Despite the ongoing volatility in the cryptocurrency market, institutional Bitcoin purchases continue unabated. In recent days, both Strategy and Binance, the world's largest cryptocurrency exchange, have increased their Bitcoin positions despite the weak market performance. These moves are interpreted as a message of long-term confidence while price pressure persists in the short term.

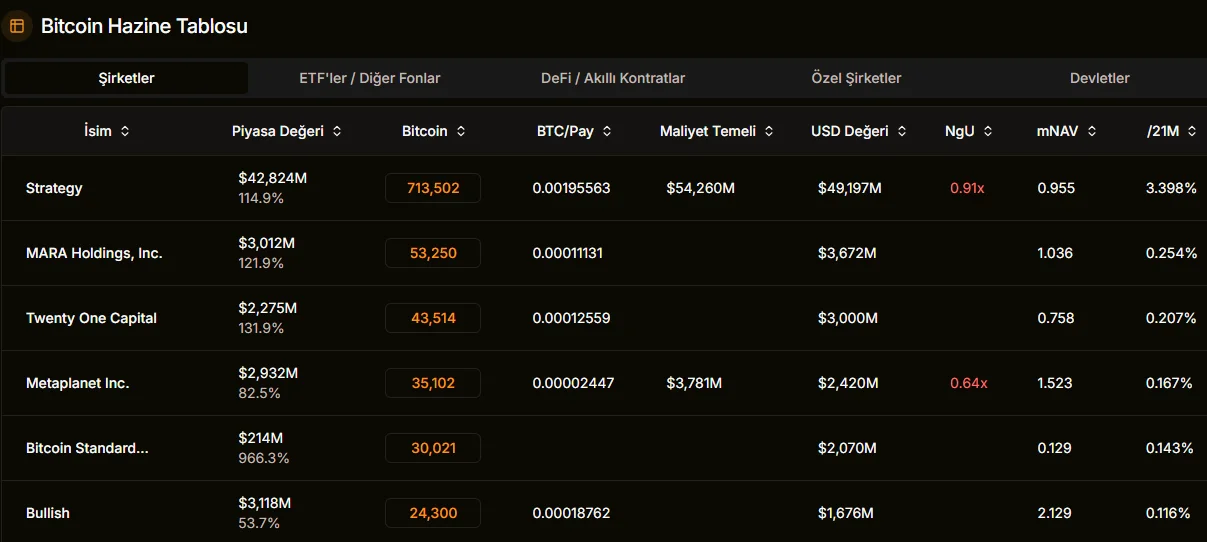

According to an 8-K filing submitted to the US Securities and Exchange Commission (SEC), Strategy purchased 1,142 BTC between February 2nd and 8th for approximately $90 million. The average cost per Bitcoin was $78,815. This brings the company's total Bitcoin holdings to 714,644 BTC. This portfolio, worth approximately $49 billion at current prices, makes Strategy by far the world's largest institutional Bitcoin holder.

Michael Saylor, co-founder and chairman of Strategy, notes that the average cost of the company's Bitcoin purchases to date has been $76,056. This portfolio, created with a total expenditure of approximately $54.4 billion, represents more than 3.4% of Bitcoin's total supply of 21 million. Although a nominal loss of approximately $5.2 billion has been incurred due to recent price drops, company management views this as a strategic risk. These purchases were financed by the sale of Strategy's Class A MSTR shares from the market. Last week alone, the company sold 616,715 MSTR shares, generating approximately $89.5 million in revenue. According to the current program, Strategy has approximately $7.97 billion worth of shares available to issue in the coming period. On the other hand, Strategy has clearly demonstrated the impact of the Bitcoin price pullback on its balance sheet. At the last earnings meeting, CEO Phong Le stated that if Bitcoin were to fall to the $8,000 level and remain there for 5-6 years, there could be serious problems in rolling over debt. It was emphasized that if this scenario occurs, the company may consider options such as an additional share issuance, new borrowing, or restructuring.

Binance accelerates Bitcoin accumulation for SAFU fund

Similarly, Binance continues its Bitcoin purchases despite market pressure. The exchange purchased approximately $300 million worth of 4,225 BTC for its SAFU (Secure Asset Fund for Users) fund, which it created to protect user assets. According to data from the blockchain analytics platform Arkham, this move increased the fund's Bitcoin holdings to over $720 million.

At the end of January, Binance announced a plan to gradually convert its total $1 billion user protection fund into Bitcoin. The company also commits to rebalancing if the fund's value falls below $800 million due to market volatility. While this strategy reflects long-term confidence in Bitcoin, it is noteworthy that the fund has become more vulnerable to short-term price volatility.