The Commodity Futures Trading Commission (CFTC), the US derivatives regulator, has launched a new initiative to allow stablecoins to be used as tokenized collateral.

CFTC Issues Critical Decision on Stablecoins

Caroline Pham, the commission's interim chair, has long advocated for stablecoins as a "killer app" in collateral management. In a statement, Pham stated that they will work closely with the industry and aim to develop policies that will enable the use of tokenized assets like stablecoins as collateral.

Last year, Pham proposed a similar regulatory "sandbox" idea and advocated for pilot programs for stablecoin-supported tokenization. Now, due to the lengthy and controversial confirmation process for Brian Quintenz, nominated by President Donald Trump, Pham has taken the initiative as interim chair.

Stablecoins are now covered by the GENIUS Act, the first comprehensive legislation regulating the stablecoin market in the US, passed last summer. These dollar-denominated digital assets form the backbone of liquidity in crypto markets and play a critical role in smart contract-based financial transactions. The CFTC's latest statement also included messages of support from executives at Circle, Coinbase, and Ripple.

As part of the new initiative, the agency has begun collecting written comments from market participants. Participants have until October 20th to submit their comments. Last year, the CFTC's Global Markets Advisory Committee (GMAC) also recommended expanding the use of non-cash collateral through distributed ledger technology in its advisory report.

Market experts believe the use of tokenized collateral in derivatives contracts could offer significant advantages. Jack McDonald, Vice President of Ripple Stablecoin, argued that this approach could increase efficiency and transparency, and that collateral would make risk management in derivatives contracts more reliable. Collateral is critical for securing the obligations of parties in futures or swap agreements.

This step by the CFTC is considered a significant step toward modernizing capital markets in the US. In particular, the President's Working Group's report published last year called for the inclusion of tokenized non-cash collateral in the regulatory margin system.

Caroline Pham believes these initiatives could spark a new wave of growth in the US economy. According to Pham, markets will be able to use capital more efficiently and support economic growth thanks to tokenized collateral. She also emphasized the sector's readiness for this transformation, stating, "The public has spoken: tokenized markets are here and represent the future."

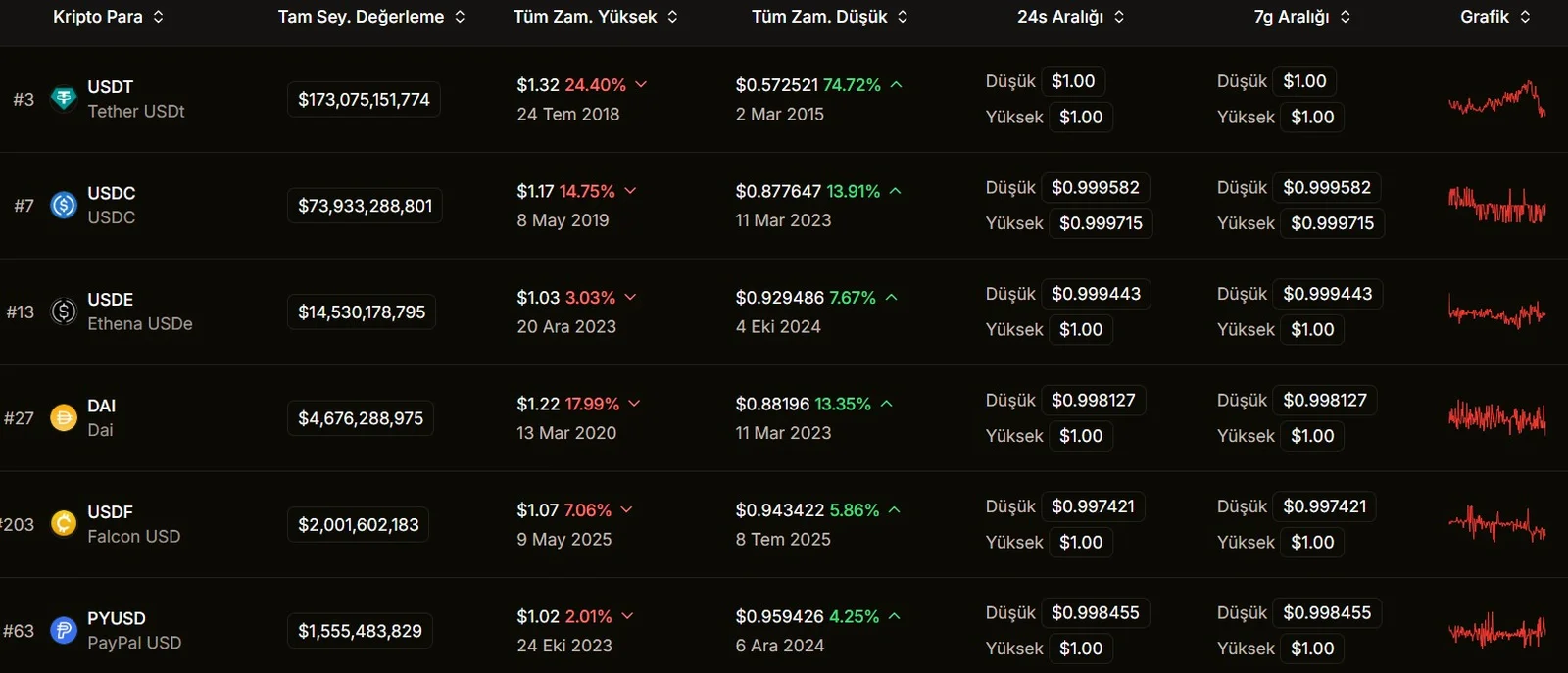

You can see the largest stablecoins in the table below: