for long-term investors.

During this period of increasing whale activity, market observers continue to closely monitor on-chain data. As has been seen repeatedly in the past, the actions of major players can be a significant signal in determining market direction.