Bitcoin's role as "digital gold," long dubbed "digital gold," has once again become a hot topic in the financial world. According to investment giant VanEck, the leading cryptocurrency could reach half the market value of gold by the next halving in 2028. Matthew Sigel, the company's head of digital asset research, predicts that the "equivalent value" for Bitcoin will be $644,000 during this period, when gold is reaching record highs.

Gold futures have reached a record high of over $4,000 per ounce. This rise reflects the continued shift towards traditional safe havens. According to Sigel, this record high for gold also demonstrates Bitcoin's long-term potential: "At half the current price of gold, it would translate to a price of $644,000."

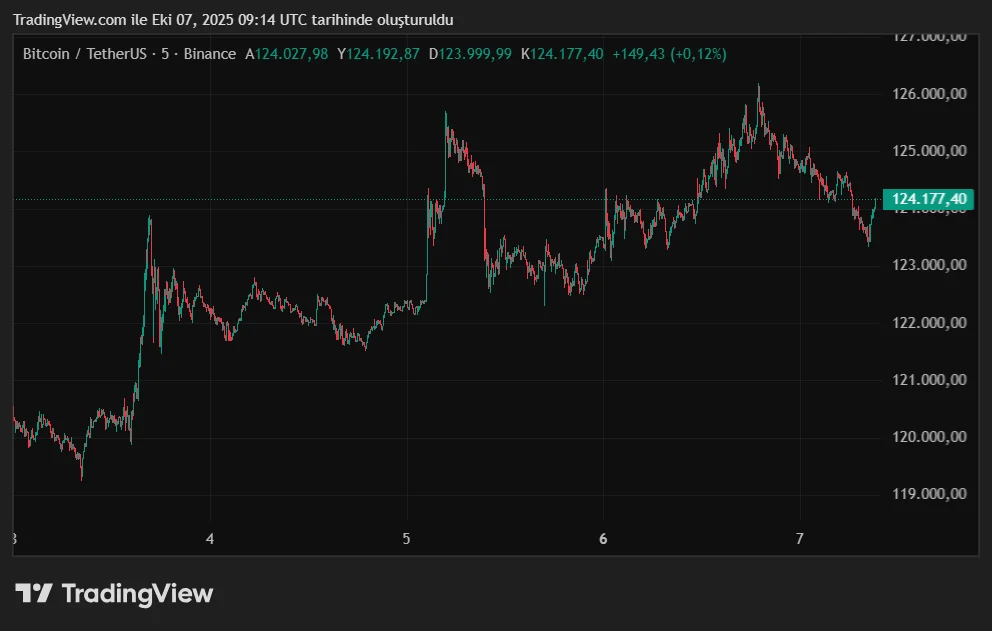

Bitcoin price is currently trading around $124,000, with a total market capitalization of $2.48 trillion. Market data shows a 12% increase in the past month. However, VanEck analysts emphasize that this target could be achieved gradually over a period of five to 10 years, rather than in the short term.

Derek Lim, manager of Caladan Research, said, “Reaching half of gold’s market capitalization requires an increase of approximately 5.6 times from current levels. Bitcoin is no longer parabolic as in the past, but exhibits more consistent growth. Therefore, achieving this target may take several years, not just one cycle.”

These predictions coincide with gold outperforming Bitcoin this year. According to TradingView data, gold rose 49 percent through 2025, while Bitcoin’s return remained at 31 percent. However, analysts believe this gap will close in the long term. Ryan McMillin of Merkle Tree Capital said, “Even JPMorgan described gold and Bitcoin as ‘hedges against loss.’ It makes sense to consider the two together; first, half-value, then parity is possible.” VanEck predicts that Bitcoin could conduct 10% of global trade and 5% of local transactions on blockchain in the long term. According to a report published by the company in July 2024, central banks could hold an average of 2.5% of their assets in Bitcoin in the future. In this scenario, Bitcoin's market capitalization could reach $61 trillion and its price $2.9 million by 2050.

Will history repeat itself?

On the other hand, the market is cautious about whether historical cycles will repeat themselves. In the past, Bitcoin peaked 500–550 days after the halving. However, this cycle could be different. Experts note that spot ETFs and institutional participation have reduced volatility and made growth more sustainable.

According to Derek Lim, “This time, we may see a more sustained upward trend, not a short-lived peak like in the past. The Fed's interest rate cut cycle has just begun, meaning Bitcoin has the wind at its back.”