Ant International, the international arm of Jack Ma-backed Chinese fintech giant Ant Group, is preparing to take an important step toward playing a more active role in the stablecoin market. According to a report by Bloomberg citing sources familiar with the matter, the company plans to apply for a license under Hong Kong's new stablecoin regulations, which will come into effect in August. Similar license applications are also expected to be filed in other major financial centers such as Singapore and Luxembourg.

Ant Group is known as a subsidiary of Chinese tech giant Alibaba and is one of the largest players in the global digital payment sector with its Alipay payment platform, which serves 1.3 billion users.

New regulations create new opportunities

Hong Kong announced its first comprehensive regulatory framework for fiat-backed stablecoin companies with the Stablecoin Ordinance, which was passed on May 21, 2025, and will come into effect on August 1. Under the new regime, organizations wishing to issue stablecoins will be required to obtain a license from the Hong Kong Monetary Authority (HKMA). Unlicensed activities may face a fine of 5 million Hong Kong dollars (approximately 640,000 US dollars).

This regulation provides a framework for large fintech companies such as Ant International to safely conduct stablecoin operations, while also aiming to position Hong Kong as a regional hub for crypto assets.

Stablecoins are becoming key for cross-border payments

Ant International's stablecoin plans aim to strengthen the company's cross-border payment and treasury management operations. Throughout 2024, one-third of the $1 trillion in transactions processed through the company's Whale blockchain infrastructure were in this area. This system offers significant advantages in terms of time and cost, particularly for transactions with e-commerce giants such as Alibaba.

As recalled, Ant Group's planned initial public offering (IPO) in 2020 was canceled due to intervention by Chinese regulators. Following this development, Ant shifted its focus toward investing in corporate solutions and blockchain technology, particularly in overseas markets.

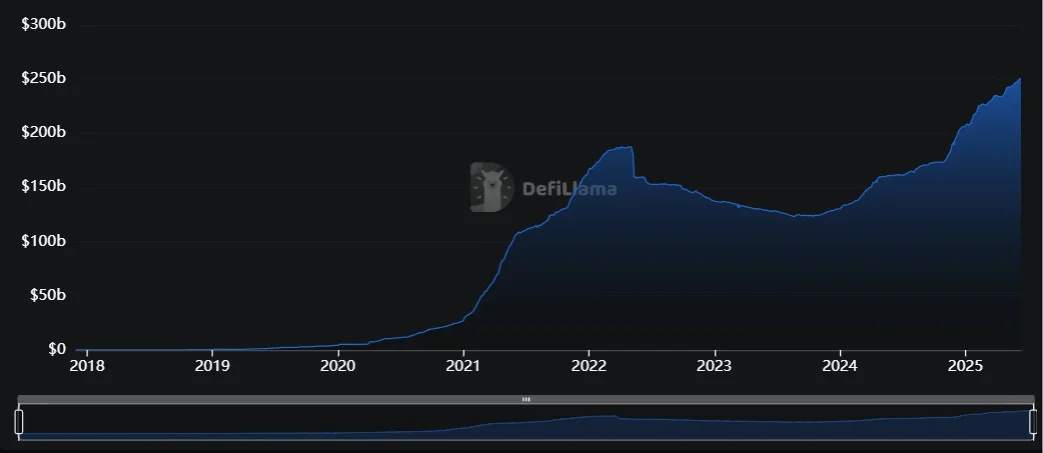

Meanwhile, Ant International's stablecoin initiative is tracking the growth of stablecoins in the sector. According to market data, the global stablecoin supply surpassed the record level of $250 billion last week, reaching a new milestone.