LayerZero (ZRO) Technical Analysis: Breakout Confirmed—Is a Bullish Trend Underway?

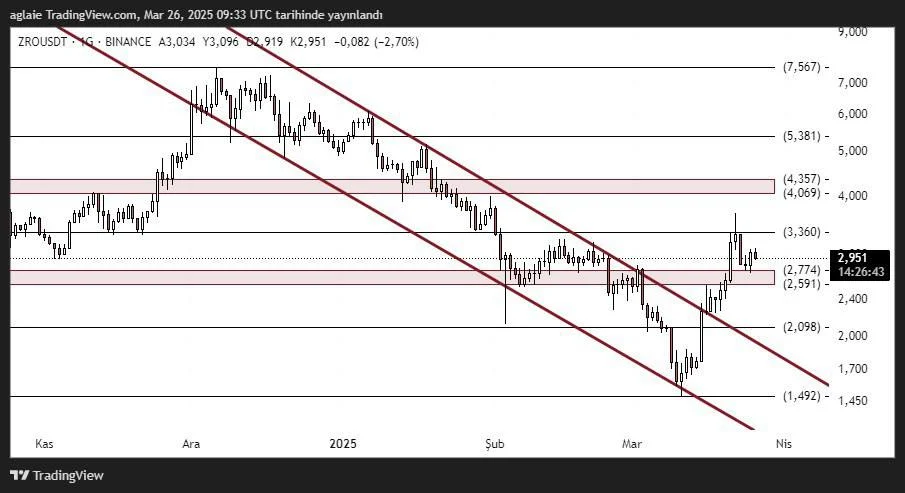

LayerZero has recently broken out of its long-standing descending channel, drawing significant attention in the crypto market. The ZRO/USDT pair is currently trading around $2.951, and this breakout marks a critical technical event. Breakouts from descending channels often signal the start of a new bullish trend.

Previously, ZRO had fallen as low as $1.492, where it encountered strong buying interest and quickly rebounded, pushing above the channel’s upper boundary. The price is now testing the previous resistance zone between $2.774 and $2.591 as a new support.

Key Technical Levels for ZRO/USDT

Support Zones:

- $2.774 – $2.591 – Key breakout support zone (previous resistance)

- $2.098 – Short-term support

- $1.492 – Previous bottom level

Resistance Zones:

- $3.360 – Initial short-term resistance

- $4.069 – $4.357 – Medium-term resistance range

- $5.381 – Mid-to-long-term resistance

- $7.567 – Major long-term resistance

Holding above $2.774 is critical for ZRO to continue its move toward $3.360 and then $4.069, both of which have historically acted as strong reaction zones.

What Does the Channel Breakout Indicate?

The breakout from the descending channel confirms a shift away from bearish pressure, marking a potential trend reversal for ZRO/USDT. This has positively impacted market sentiment, giving the price room to move within a more bullish structure.

Increased volume during the breakout further supports the move, while momentum indicators like RSI are showing upward divergence from the neutral zone—reinforcing the likelihood of continued upside.

Suggested Strategy for Traders

- Hold Above Support: Maintaining daily closes above the $2.774 – $2.591 zone keeps the bullish outlook intact.

- Target Resistance: The next key level is $3.360, which may act as a short-term target.

- Risk Management: A close below $2.591 could invalidate the bullish scenario, indicating the breakout may have been temporary.

Post-breakout pullbacks are often healthy and provide better entries. If buyers step in again near the support zone, the bullish case for LayerZero could strengthen significantly.

Is a Trend Reversal Underway for LayerZero?

LayerZero may have officially ended its downtrend and entered a bullish structure. The technical breakout and support holding behavior suggest renewed upward potential. A confirmed break above $3.360 in the coming days could shift focus to medium-term targets and initiate a broader rally in ZRO/USDT.

Disclaimer: This analysis does not constitute financial advice. It highlights potential support and resistance levels that could offer short- to medium-term trading opportunities under current market conditions. All trading decisions and risk management are the sole responsibility of the trader. Using stop-loss orders is strongly recommended.