One of the major Bitcoin whales, known for its silence in the crypto market, has resurfaced after seven years of inactivity. According to data from blockchain analysis firms, the owner of the giant wallet sold a significant amount of Bitcoin (BTC) and redirected these assets to Ethereum (ETH). This move sparked both surprise and curiosity in the market.

A massive Bitcoin inheritance flowed into ETH

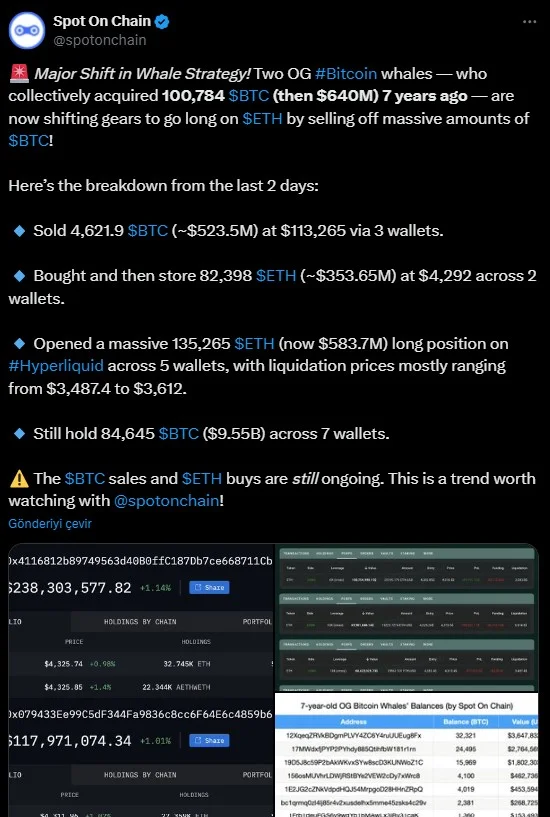

According to analysis firm Lookonchain, the wallet in question acquired 100,784 BTC seven years ago. These funds, which remained dormant for a long time, were reactivated in a series of transactions in recent days. The whale sold some of his BTC holdings, raising 62,914 ETH (approximately $270 million) from the spot market. Not content with this, the investor opened a long position of 135,265 ETH (approximately $580 million). According to Spot On Chain's summary, in just the last two days, these whales sold a total of 4,621 BTC at an average price of $113,265. They then bought and staked approximately 82,398 ETH at $4,292. These transactions, combined with the massive long positions opened on the Hyperliquid exchange, create a strong message of confidence in Ethereum.

Multiple wallets, one strategy

Interestingly, the on-chain data isn't limited to a single wallet. Lookonchain has identified at least six different wallets believed to belong to the same investor or group. These wallets currently hold 83,585 BTC (approximately $9.45 billion). This means the whale's total reserves remain substantial.

Arkham Intelligence data also confirms these transactions. Shared screenshots show that BTC, which has been entering exchanges like HTX since 2018, has been transferred to Hyperliquid hot wallets in recent weeks, followed by ETH purchases.

The timing is striking

The whale's shift from Bitcoin to Ethereum coincides with a critical period in the market. Bitcoin fell to $112,000 today, testing a two-week low. Meanwhile, Ethereum is gaining strength, gradually approaching its 2021 ATH of $4,878.

This scenario reinforces the logic behind investors' short-term shift towards Ethereum over Bitcoin. The trend in spot crypto ETFs also supports this. According to SoSoValue data, on Thursday alone, Bitcoin ETFs saw a net outflow of $194.3 million, while Ethereum ETFs saw a net inflow of $287.6 million.

In recent weeks, not only this wallet but also other "sleeping" Bitcoin whales have begun to reactivate. Billions of dollars worth of BTC are being transferred from wallets that have been dormant for years. With the market near historic highs, whales' strategies could reshape investor expectations for the future.