Bitcoin, Ethereum, and other major cryptocurrencies experienced a sharp decline on Sunday following news of escalating geopolitical tensions between the US and the European Union, and this decline continued into Monday morning. US President Donald Trump's threat of tariffs on European countries via Greenland further weakened already fragile market sentiment. However, by Monday morning, prices had largely stabilized at similar levels.

Bitcoin and altcoins experienced a decline

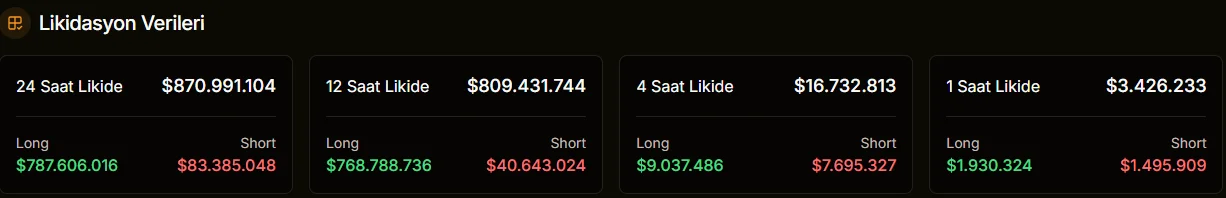

Bitcoin, which was trading around $95,500 at approximately 5 PM on Sunday evening, fell to $92,474 within a few hours. This sudden drop of approximately 3% quickly spread across the entire market. Major altcoins such as Ethereum, XRP, and Solana followed Bitcoin, losing value at similar rates. The sharp price movement also led to a significant liquidation in the derivatives markets. According to market data, over $750 million in long positions were liquidated in just a four-hour period. Analysts say the primary trigger for this liquidation wave is concerns about a potential trade war between the US and the EU. Already weakened risk appetite made the market extremely vulnerable to such headlines.

Min Jung, a researcher at Presto Research, points out that crypto markets have underperformed significantly compared to other risky assets. According to Jung, while US-EU tensions are putting significant pressure on sentiment, the sideways or positive performance of some traditional markets, such as the South Korean stock market, indicates a continued weakness specific to crypto. Investors continue to be wary of crypto assets despite the overall market rally.

What lies behind the tension?

At the heart of the tension is Trump's threat to impose staggered tariffs on imports from eight NATO countries if Denmark does not sell Greenland to the US. According to Reuters, European leaders have explicitly described these statements as "blackmail" and warned that a dangerous phase could begin in transatlantic relations. On the EU front, retaliatory options such as restricting US services, introducing new taxes, or limiting investments are being considered.

BTC Markets analyst Rachael Lucas emphasizes that recent headlines have added a new wave of volatility to the market, but that geopolitical developments are not the sole reason for the current decline. According to Lucas, sentiment in the crypto market was already disrupted by the postponement of the bill aimed at regulating the crypto market structure in the US. The suspension of the Senate process, especially after Coinbase withdrew its support for the bill, deepened the uncertainty.

Lucas also reminds us that Bitcoin has been in a long period of horizontal consolidation since its peak of $126,000 seen in October 2025. Increased profit-taking triggered algorithmic selling as it fell below the 50-week moving average. The billions of dollars in outflows from spot Bitcoin ETFs and the decrease in open positions in futures also indicated a weakening risk appetite. According to the analyst, if macroeconomic pressures persist, the Bitcoin price could retreat to the $67,000-$74,000 range. However, Lucas adds that this period is unlike past crypto winters, indicating a more mature structure for the sector and suggesting that more constructive signals are continuing to come from the regulatory side in the long term. As of Monday morning, prices are seen to be trading sideways at the same levels after Sunday's sharp drop. This suggests that markets are currently preferring to digest developments rather than trigger a new wave of selling. However, both geopolitical risks and regulatory uncertainties in the US indicate that volatile movements in the crypto market may remain on the agenda for some time.