Cryptocurrency exchange Binance has announced a significant change in its margin trading market as part of its regular risk and liquidity assessments. According to the official announcement, some FDUSD-based margin trading pairs will be removed from the platform as of January 6, 2026, and margin trading will be completely stopped for these pairs.

Which margin trading pairs are being removed?

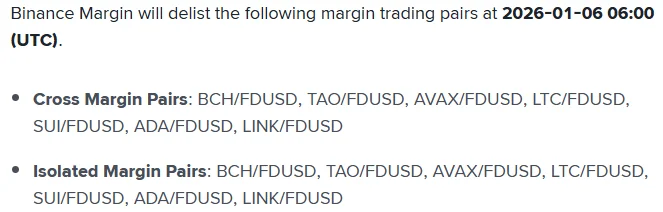

According to information shared by Binance, this delisting decision covers both Cross Margin and Isolated Margin markets. Accordingly, the BCH/FDUSD, TAO/FDUSD, AVAX/FDUSD, LTC/FDUSD, SUI/FDUSD, ADA/FDUSD, and LINK/FDUSD trading pairs will be removed from margin trading options on the specified date. Both cross-margin and isolated margin trading will end for the same pairs.

In a statement released by the exchange, it was emphasized that this step was taken to increase user security and create a healthier trading environment in the margin market. Binance reminded that it regularly reviews the pairs traded in the margin market and can make such decisions based on liquidity conditions, market depth, and overall risk levels.

The delisting process closely affects not only the closing of trades but also users' account activity. According to the statement, with the announcement of the decision, the transfer of assets in the relevant pairs to isolated margin accounts via manual or automatic transfer has been stopped. However, a limited exception will apply for users with outstanding debt. After deducting existing collateral, only the amount of the debt can be manually transferred to isolated margin accounts.

From a timeline perspective, the process will proceed in stages. On December 31, 2025, borrowing transactions in the relevant isolated margin trading pairs will be suspended. After this date, users will not be able to open new debt. The truly critical date will be January 6, 2026. As of 09:00 Turkish time, Binance will automatically close all open margin positions in the aforementioned pairs, reconcile accounts, and cancel all pending orders. Following these processes, the relevant trading pairs will be completely removed from the margin market.

Binance specifically stated that the delisting process may take approximately three hours, during which time users will not be able to update their positions. Therefore, the exchange strongly advises users to manually close their positions or transfer their assets from margin accounts to spot accounts before margin trading is halted to prevent potential losses. Binance also explicitly stated that it will not be responsible for any potential losses that may occur during this process.

On the other hand, it was reminded that trading will continue on Binance's spot and other suitable trading pairs for the relevant crypto assets of these pairs that will be removed from the margin market. In other words, the decision does not mean the complete delisting of these assets; it only affects margin trading options.

According to experts, such steps are among the developments that should be closely monitored, especially by investors who engage in margin trading. Changes in the margin market can have direct impacts on both risk management and portfolio planning for users holding leveraged positions. Therefore, it is important for investors to act according to the schedule and alerts shared by Binance.