The crypto market is preparing for a new turning point with $5.4 billion in Bitcoin and Ethereum options expiring today on the Deribit exchange. This massive expiration is a critical test that will determine both price volatility and investor behavior. Bitcoin is trading around $102,000, while Ethereum is trading sideways around $3,350.

In the options market, attention is particularly focused on Bitcoin's "max pain" level of $107,000. This level represents the price range where the majority of investors incur the most losses. Meanwhile, $3,800 stands out as a similar psychological and technical resistance for Ethereum.

Traders are cautious, but still betting against volatility

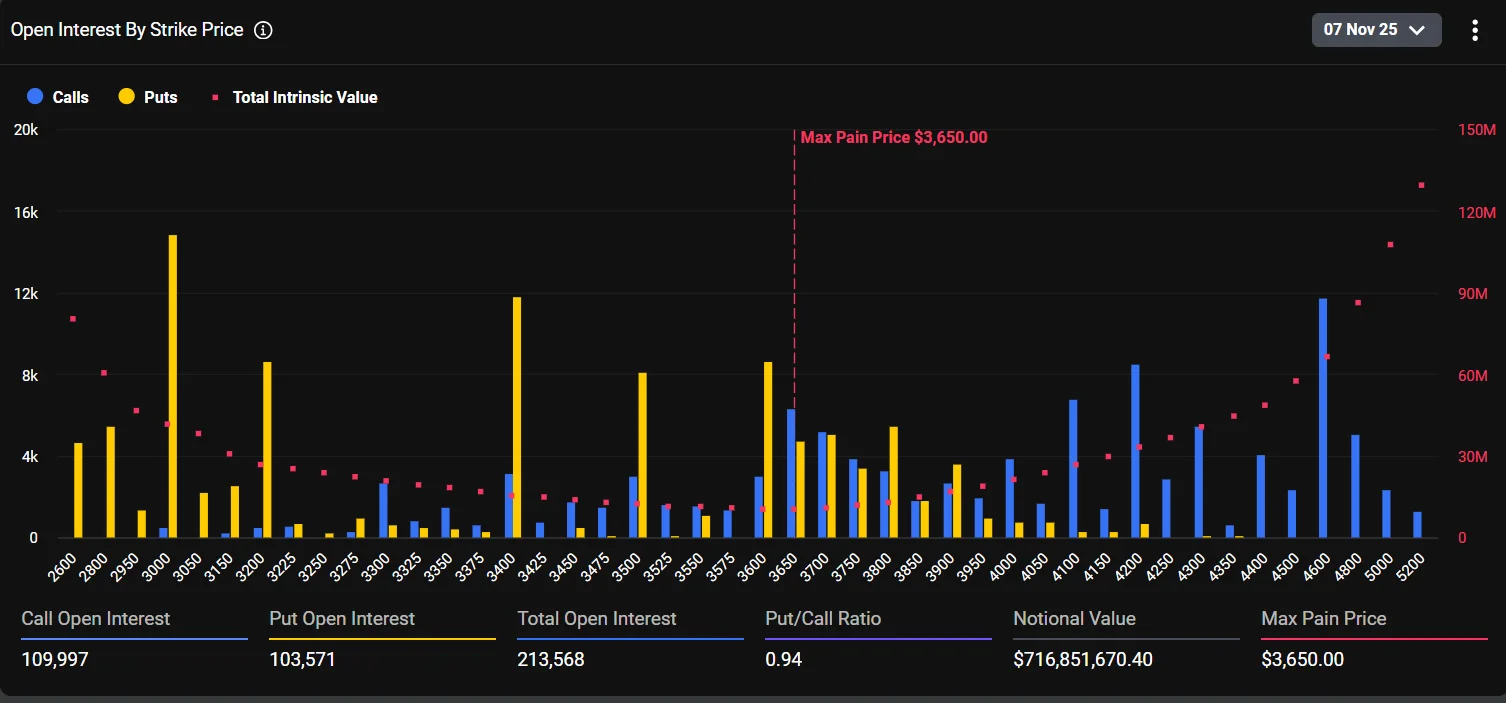

At a time when analysts are warning of "end-of-cycle signals," it's noteworthy that traders are trying to suppress volatility with short positions. An analysis by Greeks.live indicates that many investors continue to sell options, focusing on the ETH 3,650, 3,400, and 3,800 levels. These strategies are based on the expectation that the market will remain stable; however, it also emphasizes the potential for significant losses if prices suddenly break out.

