UNI/USDT Technical Analysis

A major and exciting shift is taking place within the Uniswap ecosystem. Under the proposal called “UNIfication,” trading fees are expected to be activated and millions of UNI tokens will be burned. This transformation could turn UNI from a simple governance token into a value-producing asset.

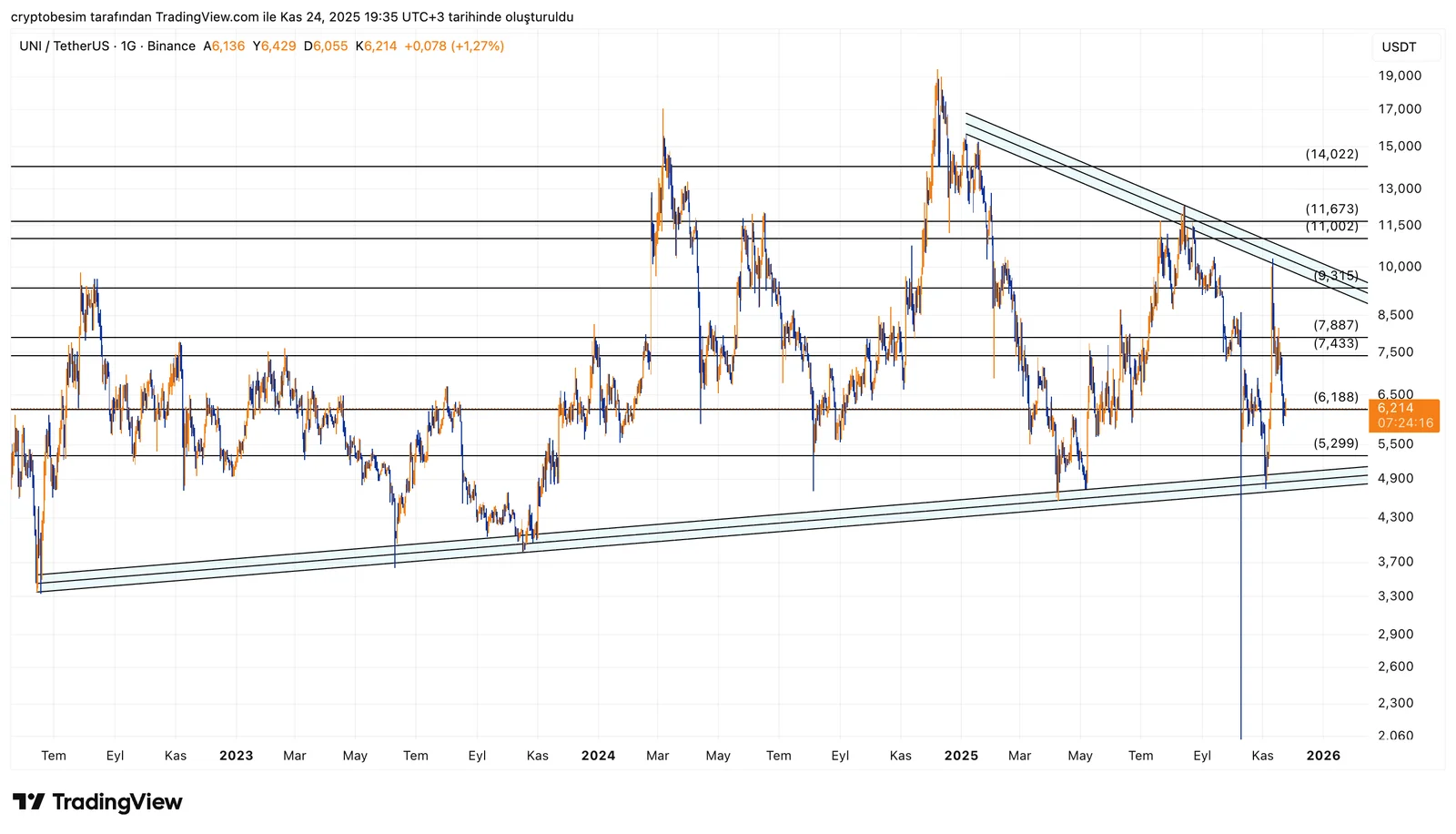

From a technical perspective, the structure on the chart is quite clear. There is a long-term ascending main trend, and the price continues to react positively each time it pulls back toward this trend. At the same time, a medium-term descending trend is pressing down from above. The interaction of these two structures has formed a distinct symmetrical triangle on the chart.

The price is currently positioned around the middle of this triangle, and the available movement range is narrowing. In such formations, the direction of the breakout typically determines the next major trend.

- Bullish Scenario

If the price begins to break above the 6.18 – 7.43 range, the first target becomes 7.88. The key decision zone, however, lies between 9.30 – 11.00. Sustained closes above this area would break the descending trend and shift UNI back into a strong bullish structure.

- Bearish Scenario

The 5.30 region remains the main support forming the lower trend. As long as this area holds, the overall structure is not considered broken. However, a close below this level would signal a downside breakout of the triangle, potentially pushing the price toward 4.90 or even 4.30.

UNI is currently squeezed between a long-term ascending trend and a short-term descending trend. It may continue ranging within this band for a while, but once a breakout occurs, the asset carries a high probability of generating a sharp directional move.

These analyses do not constitute investment advice. They focus on support and resistance levels that may offer potential short- or medium-term trading opportunities depending on market conditions. The responsibility for trade execution and risk management lies entirely with the user. Stop-loss usage is strongly recommended for all shared setups.