US-based digital asset management company Bitwise predicts that spot Bitcoin exchange-traded funds (ETFs) will experience record inflows in the fourth quarter of the year. The company believes this momentum could even surpass the total in 2024.

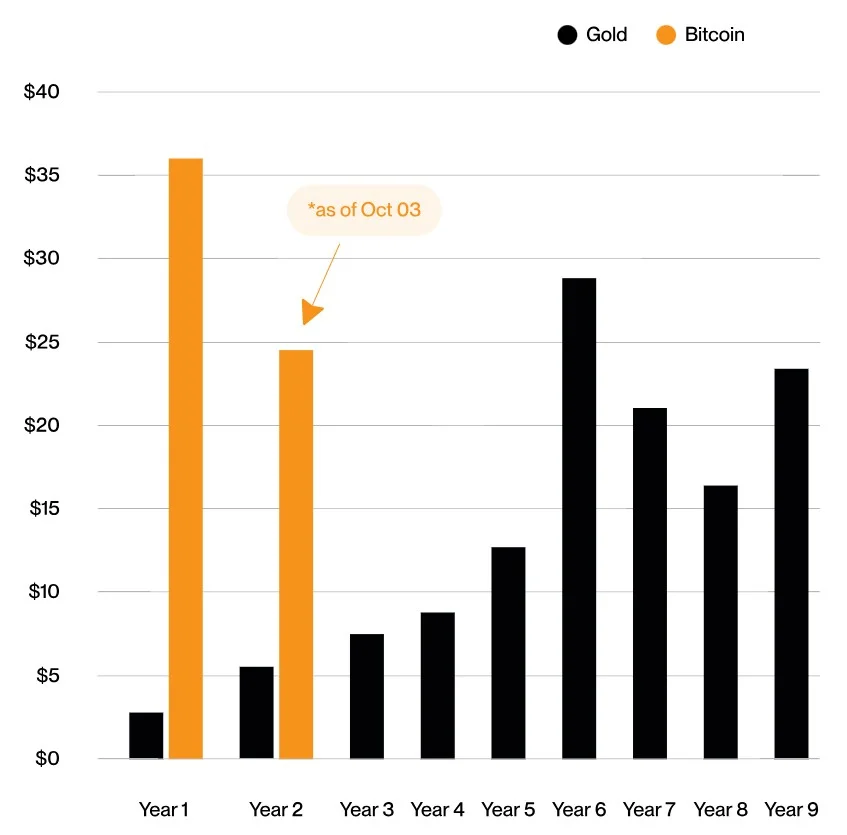

Bitwise Chief Investment Officer Matt Hougan predicted at the beginning of the year that Bitcoin ETF inflows in 2025 would surpass the $36 billion launch period in 2024. Approximately $22.5 billion has flowed into these products so far, and they are expected to reach $30 billion by year-end. However, in his latest investor note, Hougan stated that this figure could be much higher, with a particularly strong wave of inflows expected in the final quarter of the year.

Three Key Factors Supporting the Fourth Quarter

According to the Bitwise report, three main factors are fueling this expectation: Bitcoin ETF approvals by asset management firms, the recent surge in Bitcoin prices, and the "debasement trading" narrative.

Morgan Stanley recently adopted a new policy allowing limited investments in crypto assets. The bank offered a 0% Bitcoin ETF allocation for cautious investors and a 2% to 4% allocation for those with a higher risk tolerance. Wells Fargo also offered its advisors access to Bitcoin ETFs. Major players like UBS and Merrill Lynch are expected to join the group. According to Bitwise, these moves signal significant pent-up demand among advisors and portfolio managers.

The "value erosion" narrative is gaining traction

Hougan noted that gold and Bitcoin have become the two strongest asset classes this year. While the US money supply has increased by 44% since 2020, investors are turning to assets that retain their value during periods when governments weaken their currencies. JPMorgan also highlighted this trend in its latest report. As year-end portfolio reviews approach, many financial advisors are reportedly aiming to capitalize on this performance by adding gold and Bitcoin to their clients' portfolios.

Inflows increase as price rises

Bitwise noted that historically, when Bitcoin's price increases by double digits, billions of dollars also flow into ETFs. In early October, Bitcoin rose 9% to a new record high of over $125,000. Following a slight correction, it currently trades around $122,744. Hougan says this performance has rekindled investor interest and laid the groundwork for a strong final quarter.

$3.5 billion inflows in the first four days

According to Bitwise data, $3.5 billion in net inflows into Bitcoin ETFs occurred in the first four trading days of the fourth quarter. This brings the total inflow since the beginning of the year to $25.9 billion. "We have 64 days until the end of the year. Another $10 billion needs to come in, and I think we'll go beyond that," Hougan said.

As of Tuesday, ETFs added $875.6 million to this amount. BlackRock's IBIT fund led the day with $899.4 million in inflows. The day before, on Monday, ETFs had recorded their largest daily inflow since Donald Trump's November 2024 election victory: a whopping $1.21 billion.