The longest-running and most controversial legal battle in the cryptocurrency market, the Ripple and US Securities and Exchange Commission (SEC) case, has entered a new turn just as it was about to end. US District Judge Analisa Torres officially rejected the parties' request for a special settlement that could override previous decisions in the case. This development complicated Ripple's position in the case and caused short-term fluctuations in the XRP price.

Critical request rejected in Ripple and SEC case

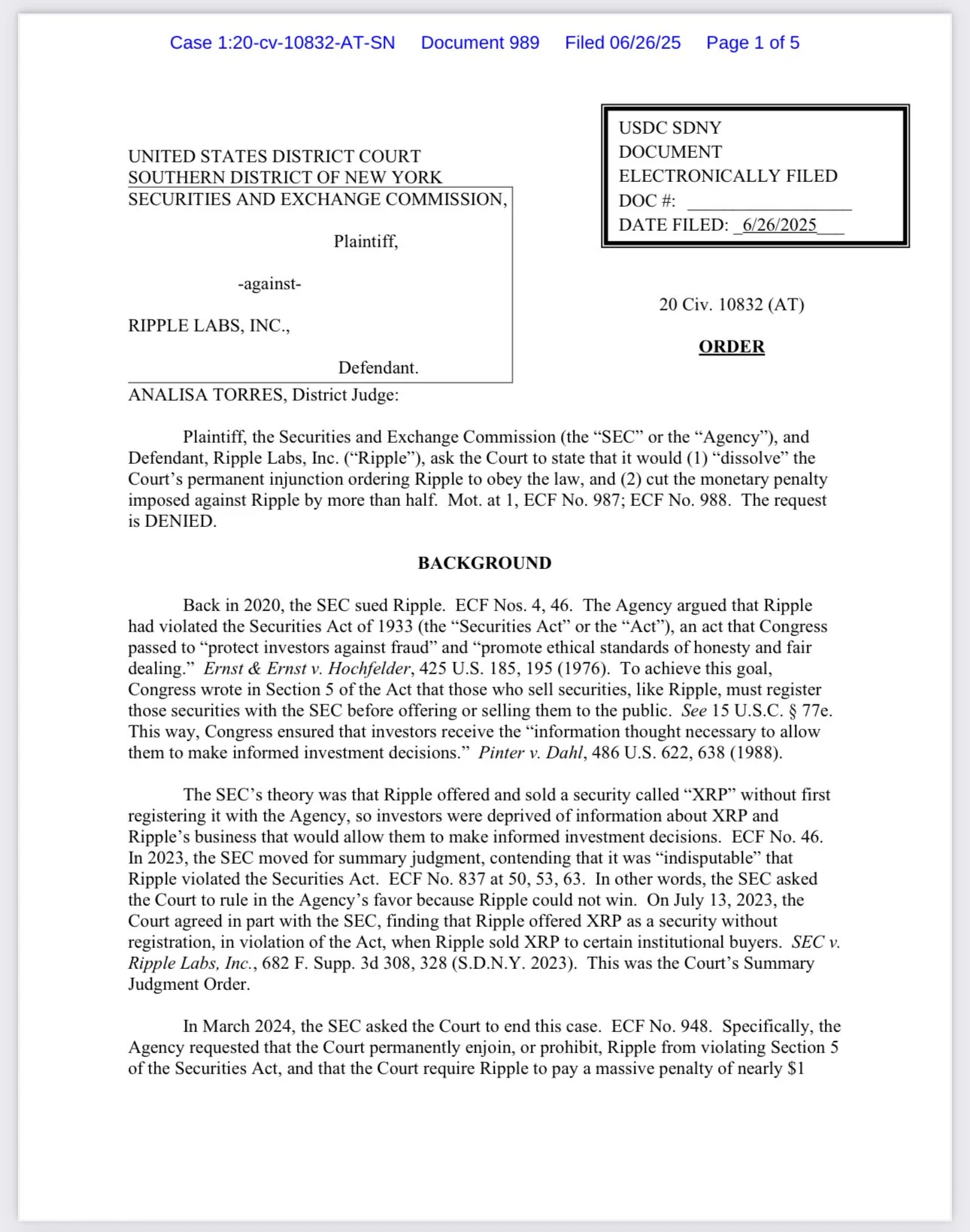

The SEC and Ripple had filed a joint application with the court, requesting that the public decision be eliminated with a special agreement. However, Judge Torres clearly emphasized that such special settlements cannot override final decisions made legally. In her decision, she stated, "I can only reconsider a judicial decision made on the basis of law if the law changes. Agreements reached by the parties cannot override court decisions."

The ruling means Ripple will continue to face a $125 million fine and legal restrictions on institutional sales. The litigation could last until late 2026 or early 2027. However, experts say it is more likely that the parties will reach a settlement in late July or early August rather than such a long trial.

Crypto lawyer Fred Rispoli said on social media that both sides are expected to submit an update on the case to the 2nd Circuit Court of Appeals in August. According to Rispoli, this update will either announce that the appeals process will continue or that a settlement has been reached. It is known that Ripple has requested a broader settlement in the past months, but the court has not been keen on it.

XRP ETF approval has increased

Ripple’s legal battle with the SEC is affecting not only the company’s future, but also XRP’s market outlook and ETF approval prospects. According to a recent report by Bloomberg, the probability of XRP receiving ETF approval in 2025 has increased to 85 percent. This optimism is driven by the increasing interest of institutional investors and steps taken towards clarity in crypto regulations in the US. On the other hand, despite the legal hurdles Ripple faces, XRP continues to be heavily traded. Judge Torres also stated in his decision that the SEC is not currently intervening in XRP transactions, so market activities will not be disrupted at this stage. Nevertheless, the XRP price fell by 4 percent after the decision, falling to $2.09, but quickly regained its balance around $2.10.