AAVE Technical Outlook

Aave draws attention with its new market Horizon, which brings traditional financial assets (RWA – real world assets) into crypto, and in this market, more than 590 million dollars of assets are currently locked.At the same time, Aave is at the focus of major investors and liquidity flows: its integrations with exchanges and new chains are increasing, and the capital entering the liquidity pools is rising.These facts make AAVE not only a “lending” protocol, but a structure that builds a bridge between crypto and traditional finance. Now let’s evaluate how this background is reflected on the price chart.

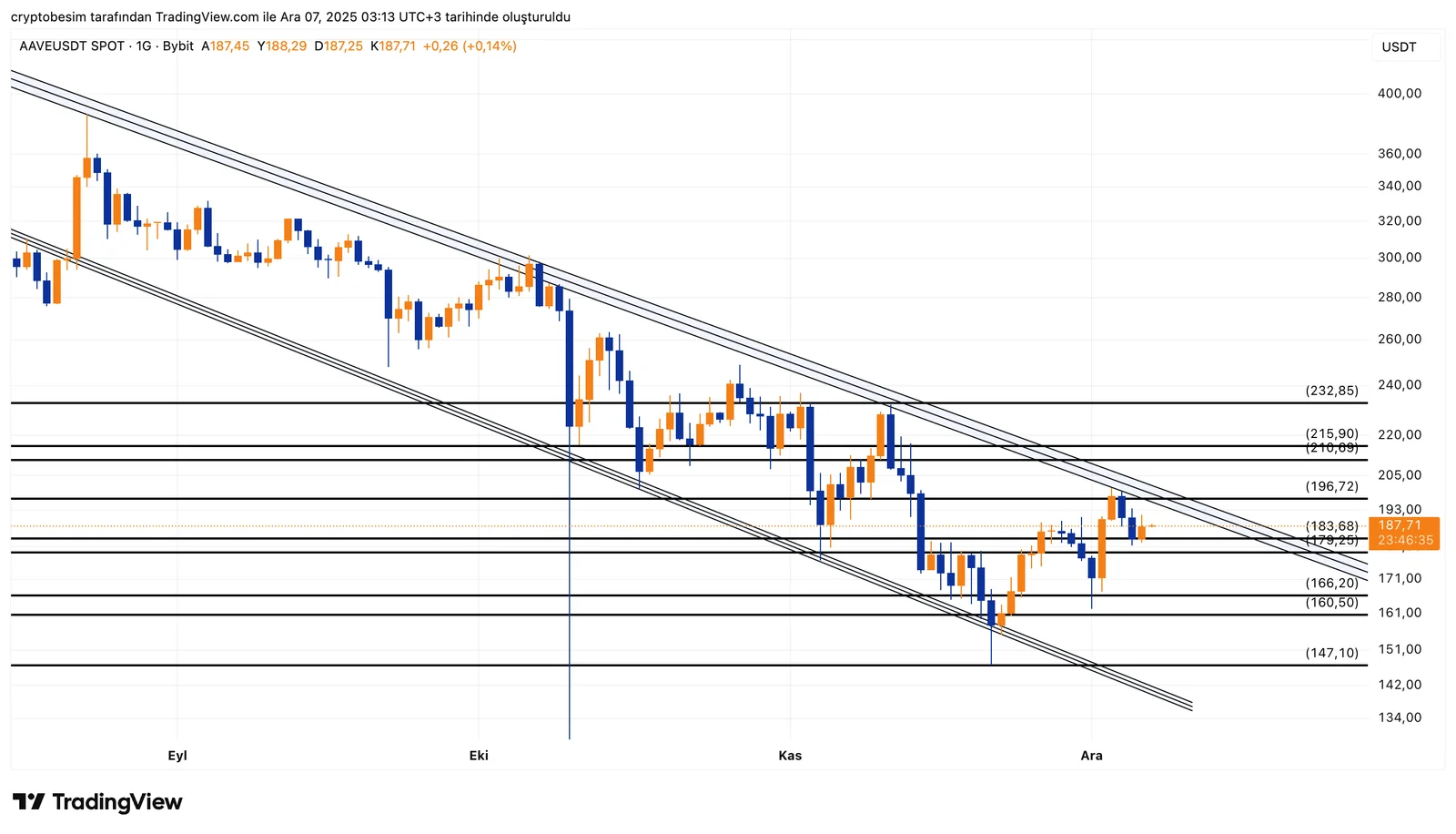

In the daily chart, AAVE moves within a clear descending channel structure and the price is still consolidating in the mid-lower band of the channel. The trend structure is not broken; therefore, the main direction is still down. However, the recent reaction movement seen in the last few days carries a potential for an upward attempt in the short term.

The price is currently at a critical threshold. The 183 – 196 region is both a horizontal resistance and corresponds to the mid-band of the channel. As long as there is no clear breakout from this region, it is difficult for the upward movement to be permanent. If the breakout occurs, the first target becomes the 205 – 216 range. This would mean a move towards the upper bands. Ultimately, the channel’s upper band at 232 is a possible target for a broader time frame.

In the downward scenario, the 179 – 166 supports are the areas that need to be preserved. A dip below this region can bring a new selling wave towards the trend’s lower band of 151 – 147. Since this region is a long-term trend support line, the probability of receiving a stronger reaction is high.

Overall, AAVE is still inside the downtrend. There is a reaction movement, but the trend is not broken. To see the continuation of the upward movement, permanence above 196 is needed; otherwise, the downward pressure will come to the forefront again.

These analyses, which do not provide investment advice, focus on support and resistance levels that are thought to create short and medium term trading opportunities depending on market conditions. However, the responsibility of trading and risk management belongs entirely to the user. In addition, it is strongly recommended to use stop loss for the positions shared.