AVAX Technical Analysis

Avalanche has recently come back into the spotlight with both technical infrastructure and ecosystem developments. For example, the number and use cases of “sub-networks” created on the Avalanche network are increasing, which strengthens the flexibility and practical usage of the network.In addition, new projects focusing on the tokenization of media and entertainment assets are choosing the AVAX blockchain. This shows that AVAX can go beyond classic crypto usage and position itself within a broader ecosystem.In light of these fundamentals, AVAX should be considered not only a “coin” but an infrastructure token with real-world applications and expanding use cases.

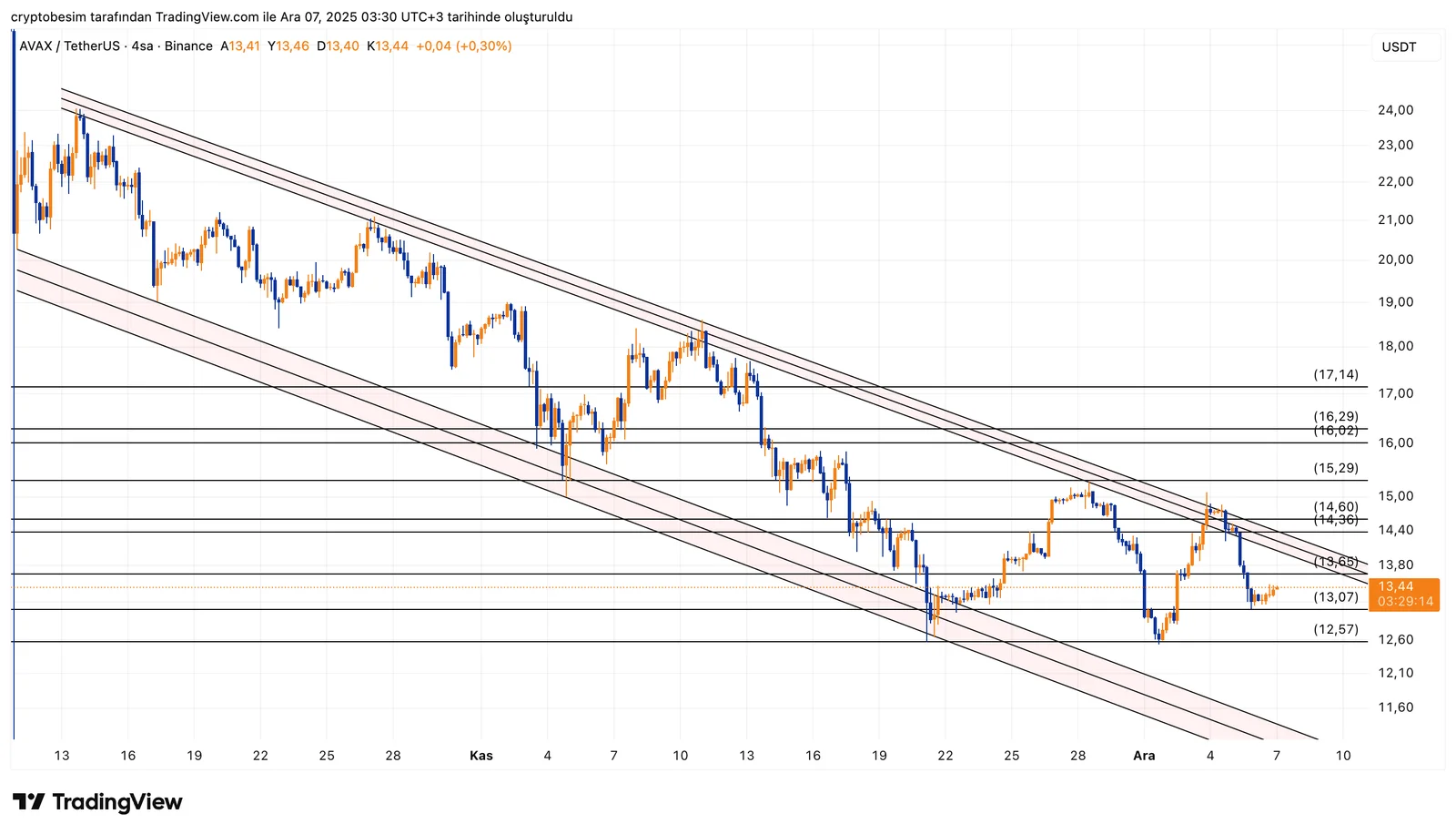

In the 4-hour chart, AVAX moves within a wide descending channel structure similar to AAVE and the price is still squeezed in the mid-lower band of the channel. The trend structure maintains downward pressure, but the recent reaction movement in this region makes an upward attempt possible in the short term.

The price is currently squeezed in the 13.80 – 14.60 band. This region is critical because it is both a horizontal resistance and corresponds to the mid-band within the channel. If permanence is ensured above 14.60, the first target becomes the 15.30 – 16.00 region. The channel upper band at 17.10 is on the table as a strong trend target. These levels may trigger more aggressive movements with a trend breakout.

Below, the 13.00 – 12.57 region is the support that needs to be preserved in the short term. If this area is lost, a new dip towards the channel lower band of 11.60 – 11.20 may be seen. Since this area is the bottom region of the trend structure, the possibility of a strong reaction is high, but the price reaching this area would indicate that the structure has weakened.

The general structure is still in a downtrend and the reaction movement has not turned into a trend breakout. To see continuation of the bullish scenario, a close above 14.60 is needed; otherwise, the price may again face pressure towards the lower band.

These analyses, which do not provide investment advice, focus on support and resistance levels that are thought to create short and medium-term trading opportunities depending on market conditions. However, the responsibility of trading and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss for the positions shared.