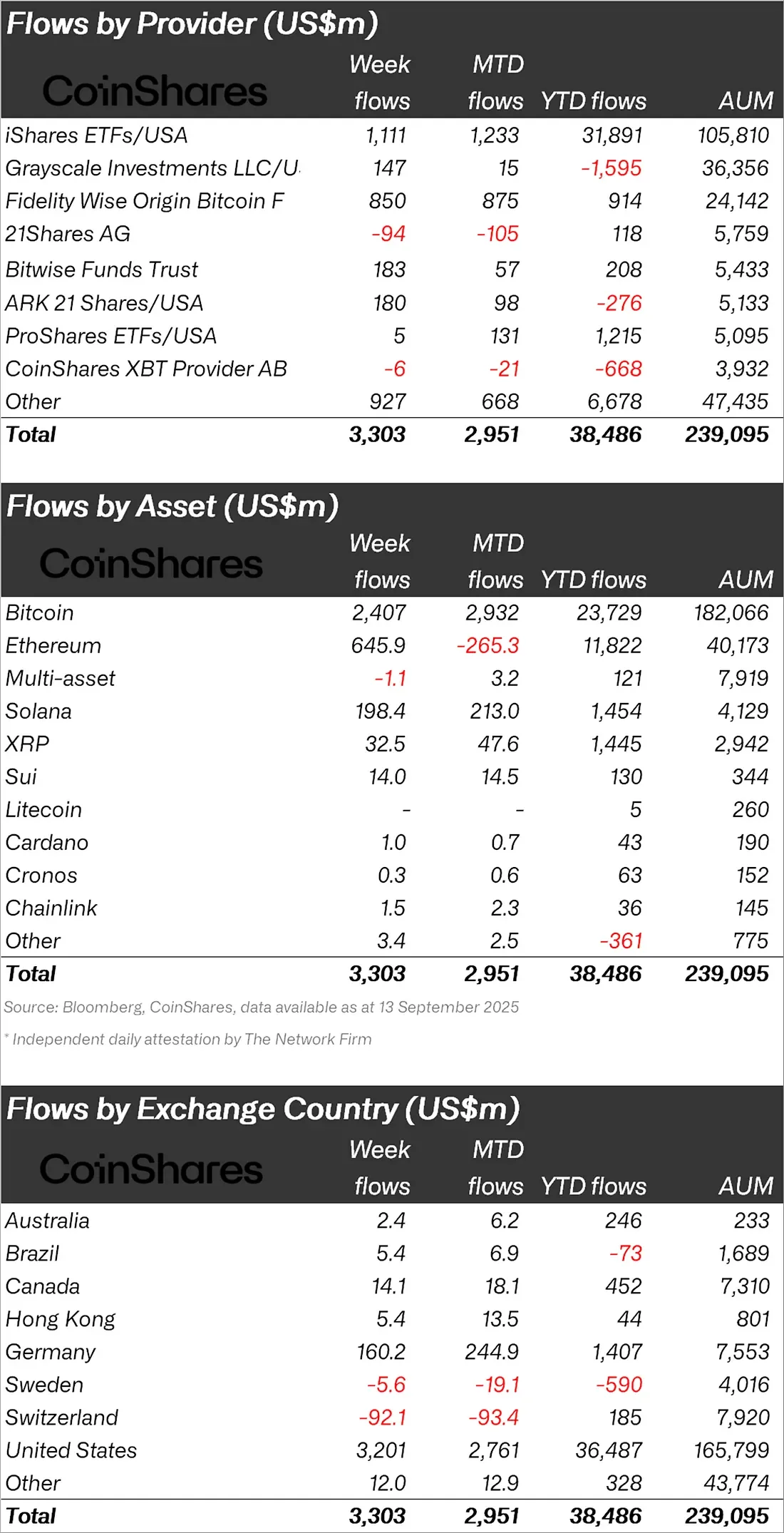

Digital asset investment products saw a strong recovery last week, recording a total inflow of $3.3 billion. This move brought assets under management (AuM) to $239 billion, revisiting the record high of $244 billion set in early August.

Looking at the details of CoinShares' weekly report, the most striking development was the renewed focus on Bitcoin and Ethereum. Bitcoin funds accounted for the largest share of the week with $2.4 billion inflows. This brings Bitcoin's total investment to over $23.7 billion since the beginning of the year, bringing its asset size to $182 billion.

The situation was even more striking on Ethereum. After eight consecutive days of outflows, investor sentiment reversed. Ethereum funds recorded inflows for four consecutive days last week, raising a total of $646 million. While there were still $265 million in outflows on a monthly basis, Ethereum's assets under management remained above $40 billion.

One of the surprises of the week was Solana. Solana funds saw the highest daily inflow in their history on Friday, attracting $145 million in inflows in a single day. Solana, which attracted a total of $198 million in weekly investments, once again demonstrated that institutional investors are shifting their focus to alternative networks.

What's the latest on altcoins?

XRP funds also showed a positive performance with $32.5 million in inflows, while Sui saw $14 million, Chainlink $1.5 million, and Cardano $1 million. Among smaller-scale funds, Cronos and Litecoin finished the week positive with limited investments of $300,000 and $5 million, respectively. Meanwhile, multi-asset funds saw $1.1 million in outflows. Altcoins in the "Other" category saw a total inflow of $3.4 million, but net outflows of $361 million since the beginning of the year remain significant.

The US maintained its clear lead in regional distribution, with $3.2 billion in inflows to US-based funds alone. Germany stood out with a contribution of $160 million, followed by Canada with $14 million and Hong Kong with $5.4 million in inflows. Meanwhile, Switzerland saw outflows of $92 million and $5.6 million, respectively.

By provider, iShares/USA funds stood out with $1.1 billion, and Fidelity's Bitcoin fund with $850 million. Despite receiving $147 million in inflows, Grayscale funds remain in negative territory with outflows of nearly $1.6 billion since the beginning of the year. Bitwise and ARK funds also closed the week with inflows of $183 million and $180 million, respectively.

The overall picture suggests an increase in risk appetite due to macroeconomic data from the US falling short of expectations. Digital asset funds are once again attracting institutional capital, particularly led by Bitcoin, Ethereum, and Solana. Inflows into altcoins such as XRP, Sui, Cardano, and Chainlink demonstrate that investors continue to diversify. If this trend continues, assets under management are expected to test the historic high of $244 billion again soon.