The cryptocurrency market in the US has entered a historic turning point. The House of Representatives has passed three important bills regarding crypto assets, laying the foundation for a clear legal framework for both the sector and investors. These bills were voted on as part of "crypto week," a period primarily led by Republicans.

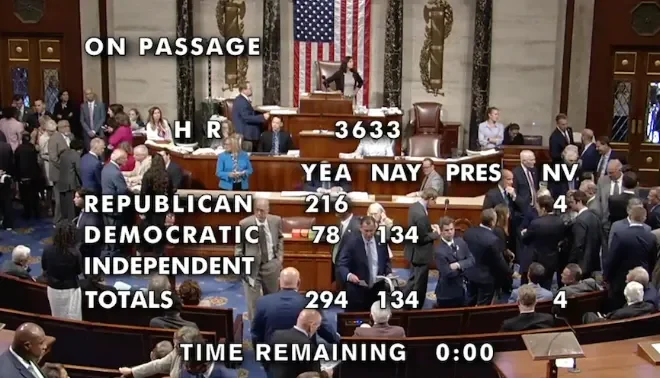

One of the most notable bills passed in the House was the Digital Asset Market Clarity (CLARITY) Act. This bill passed with a vote of 294-134, while another significant piece of legislation, the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, passed with a vote of 308-122. The more controversial Anti-CBDC Surveillance State Act was approved by a narrower margin of 219-210.

In other words, it's safe to say that the two parties are beginning to find common ground on the regulation of crypto assets. The CLARITY and GENIUS bills, in particular, received significant support from Democrats. However, the anti-CBDC bill, due to its opposition to central bank digital currencies, has generated more controversy and been heavily criticized by Democrats.

Following this flurry of activity in the House, all eyes are now on the Senate. The CLARITY and anti-CBDC bills will undergo further debate in the Senate. The GENIUS Act, having passed the Senate in June, will be directly submitted to President Donald Trump for approval. Trump is expected to sign it by Friday.

Trump plans to include crypto in retirement plans

However, Trump's crypto agenda doesn't end there. According to the Financial Times, President Trump is preparing an executive order that would allow 401(k) plans to invest in cryptocurrencies and other alternative assets. This executive order would allow individual retirement accounts to access crypto assets like Bitcoin, not just stocks and bonds.

This potential change would reinforce the decision made by the US Department of Labor in May, following the withdrawal of restrictions imposed during the Biden administration. Major financial companies like Fidelity have already begun offering crypto-backed 401(k) accounts. As of 2024, there were more than 715,000 401(k) plans in the US, with a total of $8.9 trillion in assets under management.

Trump's moves toward crypto are not limited to the economy. The president has nominated attorney Eric Tung, who has close ties to the crypto industry, to the Ninth Circuit Court of Appeals, one of the most powerful appellate courts in the US. Tung previously represented the Blockchain Association in the Tornado Cash case and is known for his rhetoric supporting stablecoin companies. If confirmed, his appointment could have significant impact, particularly in jurisdictions encompassing technology and crypto hubs like California.

However, the opposition has also drawn harsh criticism. Representative Maxine Waters described this week as "crypto corruption week," arguing that the enacted laws could weaken financial oversight and create systemic risks similar to the 2008 crisis.