The global cryptocurrency market experienced a widespread decline as of June 12, 2025. The total market value decreased by 2.1 percent in the last 24 hours, falling to $3.38 trillion. The daily trading volume also dropped by 5.27 percent to $133.81 billion. On the other hand, the Fear and Greed Index, which is a sentiment index, remains in the Greed zone. So, what is the reason behind this significant decline in Bitcoin and altcoins?

Macroeconomic developments triggered the market

This sharp decline is not unique to cryptocurrencies. A series of macroeconomic and political developments in global markets have significantly reduced investors' appetite for risk. A similar picture is evident in US stock markets. The S&P 500 index fell 0.27% to 6,022.24 points. The Dow Jones Transport Index (DJT) fell 1.87% to 20.52 points, while the NASDAQ fell 0.50% to 19,615.88 points. The Dow Jones fell by a very limited 0.0026% to 42,865.77 points.

Significant increase in Bitcoin and altcoin liquidations

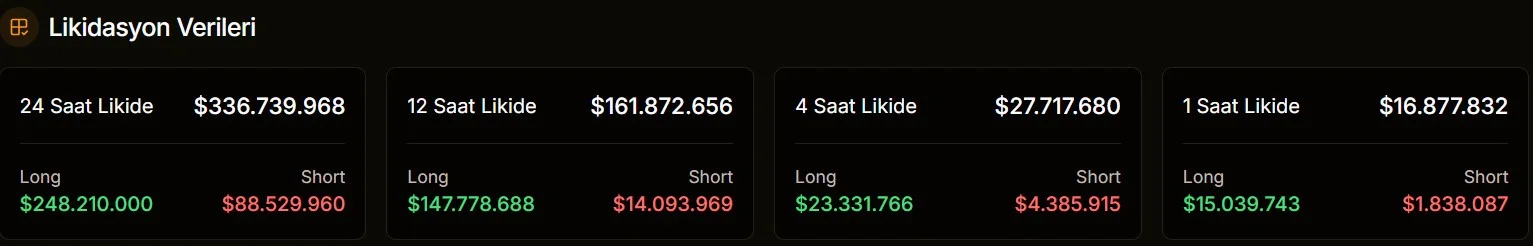

One of the most striking effects of the market shift was the increase in liquidations on crypto exchanges. Over 100,000 investors lost their positions in leveraged trades over the past 24 hours. According to JrKripto.com data, a total of $336 million worth of liquidations occurred in the cryptocurrency markets over the past 24 hours. It was notable that 91% of these liquidations were from long positions. Additionally, the largest single liquidation occurred on the BTCUSD perpetual futures pair on Binance, amounting to $2.15 million.

According to CoinGlass data, liquidations of this magnitude typically indicate misaligned expectations about the market's direction. Following the release of inflation data showing a decline, many investors had opened long positions assuming the upward trend would continue. However, the sudden selling pressure swept away both long and short positions.

Bitcoin and Ethereum lost value, with altcoins impacted more severely

Bitcoin, the pioneer of the cryptocurrency market, is trading at $107,740.76, down 1.68% in the last 24 hours. Bitcoin's market value fell to $2.14 trillion, while its daily trading volume reached $53.99 billion. Ethereum also experienced a similar decline, trading at $2,760.10 with a 1.11% loss. Major altcoins were particularly hard hit by this decline. XRP prices fell by 1.87%, while Solana (SOL) experienced a 3.97% decline in value, making it one of the hardest-hit major cryptocurrencies.

What is expected in the short term?

This decline in the markets is not driven by specific news or sudden developments, but rather by increasing uncertainty in global markets and technical correction trends. Crypto investors, especially those taking on higher risks through leveraged trading, are facing severe liquidations during such pullbacks.

Bitcoin's drop below $108,000 is seen by technical analysts as a potential test of a new support level. Ethereum remaining below $2,800 indicates that buying appetite remains weak. In the coming days, both data flows from traditional markets and crypto developments will continue to be directional. In particular, new economic data to be released in the US and statements by central bank officials will be closely monitored by crypto investors.