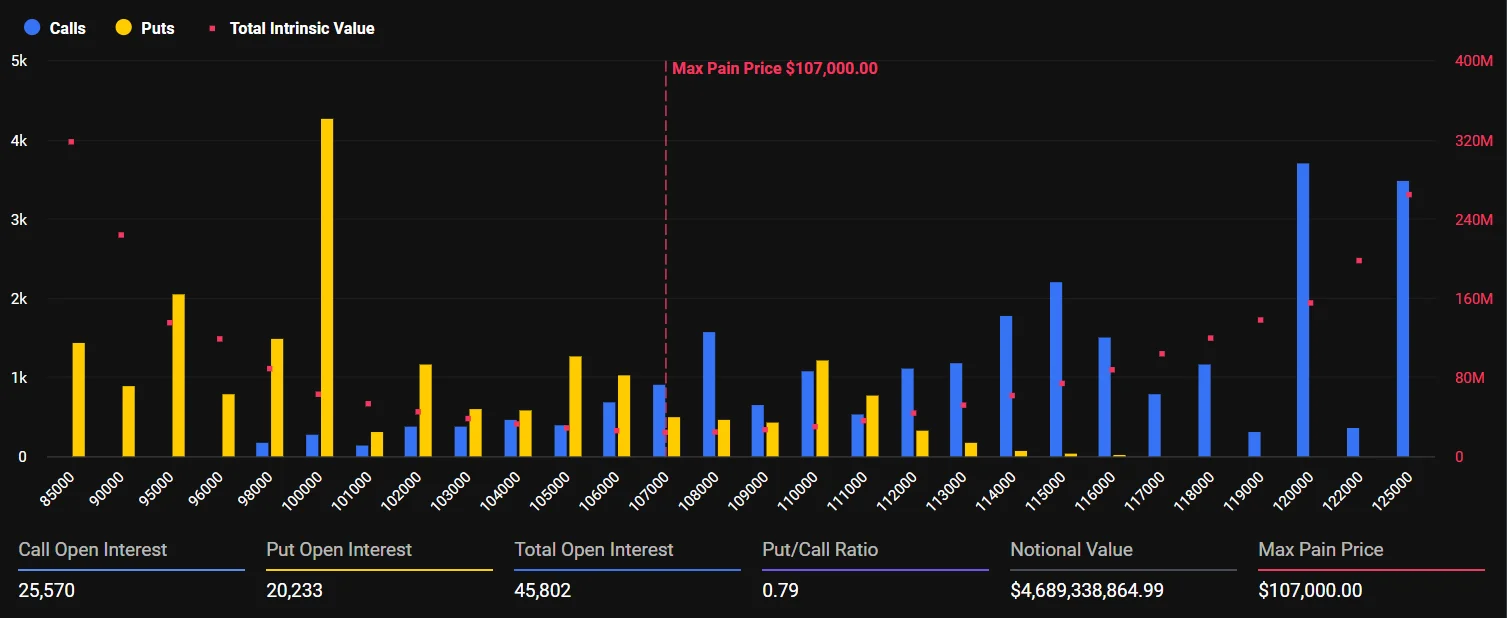

Open interest in Bitcoin options has reached 45,802 contracts. Of these, 25,570 are calls and 20,233 are puts. The total open interest exceeds $4.6 billion. This suggests that investors are still actively holding positions despite the uncertainty in the market.

The defensive line for Ethereum is $3,800

The outlook for Ethereum options is slightly more cautious. The put/call ratio is at 0.9, suggesting a balanced but defensive outlook. The largest open interest is concentrated in puts at $3,500 and calls at $4,200. This strengthens the possibility that the price will move within this range in the short term.

According to data, the total open interest in ETH options on Deribit reaches $713 million. Traders often attempt to limit downside risk and capitalize on potential upsides with complex strategies such as "calendar spread," "risk reversal," and "straddle."

Macro pressures persist

This critical juncture in the options market is compounded by increasing macro pressures. Recent US inflation data (CPI) and statements by Fed Chair Jerome Powell have weakened ETF inflows. Despite this, the high open interest rate in the options market suggests that investors are still determined to remain in the market.

The general market sentiment can be described as "cautious optimism." While increased volatility is expected in the short term, the majority of traders believe prices will not fall below $100,000. However, if volatility surges after expiration, sharp price movements in the crypto market may be inevitable today.