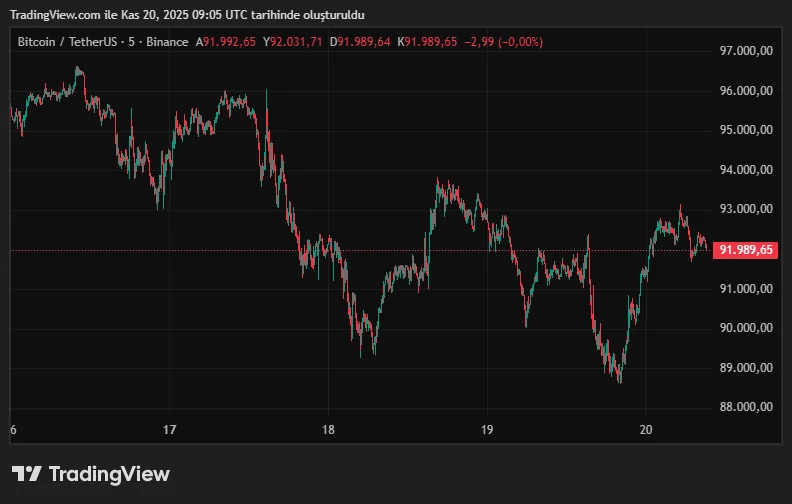

Bitcoin is under sharp pressure again, and the market landscape appears more complex than in previous corrections. The price fell to $88,600 on Wednesday, a level not seen since April. Compared to the start of the year, BTC is still down approximately 5 percent. The decline coincided with the release of the Federal Reserve's October meeting minutes, the FOMC meeting, and further shaken market sentiment.

The minutes reveal that the disagreements among Fed members have reached their most pronounced level this year. One group argues that the economy is softening, signs of a cooling in the labor market are becoming evident, and that more cautious policy is needed. Another, stating that inflation still hasn't sustained its 2% target, believes interest rates should remain steady. The fact that one member calls for a more aggressive 50 basis point cut, while another advocates "no cuts at all," highlights the broad division within the board.

This situation was immediately reflected in the market. The probability of a 25 basis point cut on Polymarket in December was 52% before the minutes, but dropped to 30% after the announcement. The market currently assigns an approximately 70% probability to interest rates remaining stable. CME FedWatch data confirms this division.

As macro uncertainty rises again, the already fragile Bitcoin structure has been further disrupted. K33 Research analyst Vetle Lunde states that a "dangerous leverage" structure has emerged in the derivatives market. The increase in open interest in futures positions, exceeding 36,000 BTC in the past week, is the largest increase since April 2023. The positive funding rate suggests that most investors are still attempting to buy reactively, in other words, the typical "catch the knife when it falls" behavior is evident in the market. Lunde notes that this structure has generally resulted in deeper declines in previous periods.

According to the analyst, a strong bottom could form between $84,000 and $86,000; However, if the sell-off accelerates, a retest of the $74,500 low from April is also possible. The situation is no different for Ethereum; ETH has fallen to around $2,870, falling below $3,000 for the first time since July. XRP, on the other hand, is trading at a significant threshold, approaching $2 again after five months.

QCP Capital's assessments also explain the extent of the decline. The company states that the sell-off is not due to a single reason, but rather to weakening liquidity conditions, continued ETF outflows, and a sharp reversal in macroeconomic expectations. In particular, the decline in the probability of an interest rate cut, which was considered a certainty in December, to 50% within the week quickly dampened risk appetite. The liquidation of a $559 million leveraged position in the last 24 hours also demonstrates this effect.

QCP emphasizes that while stocks are supported by strong balance sheets and artificial intelligence-focused institutional investments, Bitcoin does not enjoy the same protection. Due to BTC's reliance on liquidity, the impact of ETF outflows is magnified. The institution also notes that labor force data and the LEI indicator, due this week, could inform Fed policy, and therefore volatility is expected to remain high for some time.

Bitcoin Price Update

Following this decline, Bitcoin price has returned above $90,000. At the time of writing, it is trading at $91,900, a 0.7 percent increase.