Attention in the crypto derivatives markets is focused today on the large options expiry on Deribit. Approximately $3 billion worth of Bitcoin and Ethereum options contracts expire at 11:00 AM Turkish time (08:00 UTC), raising expectations of short-term volatility in the market.

Critical Threshold After Expiration

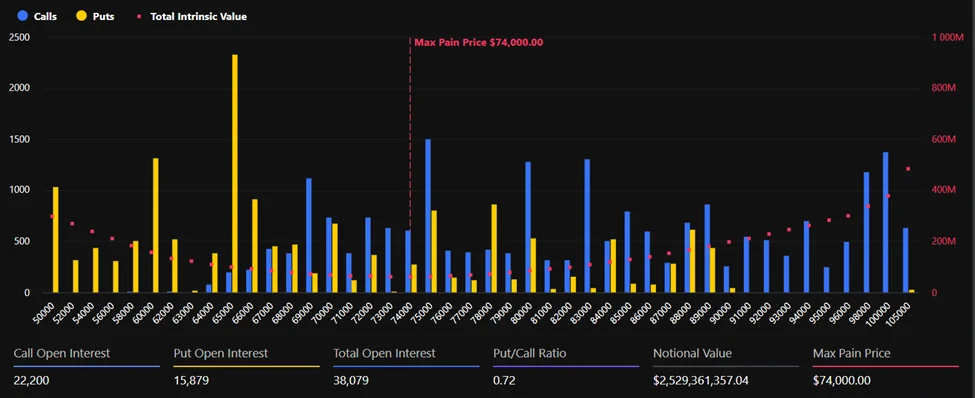

According to data, approximately $2.5 billion worth of Bitcoin and over $400 million worth of Ethereum options are expiring today. Closings of this magnitude can create short-term fluctuations in the spot market, especially when prices are near certain strike levels.

At the time of writing, Bitcoin is trading at $66,372, with its maximum pain point around $74,000. The total open interest exceeds $2.53 billion. On the Ethereum side, the price is near $1,950; with approximately $425 million in open interest, the maximum pain level is $2,100. The maximum pain level refers to the price point where the greatest number of option contracts expire worthless. Theoretically, this level represents the area where option sellers gain the most advantage. The market doesn't always have to go to this point; however, due to dense clustering of open positions, hedging transactions, and market makers' gamma positions, prices may be "pulled" towards these areas.

The sharp sell-off in the last week and the rapid drop below $70,000 led to significant liquidations in the derivatives market. This movement sharply increased demand, especially for put options. Risk reversal (RR) indicators are still significantly in negative territory. The fact that the 1-week and 1-month 25-delta risk reversal values remain at negative levels shows that investors' demand for downside protection continues.

The risk reversal metric sheds light on market sentiment by measuring the premium difference between call and put options. Negative values indicate that investors are paying higher premiums to protect against declines and are pricing in downside risks. According to Greeks.live analysts, over $1 billion worth of put options were traded on Bitcoin today, representing 37% of the total volume. It's noteworthy that a large portion of these positions are concentrated in the out-of-the-money range of $60,000-$65,000. This suggests that institutional players, in particular, remain cautious regarding the medium term. However, with volatility receding from panic levels in recent days, some investors are starting to turn to call options again. This indicates a fragile balance in the market. On one hand, there is continued demand for downward hedging, while on the other, expectations of a short-term recovery are gaining strength.

Large option expiry dates generally open the door to two different scenarios. In the first scenario, hedging pressure decreases with the closing of contracts, and the market may experience temporary relief. In the second scenario, due to the clustering of large open positions, prices may exhibit sharp movements towards critical levels.

The current prices of Bitcoin and Ethereum are relatively close to their maximum pain levels. This increases the likelihood of intraday price “pinning,” sudden increases in volatility, and liquidity-driven movements. However, macroeconomic flows, spot demand, and overall risk appetite will continue to be decisive in determining the post-expiration direction.

In conclusion, today’s approximately $3 billion in options expiring represents a short-term stress test in the market. Derivative investors, still remaining defensive after the liquidation shock, have not yet reached a clear consensus on the direction. Therefore, it will not be surprising to see sharp and rapid fluctuations in intraday price movements.